Business Sectors

Events

Contents

Poten & Partners: Global tension has limited impact on tanker market (so far)

US shipbroker and shipping research house Poten & Partners’ head of tanker research Erik Broekhuizen examines the link between global geopolitical tension and the tanker market

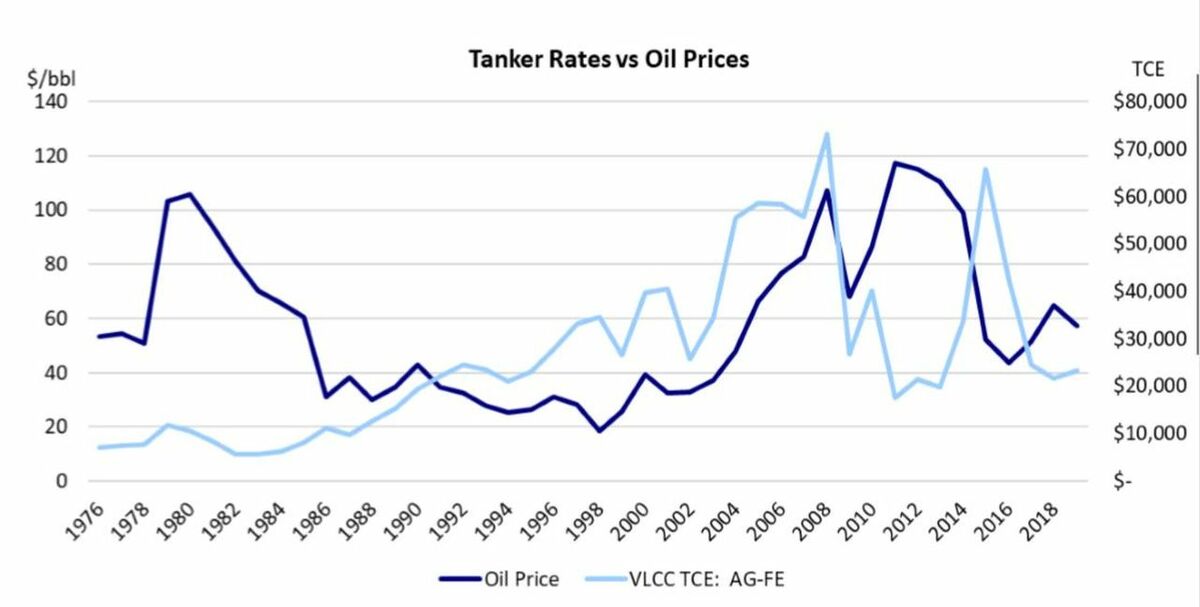

Geopolitical tension and the tanker market are linked, because there is typically a close relationship between geopolitical events and oil prices. Historically, many of the world’s leading oil producing countries are politically unstable and some are at odds with the U.S. and subject to sanctions. Going back to the 1960s, geopolitical events have been the catalyst for many of the biggest moves in tanker rates and prices. The closing of the Suez Canal on 5 June 1967, at the beginning of the Six Day War is probably the best known and certainly one of most impactful examples. The closure of the Suez Canal was sudden and unforeseen and created an unexpected shock to global trade flows. The closure, which lasted eight years, fast-tracked the growth of the VLCC and ULCC fleet, to take advantage of their superior economies of scale. Freight rates initially skyrocketed, but in later years dropped due to the significant overbuilding of tanker capacity. When the Suez Canal reopened in 1975, it was deemed a non-event for the tanker market, which was already depressed. Another geopolitical event that had a big impact on the oil and tanker markets was the Iranian revolution of 1979, followed in 1980 by Iran-Iraq War which lasted until 1988. The common denominator for geopolitical events that have a significant impact on the tanker market is that it is a surprise event in a relatively balanced market. If we look at the current geopolitical landscape around the world, where is it most likely that we could experience a surprise?

Iran is the first place that comes to mind. Iran is facing severe pressure from the United States after President Trump pulled out of the Iran Nuclear Deal in 2018. Between mid-May and mid-June, six tankers were attacked just outside the Arabian Gulf. The U.S. blames Iran, but Tehran denies the allegations. On4 July, authorities in Gibraltar, assisted by the British navy, seized the Iranian VLCC Grace 1, claiming the vessel was taking Iranian oil to Syria, in breach of EU sanctions. Again, this was denied by the Iranians. In an apparent retaliation, Iranian vessels attempted to stop the BP operated tanker British Heritage from passing through the Strait of Hormuz. According to a U.K. government statement, the British navy intervened, although Iran denied the incident. It is clear that the tension in the region is rising and a sudden escalation of the conflict, leading to the (temporary) closure of the Strait of Hormuz, is possible. Because a significant portion of the world’s oil exports are transported through this chokepoint, there will be an immediate and significant impact on the oil and tanker markets.

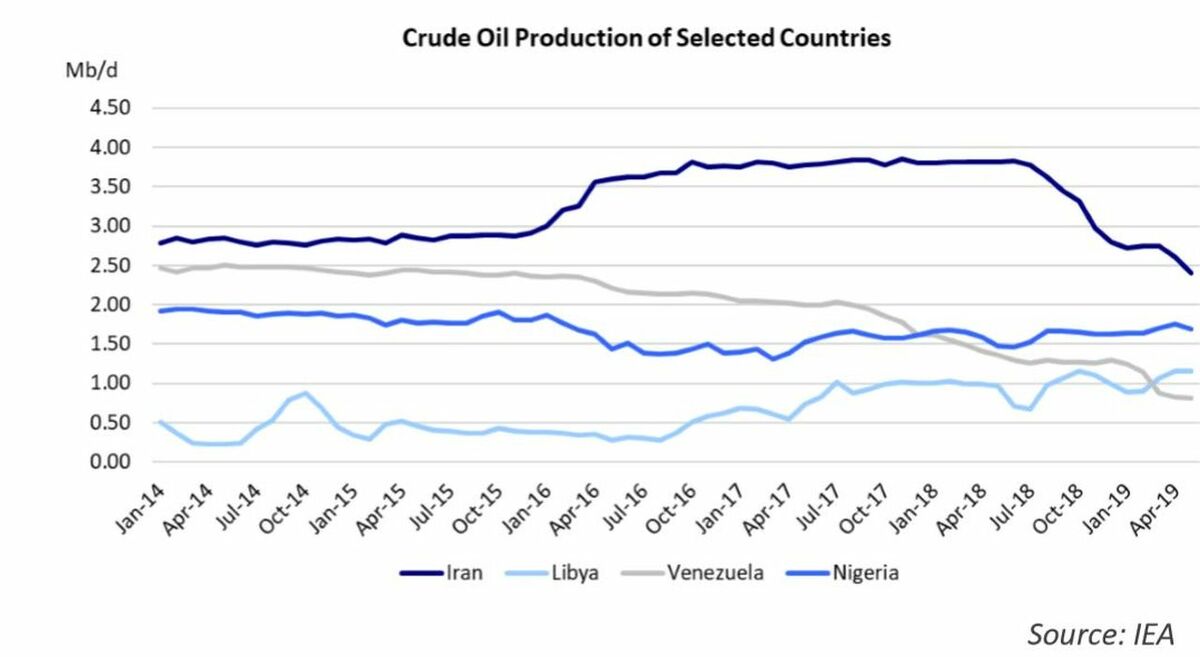

Venezuela needs to be on the geopolitical watchlist as well. Like Iran, this country is also subject to ever-tightening US economic sanctions and there is an ongoing power struggle between President Maduro and the opposition leader Mr. Juan Guaido, who has declared himself interim-president. Oil production in Venezuela is down to 750,000 b/d (and falling), only about 30% of its output 5 years ago (2.5M b/d). The remaining production, as well as the country’s refining output, is at risk and a further escalation of the domestic conflict could reduce oil production even more. While this will further exacerbate the humanitarian crisis in the country, the immediate impact on oil prices and tanker rates, if this scenario plays out, will be limited.

How about Libya and Nigeria? These countries each face significant, albeit different, challenges. Libya is still in the middle of a civil war and its oil production and exports fluctuate significantly month to month. The situation in Nigeria seems to have stabilized and its production is gradually recovering.

Despite the OPEC production cuts on top of the production challenges facing Iran, Venezuela and Libya, the oil markets remain well supplied (thanks to US shale). Oil prices have shown a limited response to the rising geopolitical tension. The tanker market is well-supplied and a significant disruption is needed to materially change the supply/demand balance and impact rates.

Related to this Story

Rethinking tank washing

CMB.TECH and Golden Ocean eye merger

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.