Business Sectors

Events

Contents

Covid-19: box ship journey counts improve but values decline

The impact of coronavirus on vessel demand, values and rates

The impact of Covid-19 on vessel demand has been felt as consumer demand from Asia and the EU has fallen and values and rates have declined.

Although there are some positives in that after initially being affected, post panamax and larger container ship vessel journey counts out of Asia have improved, says VesselsValue.

VesselsValue held a mini-series, with one episode examining container vessel demand and how it had been affected by Covid-19. It tracked the journeys of larger panamaxes and container vessels into and out of the larger container import and export countries to measure demand since the start of the year.

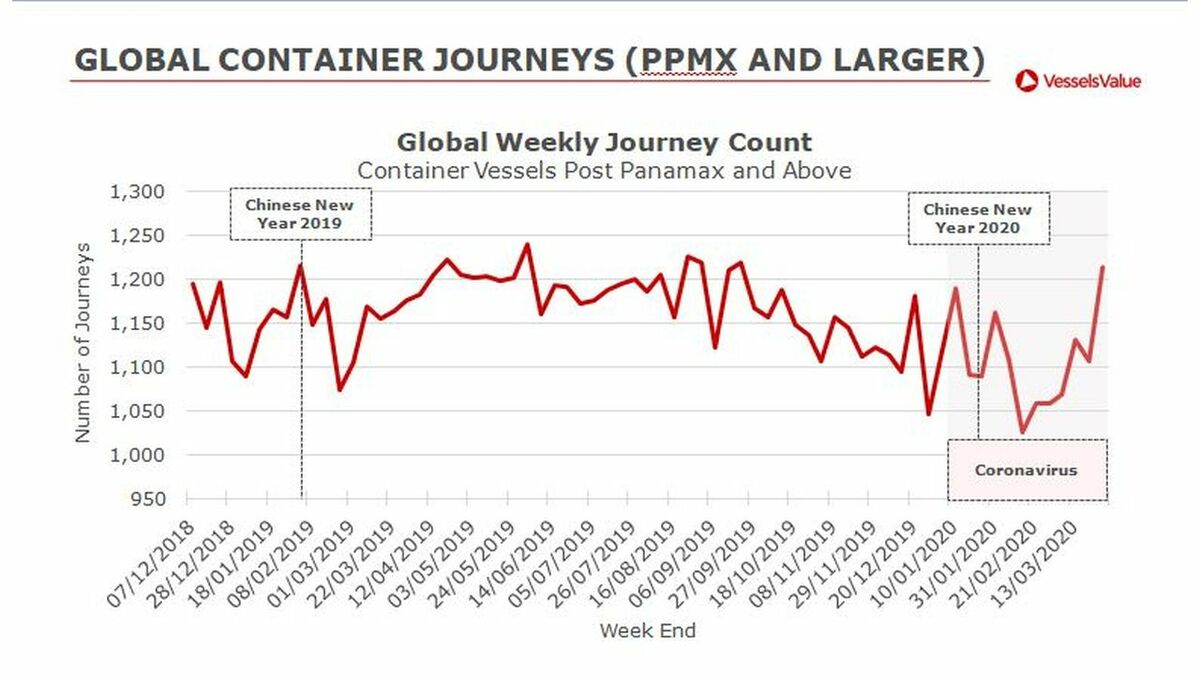

Weekly global journeys of post panamax and larger container ships show a slump that ties in with the coronavirus, falling to under 1,100 at the end of January and falling further to under 1,050 in the week starting 22 February. This is a decline compared to last year when around the same time (Chinese New Year), journeys were above 1,200.

But numbers recovered to rise to over 1,200 in mid-March. VesselsValue chief strategy officer Adrian Economakis says, “In early February there was a massive decline which caused utilisation rates to be reduced, but numbers increased rapidly to reach above the numbers recorded in December and January.”

Delving into individual tradelanes, weekly journey counts of post panamax and above box ships from China to global trades plunged to 250 on 21 February, its lowest point since 7 December 2018. But they climbed up quickly and as of March 13 they were up to 450.

Mr Economakis says, “At the beginning of February there was a fast and rapid fall, but at the start of March there was a fast, V-shape recovery.”

Looking at journeys into and out of other Asian countries, he says “Out of South Korea, a downwards trajectory started at the beginning of the year. While coronavirus had an effect, it was less significant than in other areas. There has been quite a significant recovery up to pre-crisis levels.”

Elsewhere, Malaysia dropped off but showed a “nice upwards trajectory recently, although it hasn’t quite recovered”. Singapore is “still down” and although there has been a “little bit of recovery, this is nowhere near as much as needed”.

In Japan there has been volatility and some recovery, but VesselsValue still exercises caution in this area.

Turning his attention to post panamax journeys to the west, VesselsValue figures show the negative effect of the coronavirus and the impact of the lockdown taking place in Europe. Global weekly journeys to the US reached their lowest point since 7 December 2018, when they fell to 150 in the week starting 21 February, however they did rally and hit almost 180 in early April.

Mr Economakis says, “The coronavirus certainly had a negative effect.” While numbers have risen, he says “we expect that to reduce again because of what is happening in the US.”

In Italy, there was a “significant decline” in the number of journeys in February and in much of March. Numbers rallied to over 50 at the end of March before falling to just over 35.

Weekly journeys to the Netherlands fell to just above 35 at the week starting 21 February before rising to 45 and then plummeting to 30. Mr Economakis says, “The Netherlands declined significantly recently, which goes in line with the more stringent lockdowns in Europe.”

Values: ‘lots of red ink’

Moving onto container ship values, the impact of the coronavirus can be seen by VesselsValue data. Mr Economakis says, “The percentage change in values since 11 February for the main types of vessels, [shows it has] been a pretty horrible time – lots of red ink all over the place and lots of values falling.” He says the best performers were the smaller sized vessels, the feedermax sector, which saw values drop by between 2-3% over the last couple of months.

The worst hit vessel type was the post panamax sector – the value of vessels under a year old slumped by an average of 15.23% since 11 February, while those five years old saw their values fall by 12.6%. Those of 15 years fell by an average of 11.14%. In the ultra large container ship sector, those less than a year-old saw values plummet by 7.52% and those five years old by 7.68%.

In contrast, the picture was more positive for container ship earnings. Mr Economakis says, “Surprisingly earnings held up well and recently climbed at a rapid rate.”

Summing up the situation, Mr Economakis says “There is positive news as journeys out of Asia recovered fast and that is very much a good sign but cautious consumer demand from Europe and the US have seen container journeys dropping and we expect consumer demand to continue to decline with the extended lockdown.” He also highlighted concerns about the decline in values over the last couple of months.

The number of idle vessels has also ramped up since the start of the year but has decreased compared to earlier levels. VesselsValue has released data on stationary container ships since the beginning of December 2019. VesselValue counted them as stationary when they haven’t moved in seven days or more. Stationary container vessels made up 0.7% of the fleet at the start of December 2019. This climbed to 1.7% at the beginning of March, before falling to around 1% at the start of April.

Time charter rates impact

Elsewhere, the latest Container Shipping Forecaster from Maritime Strategies International (MSI) analyses the impact of the pandemic on time charter markets in light of reduced demand and falling fright rates.

MSI said in early April, container ship time charter rates had retreated in recent weeks and since the start of 2020, most benchmarks have seen earnings retreat by 10-15%. The number of idle units excluding larger vessels tied up with scrubber retrofits or blanked sailings has not surged and levels of activity in terms of fixtures volumes, while lower than normal seasonal trends, have not slumped.

Spot freight rates, notwithstanding a sudden and unprecedented surge in blanked sailings announcements, are likely to retreat given tumbling bunker costs.

“Since the onset of the Covid-19 crisis, movements in both container freight and time charter markets have been relatively limited, although for the most part trending downward, that is now likely to change,” says MSI analyst Daniel Richards. “As the industry digests what is sure to be a sharp and sudden drop-off in trade volumes and liner companies increasingly feel the cash flow implications of business lost during China’s shutdown, a stately decline in time charter earnings seems unsustainable.”

Major container lines are already talking about reducing their time charter exposure in response to Covid-19, with Hapag-Lloyd confirming this when reporting its 2019 annual results. MSI expects the tally of idle vessels across all size bands to trend upwards over Q2 2020 as demand weakens, driving time charter earnings downwards.

“The question is how far earnings will fall and how long they will stay low. Across benchmarks, markets in 2016 represent a worst-case scenario, where earnings for numerous benchmarks fell beneath opex,” adds Mr Richards. “We do not expect earnings to fall this far and there will be recovery over the second half of 2020 rather than a drawn-out trough. This is due to a mix of healthy supply-side developments, a more efficient container ship cascade, and disruptions to the available fleet from delays at repair yards.”

Related to this Story

Events

Maritime Cyber Security Webinar Week

International Chemical & Product Tanker Conference 2024

Marine Propulsion: Fuels Webinar Week

How enhanced connectivity is propelling maritime into the AI era

© 2023 Riviera Maritime Media Ltd.