Business Sectors

Events

Contents

Register to read more articles.

Suez Canal blockage halts Qatar to Europe LNG flow

With salvors warning that it could take weeks to free the ultra-large container ship Ever Green grounded in the Suez Canal, the movement of oil and LNG from the Middle East to Europe is facing significant disruption

“It’s not often that LNG vessel traffic is disrupted, and the current blockade at the Suez Canal can be considered as a major obstacle for LNG flows to Europe,” Rystad Energy head of gas and power markets Carlos Torres Diaz said.

“The Suez Canal is one the world’s busiest trade routes, and this blockade is having great implications on global trade, including LNG, as shipments to Europe from one of the world’s largest LNG producers - Qatar – essentially all pass through there,” he said.

During 2020, close to 260 LNG cargoes were sent from Qatar to Europe via the Suez Canal, or an average of five per week.

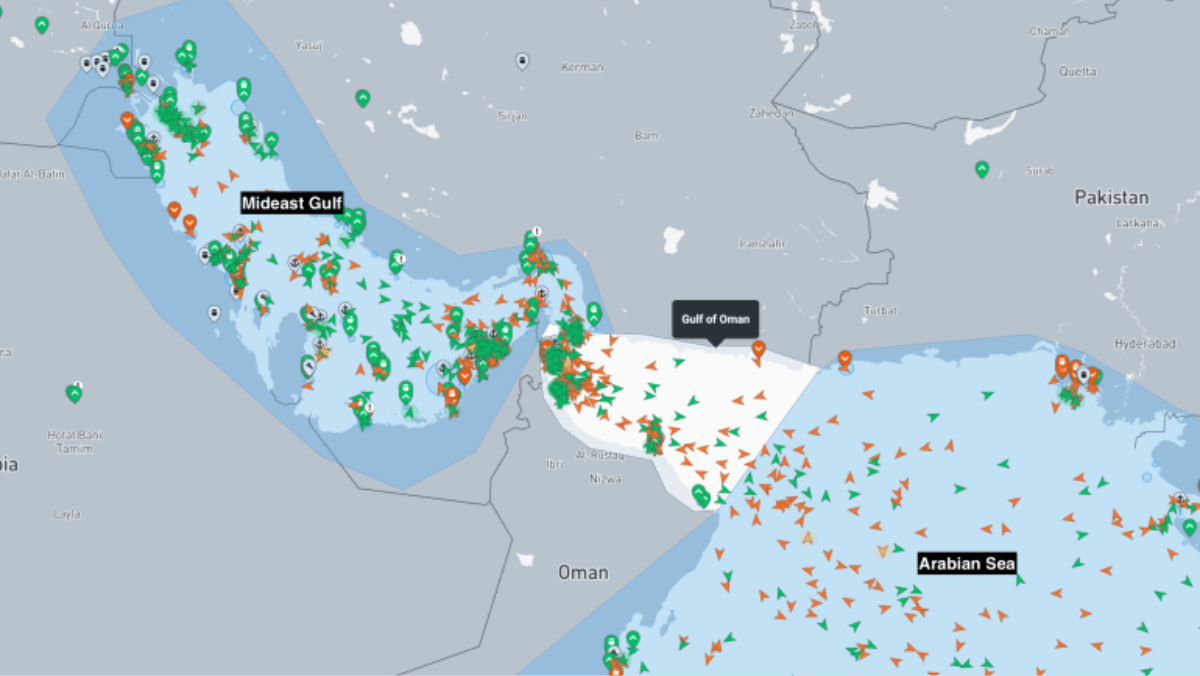

Data shows that currently there are three loaded cargoes in the Suez Gulf waiting to cross to the Mediterranean that were originally expected to arrive at European regasification terminals during the first week of April.

There are at least another two in the Arabian Sea that are headed to the Suez Canal. These cargoes have a combined capacity of more than 1M m3 of LNG or close to 0.5M tonnes that cannot be delivered to their European buyers, according to Rystad Energy.

“Dredgers are already in place trying to dig out the huge Ever Given vessel to liberate the route,” said Mr Torres, “but according to preliminary reports from rescuers, the canal could remain blocked for several weeks.”

Assuming an average of five vessels per week, Mr Torrees said around 1M tonnes of LNG could be delayed for delivery to Europe if the blockage were to last for two weeks. In a worst-case scenario where the canal remains blocked for four weeks, then there would be 2M tonnes of delayed cargo deliveries.

The voyage from Suez to northwest Europe (eg Isle of Grain in the UK) takes around nine days at an average speed of 15 knots. The complete route from Qatar to northwest Europe takes around 17 days and the alternative route around the Cape of Good Hope would take more than 30 days, making this an unviable option, at least for the time being.

“Even if the route is liberated within one week, there is a large queue of cargoes lining up to cross the canal, so the return to normal flow will take some time. And the longer it takes to liberate the route, the longer the queue of vessels,” Mr Torres pointed out.

He said the main beneficiaries of LNG and gas supplies south of the Suez being blocked could be Russia and the US.

“Given that Russian pipeline supplies to Europe are currently below maximum capacity, Russian supplies could help provide some flexibility so the blockade will inevitably support gas prices across Europe,” he said.

“It [will be] interesting to see if the US will try to benefit from the Suez blockade as shipments from its LNG export facilities could reach Europe much quicker than a vessel starting from the Middle East that would go around Africa,” observed Mr Torres.

“US gas production is set for a continuous monthly increase and it could be a perfect opportunity for US producers to secure some orders at a time of such a transport route crisis.

The current situation could also in turn affect LNG vessel shipping rates for product of US origin, as demand could rise,” he concluded.

Riviera’s upcoming free-to-attend LNG Webinar Week series of webinars will focus on the business of shipping LNG, including mooring solutions, bunkering vessels and small-scale opportunities. Register now

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.