Business Sectors

Events

Contents

Register to read more articles.

Data reveals increased impact on dry bulk trade from proposed port fee and tariffs

The dry bulk sector faces a challenging year ahead, shaped by geopolitical trade tensions, policy shifts from the new US administration, and slowing demand growth, coinciding with a surge in newbuilding deliveries

A key concern stems from the latest US proposal to impose port fees on Chinese-built vessels. According to shipbroker Howe Robinson Partners, which discussed the issue at a recent dry bulk seminar in London, there are currently 6,839 active bulk carriers (492M dwt) built in China.

The implementation of such a measure would have a significant impact across all segments, affecting 44.0% of existing Capesize bulk carriers, 49.0% of Post-Panamaxes, 43.0% of Panamaxes, 51.0% of Supramaxes, and 47.0% of Handysize ships.

Additionally, the Chinese shipbuilding orderbook further underscores the potential impact. Data from the seminar revealed that 958 bulk carriers (81M dwt) are currently under construction in Chinese shipyards. Among these, 75.0% of VLOC-Capesize ships, 83.0% of Post-Panamaxes, 77.0% of Panamaxes, 75.0% of Supramaxes, and 46.0% of Handysize vessels are being built in China. This highlights the extent to which such fees could disrupt future fleet expansion.

Tariffs disrupting trade

Since February, the US administration has imposed tariffs on China, Canada and Mexico, triggering retaliatory measures that threaten dry bulk trade.

Howe Robinson analysed the US dry bulk export mix with these three key trade partners. In 2024, Chinese dry bulk imports from the US reached 53M tonnes, reflecting a 1M tonne increase from the previous year. Soya beans accounted for a significant portion of this trade, with the US holding a 21.0% share of China’s total imports. Other key commodities included sorghum (66.0%), petcoke (23.0%) and corn (15.0%).

Trade with Canada, however, declined, with dry bulk imports from the US dropping to 34M tonnes in 2024, a decrease of almost 2M tonnes from 2023. Despite this decline, the US remained Canada’s primary supplier of iron ore and sands, with an overwhelming 99.0% share, while its share of met coal imports stood at 70.0%.

Meanwhile, the US-Mexico dry bulk trade saw notable growth. Seaborne corn exports to Mexico rose to 7.7M tonnes in 2024, an increase of 2.8M tonnes compared with the previous year.

According to Howe Robinson, total US dry bulk imports declined by 1.6% in 2024, totalling 155M tonnes, while exports surged by 10.2% to 376M tonnes.

Slowing demand growth

The industry’s trade challenges are compounded by slowing demand growth. Howe Robinson’s forecast for dry bulk demand growth in 2025 stands at 1.5%, significantly lower than 3.2% in 2024 and 5.0% in 2023.

Iron ore demand is expected to rise only 1.6% in 2025, compared with 3.3% in 2024 and 5.1% in 2023. The coal trade is set to contract, with a projected 0.3% decline, following a 1.8% increase last year and 6.6% growth in 2023. Grain trade will also slow significantly, with demand growth falling from 6.1% in 2024 to just 0.5% in 2025. The minor bulk trade is expected to remain relatively stable, with 2.7% growth in 2025 compared with 2.8% the previous year.

Notably, bauxite demand is expected to grow by a significant 7.0% this year, with analysts highlighting the increasing role of West African dry trade in shaping the future Capesize market, particularly in bauxite and iron ore shipments. Since 2021, the share of seaborne bauxite exports within the Capesize segment has risen by 15.0%.

Notable fleet growth

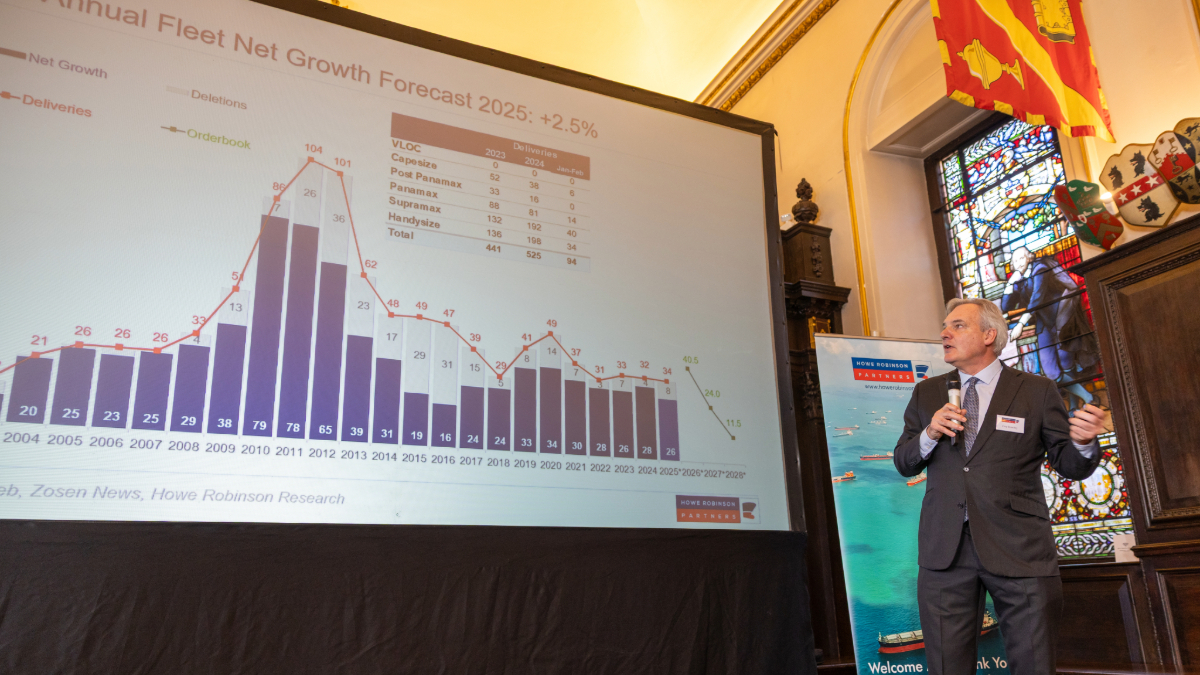

And while demand growth is expected to slow, the fleet is set to expand significantly. According to Howe Robinson, annual fleet growth will reach 2.5% in 2025. The Supramax sector is expected to experience the largest increase, with an estimated 4.8% growth when considering both new deliveries and expected demolitions. The Handysize and Panamax sectors will also expand, with projected fleet growth of 2.7% and 2.6%, respectively. Capesize bulk carriers will see a more moderate increase of 1.4%.

Newbuilding deliveries are anticipated to rise sharply from Q2 2025, peaking in Q4. According to Howe Robinson, the total orderbook for the dry bulk sector currently represents 11.0% of the active fleet in deadweight tonnage terms.

On the demolition side, analysts predicted that approximately 3.3% of the fleet, equivalent to 34M dwt, will be sent to recycling yards this year. The average scrapping age across different sectors indicates that ships continue to operate well beyond 20 years. From 2013 to 2023, the average scrapping age was around 22 years for Capesize bulk carriers, 24-26 years for Panamaxes and Supramaxes, and nearly 30 years for Handysize vessels.

Riviera’s Bulk Carrier Webinar Week will be held from the week commencing 8 April 2025. Click here to register for this free-to-attend event.

Related to this Story

Women in Maritime Today: Elin Saltkjel says no day working in maritime is dull

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.