Business Sectors

Contents

Register to read more articles.

Supply chain the key to plans for ‘green powerplant’

In October 2024, nine countries bordering European north seas held the latest ministerial meeting to discuss how to drive the development of a green powerplant in the North Sea and Baltic. This year, the North Seas Energy Cooperation (NSEC) meeting was particularly important

Europe wants to use offshore wind in northern seas to transition to green energy and provide energy security, but the last 12 months have seen the sector struggle with the effects of high inflation and higher interest rates. The EU wants 110 GW of offshore wind in northern seas by 2030 and more than 300 GW by 2050. That’s a big ask.

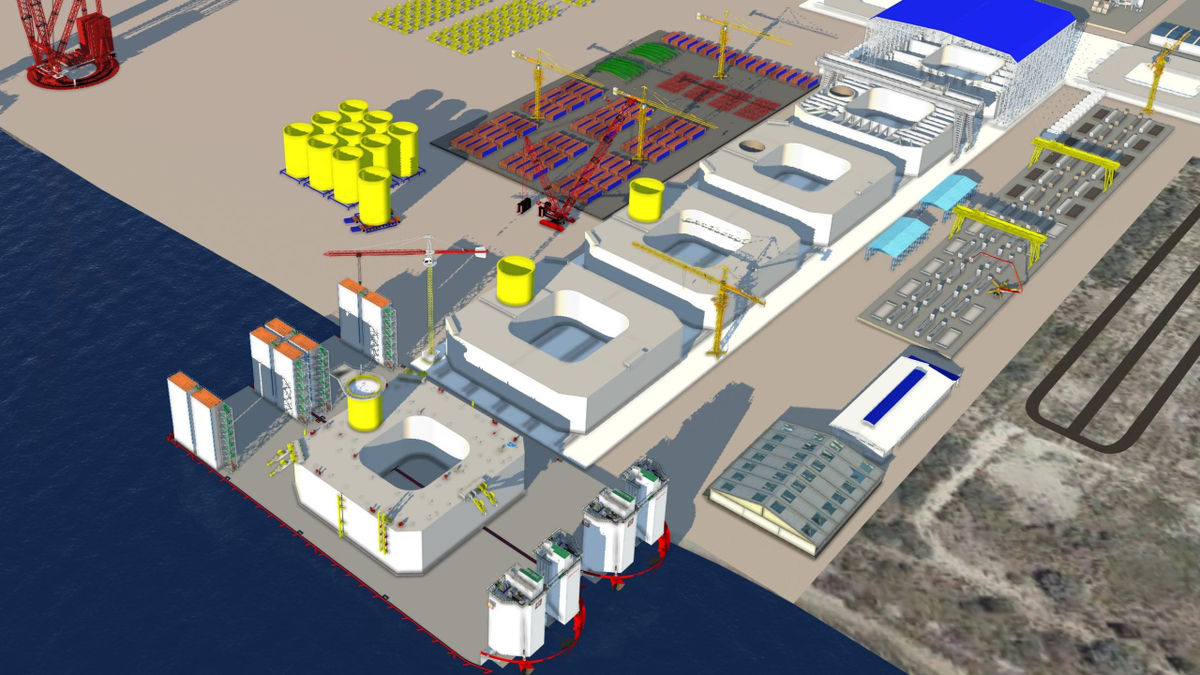

The need to continue to strengthen Europe’s wind energy supply chain was high on the list of topics discussed at the meeting, where, it was agreed, Europe needs to rethink its approach to offshore wind planning. With huge amounts of offshore wind to be installed in coming years, national-level supply chain planning will not suffice. Investment in new and expanded factories will require international co-operation and co-ordination and it is good the EU supports that and tighter prequalification criteria on cyber security and responsible business conduct.

The NSEC also recommended a ‘digital transparency tool’ that provides visibility for the entire wind energy value chain. The tool should serve as an overview of auction schedules, manufacturing capacities, equipment requirements and port capacities across the north seas’ countries. The NSEC called for "a more effective and constructive co-operation between the UK and NSEC."

Supply chain bottlenecks remain, especially the availability of offshore installation and service vessels, port infrastructure, the expansion and reinforcement of onshore grid connections and the availability of skilled workers, but the European offshore wind supply chain is ramping up. By the end of 2025, Europe will be able to manufacture 9.5 GW of offshore wind turbines a year. But will that be enough to meet such ambitious targets, and if not, where will the turbines come from?

As WindEurope notes, European companies are investing around €10.0Bn (US$10.9Bn) to build new factories and expand existing ones – for everything from wind turbines to foundations, cables and grid equipment – but Europe must continue to facilitate access to capital, and enable a level playing field with non-European competitors – that is, with China, about which you can also read more in this issue.

As a respected financial analyst and supply chain specialist told me recently, if Europe does not create the conditions for European companies to invest, others will step in and do so. As it did with solar, China could pick off ‘weak’ countries to gain market access and demonstrate to others that unless they acquiesce, they could lose out on further investment. “This is an issue where we all hang together or we all hang separately and it requires a comprehensive EU and UK approach,” he says. Unless Europe ups the pace and scale of investment, he suggests, there is a risk Europe might also lose much of its ability to innovate.

Riviera’s Offshore Wind Webinar Week will be held 4 November 2024. Click here to register for this free-to-attend event.

Related to this Story

Events

International Bulk Shipping Conference 2025

Tankers 2030 Conference

Maritime Navigation Innovation Webinar Week

© 2024 Riviera Maritime Media Ltd.