Business Sectors

Events

Contents

Register to read more articles.

Australia’s crude oil paradox

Despite producing premium crude oil, Australia faces growing fuel security concerns as its refining sector shrinks and reliance on imports rises

Australia’s crude oil production is a little-known facet of this resource-driven economy, but it operates within a dynamic landscape of shifting global markets, maturing fields, and a changing domestic refining industry. Despite being a producer of high-quality light, sweet crude oil, Australia’s oil industry is marked by an intriguing paradox: much of its crude oil is exported while its refineries increasingly depend on imports.

In 2025, Australia continues to produce crude oil, condensate, and natural gas liquids (NGLs) from key offshore basins. The North West Shelf, located off the coast of Western Australia, remains the largest oil-producing region. Its vast Carnarvon and Browse basins are prolific in hydrocarbons, with condensate production often outstripping crude oil volumes. Similarly, the Bass Strait, a historic hub of oil and gas activity, still contributes to national output, albeit at reduced levels as fields there mature. Onshore, the Cooper-Eromanga Basin straddling South Australia and Queensland provides small but steady volumes of crude oil, although it is better known for natural gas.

“Much of Australia’s crude oil is exported, while its refineries increasingly depend on imports”

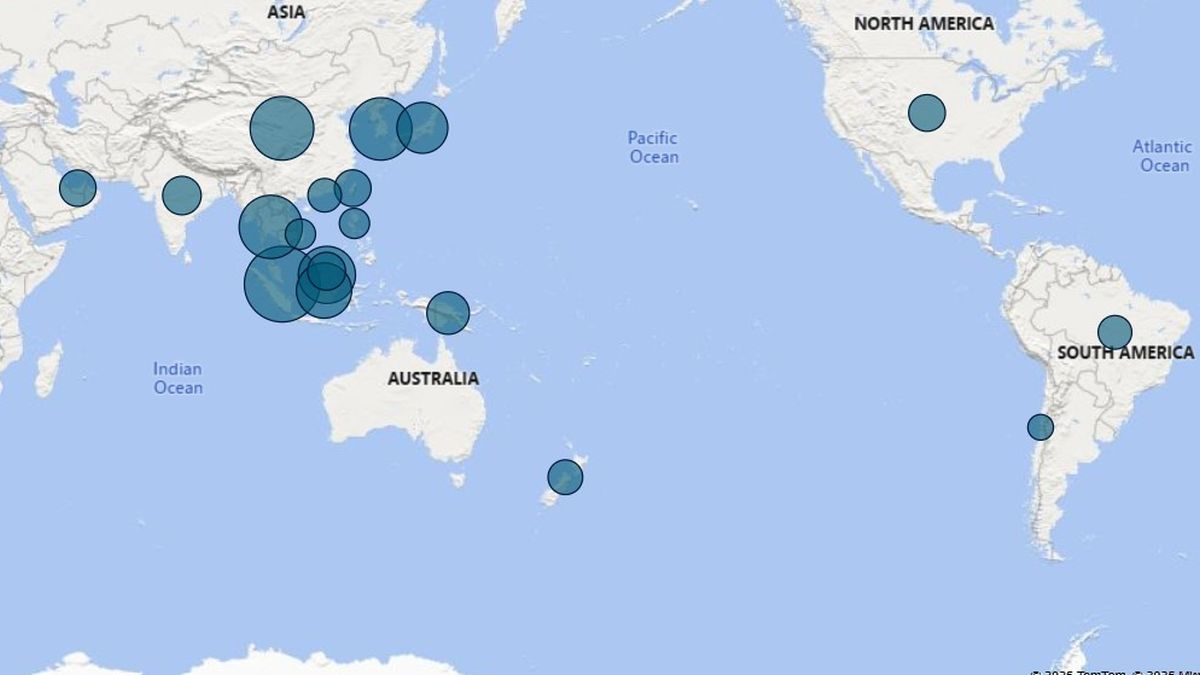

Australian crude is typically light and low in sulphur, qualities that make it highly attractive to refiners in Asia, particularly in nations like South Korea and Japan. As a result, a significant portion of Australia’s crude oil and condensate production is exported, often fetching premium prices in these markets. This export-oriented strategy is supported by the proximity of Australia’s production hubs to key Asian economies, as well as the limited compatibility of Australian crude grades with domestic refining configurations.

While Australia’s crude oil exports thrive, its domestic refining sector has faced years of attrition. The country now operates just two oil refineries: the Viva Energy refinery in Geelong, Victoria; and the Ampol Lytton refinery in Brisbane, Queensland. Both facilities are critical to Australia’s energy security, providing domestically refined fuels for transportation, industry, and other sectors. However, these refineries depend heavily on imported crude oil to sustain their operations. The unique characteristics of Australian crude, combined with logistical and economic considerations, mean it is often more cost-effective to import feedstock from regions such as the Middle East, Southeast Asia, and Africa.

The decline in Australia’s refining capacity has been stark. In 2021, the closure of BP’s Kwinana refinery in Western Australia and ExxonMobil’s Altona refinery in Victoria halved the country’s operational refineries. These facilities were repurposed as import terminals, reflecting the broader trend of global refining consolidation and Australia’s increasing reliance on imported refined fuels. Today, approximately 90% of Australia’s liquid fuel demand is met through imports, including crude oil, refined products, and other feedstocks. This dependence has raised concerns about national fuel security, particularly during times of geopolitical tension or supply chain disruption.

To address these vulnerabilities, the Australian government has implemented measures to support its remaining refineries and bolster fuel resilience. The Fuel Security Services Payment (FSSP) provides financial incentives to Viva Energy and Ampol to maintain refining operations during periods of low profitability. Additionally, the government has introduced the Refinery Upgrades Program, enabling these facilities to produce higher-quality fuels that meet new standards, effective from 2025.

A recent report, released under the Freedom of Information Act, has intensified concerns regarding Australia’s fuel security. The document details a ’war-game’ scenario that exposed significant vulnerabilities in the nation’s fuel supply chain. The exercise revealed that in the event of a major disruption, Australia’s limited fuel reserves could lead to severe shortages, affecting essential services and the broader economy. This situation underscores the critical importance of bolstering domestic fuel production and storage capabilities to mitigate potential risks associated with over-reliance on imported fuels.

Related to this Story

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.