Business Sectors

Events

Contents

Register to read more articles.

Rigs report: 40% of Shell US Gulf of Mexico production offline

About 40% of Shell-operated production in the US Gulf of Mexico remains offline, following damage from Hurricane Ida three weeks ago

An assessment of Shell’s West Delta-143 (WD-143) offshore facilities, “revealed significant structural damage,” said the company.

“We estimate our WD-143 A platform facilities will be offline for repairs until the end of 2021, and the facilities on our WD-143 C platform will be operational in Q4 2021.”

The WD-143 A and C facilities serve as the transfer hub for production from Shell’s Mars, Ursa and Olympus fields in the US Gulf of Mexico to onshore crude and natural gas terminals. The three fields account for about 300,000 barrels of Shell’s 476,000 barrels of oil produced daily from its facilities in the US Gulf of Mexico.

As a result of the repairs required to WD-143, Shell expects production from its Olympus tension-leg platform will not start until Q4 2021. About 100,000 barrels of oil from Olympus flow through the WD-143 C platform. Production from the Mars and Ursa facilities will not start flowing again across the WD-143 A platform until Q1 2022.

Shell said its Perdido asset in the southwestern US Gulf of Mexico was not disrupted by Hurricane Ida, and its floating production, storage and offloading vessel Turritella (also known as Stones), is operating.

The WD-143 platform, owned by Shell Offshore Inc (71.5%) and BP Exploration & Production Inc (28.5%), is operated by Shell Pipeline Company LP.

Baker Hughes reported there were six rigs drilling in the US Gulf of Mexico for the week, down eight year-on-year.

Commenting on the US offshore oil patch, Rystad Energy oil markets analyst Nishad Bhushan said, “On the supply side of crude oil, the US Gulf of Mexico output recovery is improving day by day post-Hurricane Ida, trimming prices that have risen on the back of production outages.

“The production recovery is gradual but progresses realistically, as indeed some outages are expected to last till the last week of September, with the accumulated loss edging towards 30M barrels for the month.”

Added Mr Bhushan, “The weekly rig count suggested stronger fourth quarter crude oil production in the US, as more rigs were added last week, the second straight weekly gain.”

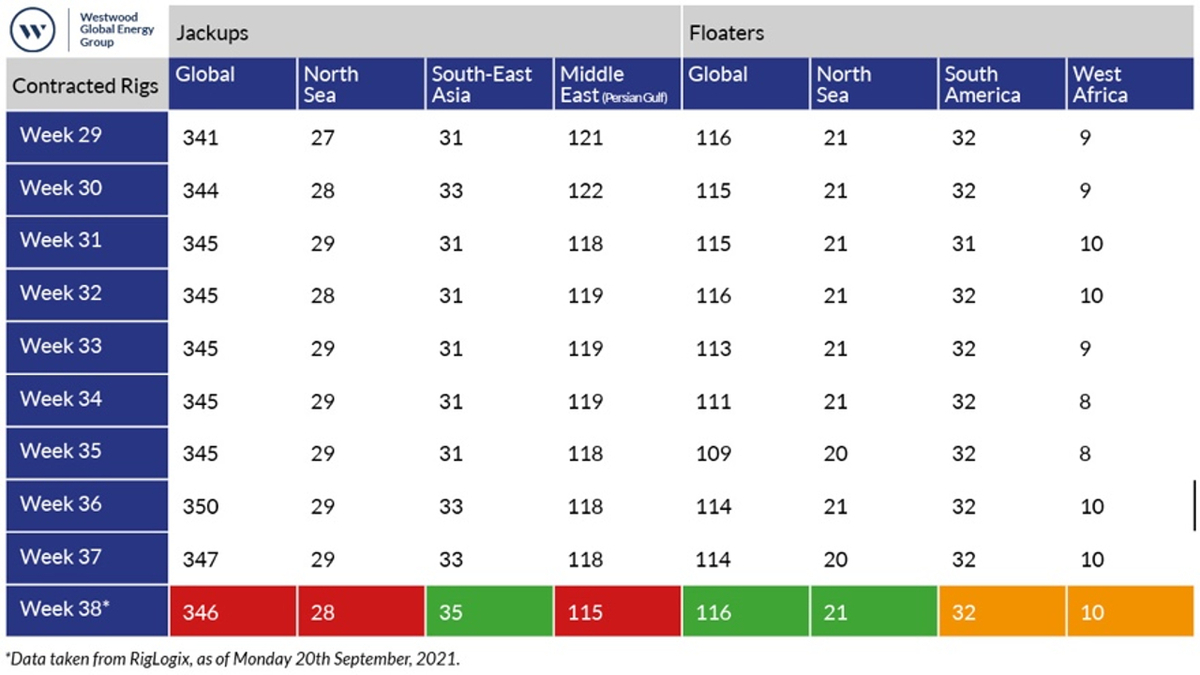

Looking at the global offshore drilling rig picture, Westwood Global Energy’s RigLogix reported there were 346 jack-ups and 116 floaters under contract for week 38, with jack-ups falling by one unit and floaters gaining two, week-on-week.

The most active jack-up market was southeast Asia, which rose to its highest level of the year, with 35 units contracted.

Deepwater activity remained steady, with West Africa and South America at their highest levels of the 2021, and the North Sea gaining one unit week-on-week to 21.

Despite a drop of US$1.88 for the day, Brent crude oil continues to sell above US$70 per barrel, closing at US$73.92, off 1.88% for 20 September at 5:59 PM EDT, according to Bloomberg.

In releasing its semi-annual review and outlook for the offshore energy market, Clarkson Research said there are clear signs of improvement.

“The drilling rig market has seen some pickup, with utilisation of floaters up 8 points since start year (to 72%), and jack-up utilisation also up, but by a more disappointing 2 points (to 77%),” said Clarksons Research managing director Stephen Gordon. “While demand has improved marginally, it is still down on pre-Covid levels (465 rigs, were active in August versus 524 at start-March 2020), and utilisation has been helped by an increase in removals (2021 year to date: 29), some of which have been finalised during Chapter 11 restructuring.”

Jack-up to support CO2 storage project

One of the most interesting contracts announced this week was for jack-up rig Valaris JU-123 for the preparation of a wellbore for the Porthos CO2 transport and storage project in the Dutch North Sea.

Awarded by TAQA, the contract will start in Q4 2021 with an estimated minimum duration of 60 days. In conjunction with this contract, Valaris JU-123 will be upgraded with a selective catalytic reduction (SCR) system. When in operation, the SCR system will eliminate almost all NOx and SOx emissions from the rig.

CO2 captured from industry at the Port of Rotterdam will be transported via offshore pipeline to a platform 20 km off the coast and stored in empty gas fields in the Dutch North Sea. Once fully commissioned, Porthos is expected to be able to store 2.5M tonnes of CO2 per year.

A second award to Valaris JU-123 will see it deployed for a one-well contract with Cairn Energy in the UK North Sea, starting in Q2 2022 with an estimated duration of 72 days.

In APAC, Valaris has been awarded a one-well contract with Carnarvon Petroleum offshore Timor-Leste for Valaris JU-107, starting in Q4 2021 for an estimated period of 30 days.

Dubai-based Shelf Drilling reported a three-year contract for the jack-up rig Parameswara with Oil and Natural Gas Corporation for operations in the Mumbai High, offshore India. The planned start-up of operations is Q1 2022.

Related to this Story

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.