Business Sectors

Events

Ship Recycling Webinar Week

Contents

Register to read more articles.

Round 3: who will bid and where in Taiwan’s offshore wind bonanza?

June 2022 will see a process initiated enabling Taiwan to acquire another 15 GW of offshore wind capacity, but which developers will bid, where will they bid and could floating wind projects be in the frame later in the process?

The first auction to take place under Round 3, Phase 1, is for up to 3 GW of capacity and is due to take place in June 2022. Construction of projects securing awards in this round should get underway in 2025. Two more Round 3, Phase 1 auctions will then take place, also each of 3 GW, in 2023 and 2024, with construction beginning in 2027 and 2029, respectively. Round 3, Phase 2 auctions are due to take place between 2032 and 2035. A total of 6 GW will be up for grabs in this phase and a total of 15 GW of offshore wind capacity in Round 3 as a whole, capacity that is attracting the interest of developers already active in Taiwan and some new ones.

As Aegir Insights managing director Scott Urquhart explained, the 2022 auction has a price cap set at TWD2.49/kWh (US$0.09/kWh) and, compared with Rounds 1 and 2 in Taiwan, Round 3 will place much greater emphasis on localisation, with local content requirements designed to continue the development of initiatives that got underway in Round 2 and encourage the extension of local content into new parts of the supply chain. An overall local content level of 60% is being sought by the authorities in Taiwan, focusing on five main categories of equipment: onshore power; foundations; wind turbine components; marine engineering services; and engineering design services. Developers must score more than 10 points on a number of ‘bonus items’ and each developer must submit an industry implementation plan including a list of qualified suppliers for key development areas as well as self-evaluated additional bonus points.

Another factor that will have an important bearing on the allocation process is that projects will be limited to 500 MW (+ 100 MW) per developer per windfarm. This is to encourage participation in the auctions from the widest possible range of developers. Mr Urquhart and other analysts believe this might drive developers to form partnerships to be able to build larger projects and exploit the benefits of scale that would accrue, a sentiment OWC Taiwan country manager Luis Gonzalez-Pinto agreed with.

“My understanding is that the Bureau of Energy established capacity limits to enhance competition between developers and to avoid dominance by a single player, but it will make it difficult for developers to achieve any scale effect,” Mr Pinto explained. “The capacity cap means that there is going to be a clear advantage if developers combine projects. Economies of scale are always important, particularly so in Round 3 given the localisation requirements. There is a lot of talk about developers joining forces, either before or after the auction, to develop bigger projects together.

“What I am hearing from developers is that the price set by the government is low considering that the size of projects is limited and localisation requirements have increased,” Mr Pinto explained. “For instance, a rule of thumb is that a jacket foundation produced in Taiwan will cost twice as much as one manufactured in South Korea, so there are doubts about to what extent the 60% localisation requirement can be met without collaboration between developers.”

Niras Taiwan managing director Raoul Kubitschek said Taiwan’s Bureau of Energy is also trying to discourage farm-downs before construction ends. “It’s an open question how the market will work with this scenario,” he told OWJ. He noted that Ørsted, for instance, is particularly well placed in Changhua because of potential synergies between projects and because construction is ongoing close to sites it might be awarded in Round 3. He agreed the 500-MW capacity limit is designed to pump up competition and drive up the number of bidders, but believes another important factor is significant infrastructure constraints in harbours and in parts of the Taiwanese supply chain that might make much larger projects difficult logistically.

Mr Kubitschek also believes the price cap set for Round 3 is designed to encourage developers to go for zero-subsidy bids and look for corporate power purchase agreements (PPAs). “Doing so will value the CO2 certificates that come with this,” he said. “It will also help the government to achieve more localisation. When comparing zero-subsidy bids, points for localisation plans will make a lot of difference. If you submit a bid of TWD2.49 you only need 60% local content; but if you go for zero subsidies and a PPA, you will need much higher levels of local content to distinguish your proposal from other zero-subsidy bids.”

Mr Urquhart agreed the price cap has been set at the level that it has to encourage developers to seek corporate PPAs rather than feed-in tariffs. He also agreed the 60% local content requirement for defined parts of projects, including key components and engineering services, will be tough to meet.

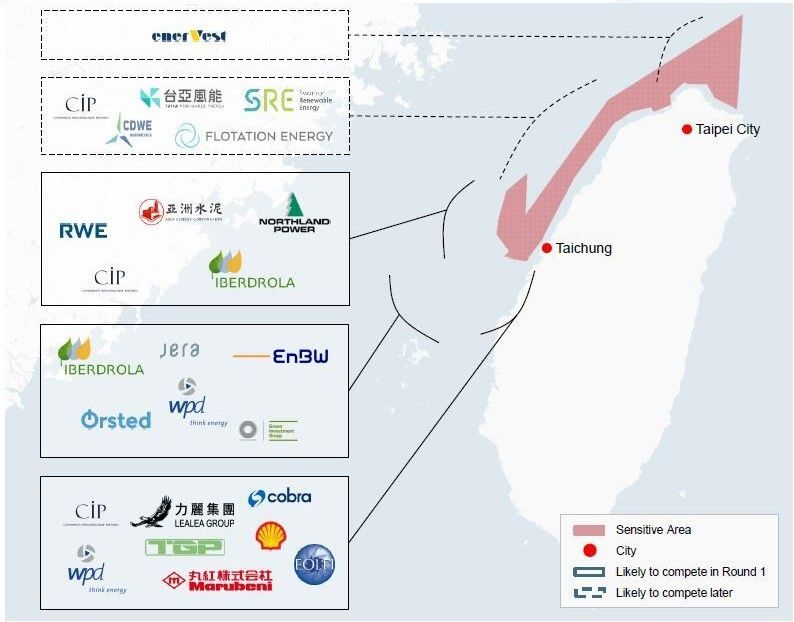

Most of the areas proposed for wind energy development in Taiwan are along the west coast of the country, although new areas are beginning to come into focus. So far, all of the capacity awarded has been fixed-bottom, but later in Round 3 that might also change. Heavy marine traffic and environmental concerns (see below) are factors to keep in mind and Round 3 projects will be required to have preliminary approval from the Environmental Protection Agency (EPA) and a site planning record registered with the authorities. With the June deadline for the first auction approaching fast, several developers are hurrying to obtain an environmental impact assessment.

In Mr Urquhart’s view, the likely scenario for Round 3 is for there to be a particularly high level of interest in the initial phases around areas already allocated for development in Round 2. “I think it’s likely that for at least the first phase of Round 3 the competition will be centred around the same geographic area as the projects allocated in Phase 2,” he told OWJ. “This scenario would be driven in part by winners from Phase 2 trying to exploit economies of scale, but also by the availability of sites that have good wind speeds that are suitable for more fixed-bottom offshore wind.”

Aegir Insights head of research and analytics Maria Bohsen agreed Taiwan has good, unused potential for fixed-bottom offshore wind and said she expects “great interest” from international and domestic developers for fixed-bottom projects. “It’s reasonable to expect developers with areas awarded in Round 2 will want to take advantage of installation and operational synergies,” she explained.

“Projects awarded in Round 2 are due to be installed by 2025. Installation of the first Round 3 projects is expected to start in 2026. This will allow developers with allocated projects in Round 3 to use existing installation setups and operation and maintenance facilities, particularly if the areas are next to or close to one another. These developers are also well-placed for the upcoming auctions because they have experience in the Taiwanese market.”

Mr Urquhart said this scenario assumes sites for floating windfarms will probably not enter the competition until later in Round 3, in order to secure a grid connection after 2027. “Based on the rate of commercialisation of floating wind, it is not expected commercial-scale floating projects will be constructed in Taiwan before the end of the decade at the earliest,” he explained. Ms Bosen said, “Even with a handful of floating wind projects having been announced in Taiwan, we expect the first auction, for which installation is planned for 2026-2027, will be dominated by fixed-bottom projects.”

Mr Kubitschek agreed with Aegir Insights’ analysis. He told OWJ, “Many of the projects that will be bidding are those left over from Round 2. There are other projects for which environmental impact assessment (EIA) hearings are underway. These projects could still get a shot at bidding in the first auction, but only if the Environmental Protection Agency works quickly and doesn’t ask them for major clarifications. Formosa 4 and Formosa 5 are also in the EIA process and could be ready,” he explained.

Asked if this means that key areas off the coast of Changhua and Taichung would be in focus in the first auction and developers such as Northland Power, wpd, Copenhagen Infrastructure Partners (CIP) and Ørsted, who were winners in Round 2, would be well-placed in Round 3, Mr Kubitschek said, “Yes, plus Swancor Renewables. The incumbents have the advantage of being more familiar with the localisation requirements and regulations and they also have an established network in Taiwan.”

Mr Pinto told OWJ that several developers have indicated they plan to use the 2023 auction to bid for floating projects, but it remains unclear if the authorities in Taiwan will enable an auction mechanism that might support the introduction of floating wind and it is questionable whether the supply chain in the country is ready to handle commercial-scale floating wind projects. “There are also several developers looking at demonstration/pre-commercial projects, but the Bureau of Energy hasn’t established any support mechanism for this kind of project yet either,” said Mr Pinto.

Mr Kubitschek is less confident about floating wind bids, certainly in the initial auctions in Round 3. “I wouldn’t discard the idea altogether but looking at the timelines I’d be surprised to see a floating wind project going in soon,” he said. “Taiwan doesn’t have a mechanism to support floating wind. Bids in 2024 could be possible. I wouldn’t completely rule them out in the near-term. The government might yet introduce a pilot project – they are thinking about it – but it’s not something that is likely to happen quickly.”

Assuming that developers seek to exploit synergies and economies of scale in areas already allocated for development in earlier rounds, Mr Urquhart also expects they will focus on key areas off the coast of Changhua and Taichung. “Northland Power, wpd, CIP and Ørsted were the big winners here in Round 2 and it looks like they will be back in Round 3,” he said, but there could well be some new entrants to the Taiwanese market.

Iberdrola and RWE are expected to participate in Round 3 at some point, as may EnBW, although its participation is less certain. Other analysts OWJ spoke to are also certain that RWE will attempt to use Round 3 to enter the Taiwanese market. Iberdrola is also predicted to bid in Round 3, potentially targeting the 2023 or 2024 auctions, and some local developers such as Taiya and Swancor Renewables can be expected to take part.

Mr Kubitschek is also certain there will be new players in Round 3. “We will definitely have newcomers,” he told OWJ. “Iberdrola is looking at multiple sites. Then there is Flotation Energy, which is already developing a site. I expect RWE to develop a Round 2 site and develop new ones, and there will almost certainly be new local developers, such as J&V Energy as well as Taiya. Marubeni has already thrown its hat into the ring for Round 3, although it is not clear whether they will actually pursue something in the early auctions. Then there are developers who are hoping to build a presence in Taiwan, like EDF, and of course TotalEnergies is already involved in Yunneng.” Interestingly, Mr Kubitschek said Shell and BP had been ‘less visible’ in the country of late.

In a March 2022 offshore wind report on the market in Taiwan, Aegir Insights forecast the levelised cost of energy (LCoE) for a number of sites that are likely to prove attractive to developers in Round 3. The LCoE forecasts are attractive, not least because of good wind conditions and the short distances to shore for many projects, which will keep grid connection costs down. The lowest LCoE of any of the sites that are up for grabs are for a fixed bottom site at Taichung that has both these advantages. Aegir Insights forecast a comparable LCoE for a fixed-bottom site in the Changhua cluster.

For floating wind projects allocated in later phases of Round 3, Aegir believes the best LCoE is to be found at the site in Hsinchu, which is driven by particularly good wind speeds and water depths of less than 100 m. Another site, Eluanbi, to the far south of Taiwan, is in much deeper water, around 400 m, but could nonetheless be attractive because it has exceptional wind resources of 11.6 m/s. Another potential floating wind site at Taipei has a higher LCoE, because of lower wind speeds (8.7 m/s) compared with the other Taiwanese sites.

The auction allocation process in Round 3 will be based on price and windfarm connection date. As highlighted above, the first auction has an upper limit of TWD2.49/kWh, but in subsequent years, the average of all winning bids from the prior round will be used as a new upper limit. The lowest bid will have priority, but if there is a tie between developers the capacity will be awarded based on the level of local content proposed and on performance. The timeline for Round 3 projects allows approximately five years from auction to commissioning. Capacity will be awarded along with a fixed year for grid connection.

Which sites will be most attractive and which might one day be off-limits?

Three of the sites in Aegir Insights’ LCoE reference cases are in areas where developers already have projects, or projects that have EIA approval or are in the process of obtaining an EIA. These are Changhua, Taichung and Hsinchu. It expects that several of the projects will participate in the 2022 auction, or participate in subsequent auctions, in 2023 and 2024.

In the northernmost site at Taipei, a couple of potential floating wind projects have been announced, but this site falls into a recently announced ‘sensitive area’ which might mean it is off-limits for development. The southernmost area at Eluanbi has technical potential for deep floating wind, but no projects have yet been announced in the area.

The sensitive area designation also affects part of the west coast of the country and could limit the number of projects that can participate in later Round 3 auctions, if sensitive areas are definitively designated as off-limits. If this happens, several projects that have been announced could be adversely affected, Aegir Insights believes.

Related to this Story

Events

Ship Recycling Webinar Week

International Bulk Shipping Conference 2025

Tankers 2030 Conference

Maritime Navigation Innovation Webinar Week

© 2024 Riviera Maritime Media Ltd.