Business Sectors

Contents

Register to read more articles.

FLEX LNG expands fleet, secures future

FLEX LNG announces strategic charter deals, ensuring long-term stability with advanced, efficient LNG carriers

FLEX LNG, established under the laws of Bermuda, operates with a strategic focus on high-efficiency, fifth-generation LNG carriers. The company recently announced a new time charter agreement for its vessel Flex Constellation with a major Asian LNG importer, marking a significant step in its ongoing expansion.

Since its inception in 2006 and redomiciliation to Bermuda in 2017, FLEX LNG has grown its fleet capabilities substantially.

The company now manages 13 advanced LNG carriers, including vessels with cutting-edge MEGI and X-DF propulsion systems equipped with partial and full reliquefaction systems. These systems reduce the boil-off rate, enhancing operational efficiency and environmental compliance.

FLEX LNG has adeptly navigated the complex financial landscape to support its expansive fleet operations. A notable arrangement involved a syndicate of banks and the Export-Import Bank of Korea providing up to US$629M for part-financing multiple vessels.

Flex LNG Management AS chief executive Øystein Kalleklev highlighted the strategic nature of these deals, "With these financing structures, we have not only enhanced our liquidity but also aligned our growth with sustainable financial practices."

Sale and leaseback transactions have also played a pivotal role. For example, the US$320M deal for Flex Constellation and Flex Courageous helped prepay existing facilities, showcasing a proactive approach to managing financial liabilities and assets.

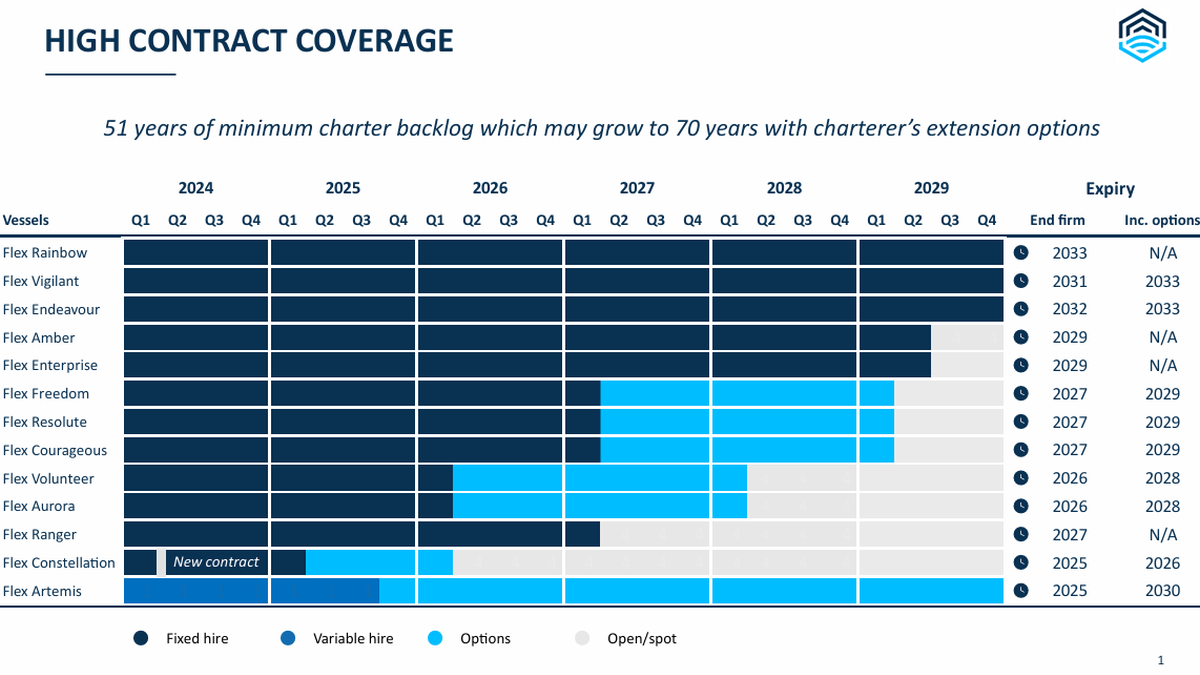

The employment strategy of FLEX LNG stresses securing long-term charters to ensure revenue stability and operational continuity. Flex Constellation, for instance, shifted from a three-year charter to a spot market operation before securing a new minimum 312-day charter agreement. This strategic employment not only underscores the vessel’s high demand but also the company’s agility in navigating market fluctuations.

The fleet predominantly operates under long-term fixed-rate charters. Mr Kalleklev pointed out, "This approach ensures a stable and predictable revenue stream, vital for long-term planning and operational success."

The recent leadership transition in FLEX LNG with Ola Lorentzon taking over as chairman marks a pivotal moment.

Mr Lorentzon brings extensive industry experience and a vision for steering the company through the next phases of LNG market expansions. "I am looking forward to working with the board and the management to develop the company further," said Mr Lorentzon, acknowledging the solid foundation left by his predecessor.

The global LNG market continues to evolve, with the United States poised to play a significant role due to increasing LNG exports. This potential increase could benefit FLEX LNG as it looks to deploy more vessels in lucrative markets such as the Caribbean and the United States.

However, the industry is not without its challenges. Fluctuating charter rates and operational costs require diligent management and strategic foresight. The company’s mix of fixed and variable rate charters helps mitigate these risks, providing a cushion against market volatility.

"By focusing on technological innovation and financial health, we aim to maintain our competitive edge and capitalise on new market opportunities as they arise," remarked Mr Kalleklev, reflecting on the future outlook.

Riviera Maritime Media’s LNG Shipping & Terminals Conference will be held in London, 12 November 2024, click here to register your interest in this industry-leading event

Related to this Story

Events

LNG Shipping & Terminals Conference 2024

Vessel Optimisation Webinar Week

International Bulk Shipping Conference 2024

"Mealtimes with My Maritime Friends" Book Launch Event

© 2024 Riviera Maritime Media Ltd.