Business Sectors

Events

Marine Coatings Webinar Week

Contents

Register to read more articles.

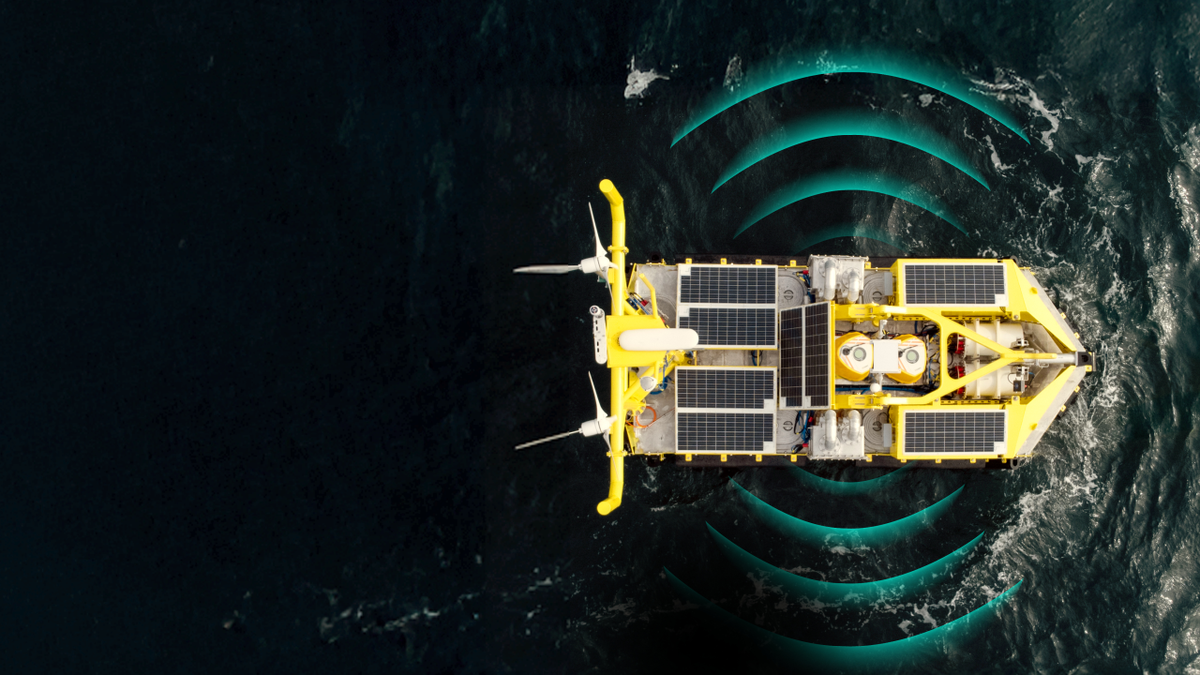

Netherlands offshore wind industry ‘under pressure’ due to financing gap

The Netherlands is at risk of losing its competitiveness in offshore wind as companies in the supply chain encounter financing and innovation bottlenecks

So says a study by JBR, commissioned by Invest-NL and TKI Offshore Energy which states scaling up and innovating in the supply chain are crucial to maintaining competitiveness and achieving climate goals.

“Offshore windfarms in Dutch waters can contribute substantially to Europe’s target of 120 GW of offshore wind by 2030, but the sector’s supply chain is threatened by increasing competition from other regions, such as China,” say the authors of the report.

“Europe’s market share in turbine assembly fell from 58% to 30% between 2017 and 2022 and without better financing and strategic investment, crucial production capacity risks disappearing abroad.

“To maintain a competitive position in offshore wind, an action-oriented approach is needed across the entire chain,” the report says. “This requires risk-reducing financial instruments, adjustments to the tender system and better use of European financing.”

Invest-NL business development manager Eva Ferrier says, “The Netherlands has all the ingredients to remain a frontrunner in offshore wind, but without action we run the risk of a sector that is crucial to the Netherlands disappearing abroad. This report shows which solutions can reverse this trend. At Invest-NL we will focus on developing financial instruments that mitigate risks and mobilise capital for the offshore wind sector.”

One of the problems the report identifies is that, because of the high level of capital investment required and long lead times for development, investment in the supply chain is seen as potentially risky.

According to JBR, this makes investors cautious and creates a financing gap between supply and demand. Sums between €2.0M (US$2.2M) and €10M are particularly difficult to obtain, it says, and low margins resulting from competition from China and the slow pace of electrification “are causing innovation and scaling to stall.”

JBR says the Dutch tender system remains largely focused on the highest bidder, which reduces margins and leaves insufficient room for innovative companies to implement new technology at scale.

The report says the tender system needs to be revised so that innovation, employment and sustainability play a greater role in the award of projects. “This will make the sector less dependent on cost-oriented competition and provide more room for qualitative growth,” it says.

The authors of the report say new financing solutions and ‘innovation subsidies’ are needed to spread investment risks and stimulate capital injections.

In addition, the Netherlands could make greater use of European financing opportunities, such as the €5Bn European Investment Bank counter-guarantee, to close the financing gap and accelerate scaling up.

Greater collaboration between the government, investors and companies could also help the offshore wind sector grow and remain internationally competitive.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Marine Coatings Webinar Week

Maritime Environmental Protection Webinar Week

Ship Recycling Webinar Week

© 2024 Riviera Maritime Media Ltd.