Business Sectors

Events

Contents

Register to read more articles.

India’s new Dhamra LNG terminal to get first cargo from Qatar

India’s new Dhamra LNG terminal will receive its first discharge cargo in early April, according to a Drewry Maritime Research analyst

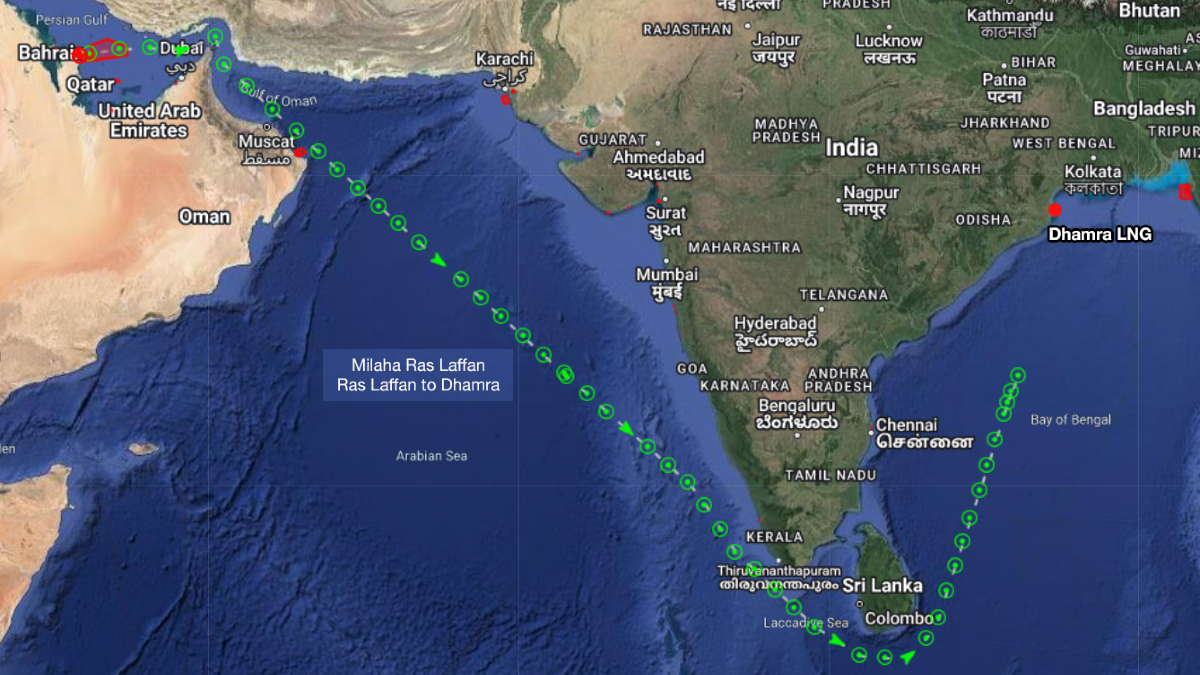

Pratiksha Negi, senior research analyst, Drewry Maritime Research, reported Qatar Shipping’s 138,200-m3 LNG carrier Milaha Ras Laffan is sailing in the Bay of Bengal after loading from Ras Laffan on 21 March. AIS data suggests India’s Dhamra as the destination of the gas carrer with an estimated arrival of between 5 and 6 April. The cargo will mark the first discharge for India’s seventh LNG terminal and only the second on the country’s eastern coast.

Located in Orissa on the east coast of India, the Dhamra LNG terminal has a capacity of 5 mta, with two storage tanks of 180,000 m3 each and is jointly owned by the Adani Group and TotalEnergies. The expected start-up for the terminal was mid-2021, which was revised to mid-2022 due to Covid regulations, and then to 2023 due to delays with associated pipeline construction, said Ms Negi.

The Dhamra LNG terminal project was proposed in May 2015, with India’s GAIL and IOCL signing an MoU with Adani Group to reserve regasification capacity in the terminal. The project cost reported in 2017 was US$930M. Initially, IOCL and GAIL were to have a 39% and 11% share respectively in the terminal, which later expired in 2018, leaving the Adani Group as the sole owner. In 2019, TotalEnergies acquired a 50% stake in the project, and the Adani Group retained their original 50%.

Instead, IOCL and GAIL signed a take-or-pay contract with the Adani Group in 2018 for 3.0 mta and 1.5 mta regasification capacity respectively for 20 years.

With the opening of the terminal India’s regasification capacity will increase to 47 mta. The Dhamra terminal is expected to regasify 2.2M tonnes of LNG in fiscal year 2024 (ending March 2024), backed by IOCL securing a tender for eight LNG cargoes in March 2023 for delivery between June 2023 and May 2024.

The terminal, with an initial 5 mta capacity, can be further expanded to 10-12 mta and will benefit local industries and city gas distribution (CGD) networks in the country. The terminal can cater to LNG carriers with capacities ranging between 70,000 and 265,000 m3 and will offer breakbulk services, allowing the terminal to supply LNG to neighbouring countries, such as Bangladesh and Myanmar.

Tonne-mile demand increase

Ms Negi pointed out that the location of the new terminal on the east coast of India will generate additional tonne-mile demand. She said, “The distance between Ras Laffan and Dahej is around 1,477 nm, while the distance between Ras Laffan and Dhamra is about 3,497 nm. Regarding shipping demand, cargo shipped from Qatar to the Dhamra terminal will generate 140% higher tonne-mile demand compared with that shipped between Qatar and Dahej.

“For instance: Hypothetically, an LNGC carrying 67,500 tonnes of LNG from Qatar to Dahej will generate 99.7M tonne-miles while the same vessel will create 236M tonne-mile demand when shipping an LNG cargo from Qatar to Dhamra. Thus, operations in the Dhamra port will boost the shipping business slightly, augmenting extra tonne-mile demand in the shipping sector,” she concluded.

Related to this Story

Events

Maritime Regulations Webinar Week

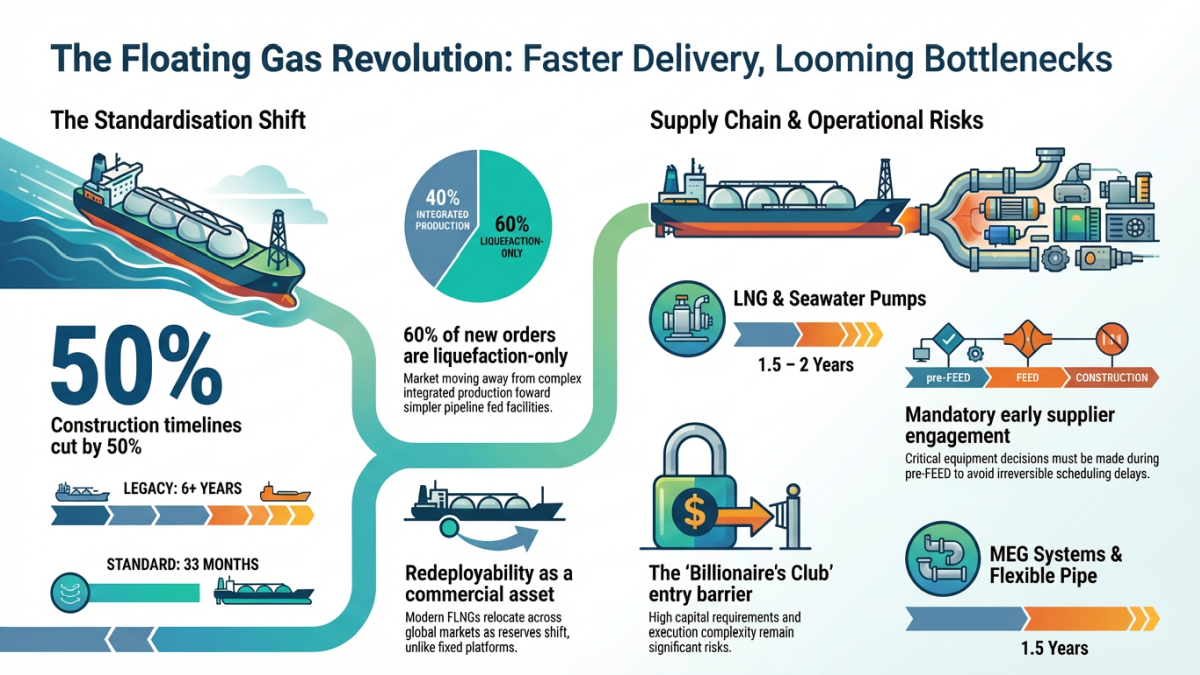

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.