Business Sectors

Events

Contents

Register to read more articles.

Rigs report: Stena Drilling eyes fleet expansion with drillship deal

Stena Drilling could be on the verge of expanding its fleet with a new 7th-generation ultra-deepwater drillship

Last week, it entered a purchase agreement option with South Korea’s Samsung Heavy Industries (SHI) for a drillship, one of two such vessels originally ordered by OceanRig UDW in 2013-2014. SHI was left with the two newbuild drillships after Transocean acquired Ocean Rig and did not take delivery of the vessels.

One of the drillships, Santorini, has been leased by SHI to Saipem, which holds an option to buy the vessel.

As for Stena Drillling, it plans “to fit the drillship according to our specifications with hybrid technologies including the use of batteries. If we find a suitable contract, we will use the option to buy the unit,” said Stena Drilling chief executive Erik Ronsberg.

The Korea Herald reported the purchase price for the drillship was US$245M.

“Stena clearly recognises the need to decarbonise the economy as soon as possible,” said Mr Ronsberg. “We also understand that society needs to function while we are in this important transition. Fossil resources will be phased out, but during the transition, Stena are taking the responsibility to offer safe and efficient services within energy supply.”

Stena Drilling’s fleet consists of two semi-submersibles and four ultra-deepwater drillships.

One of those is Stena Drilling’s sixth-generation DP3 ultra-deepwater drillship Stena IceMAX, which is supporting a campaign for FAR Ltd in offshore Gambia.

Deepwater drilling at the Bambo-1 well offshore Gambia in West Africa has been temporarily halted at a depth of 3,216 m because “significant fluid losses were experienced,” said Australia’s FAR Ltd in a regulatory filing. FAR, which is the operator for the joint venture with partner Petronas, is now planning to plug and side-track the well to continue drilling to the planned total depth of 3,450 m. FAR estimates the cost to complete the well will increase from US$51.4M to US$61.27M.

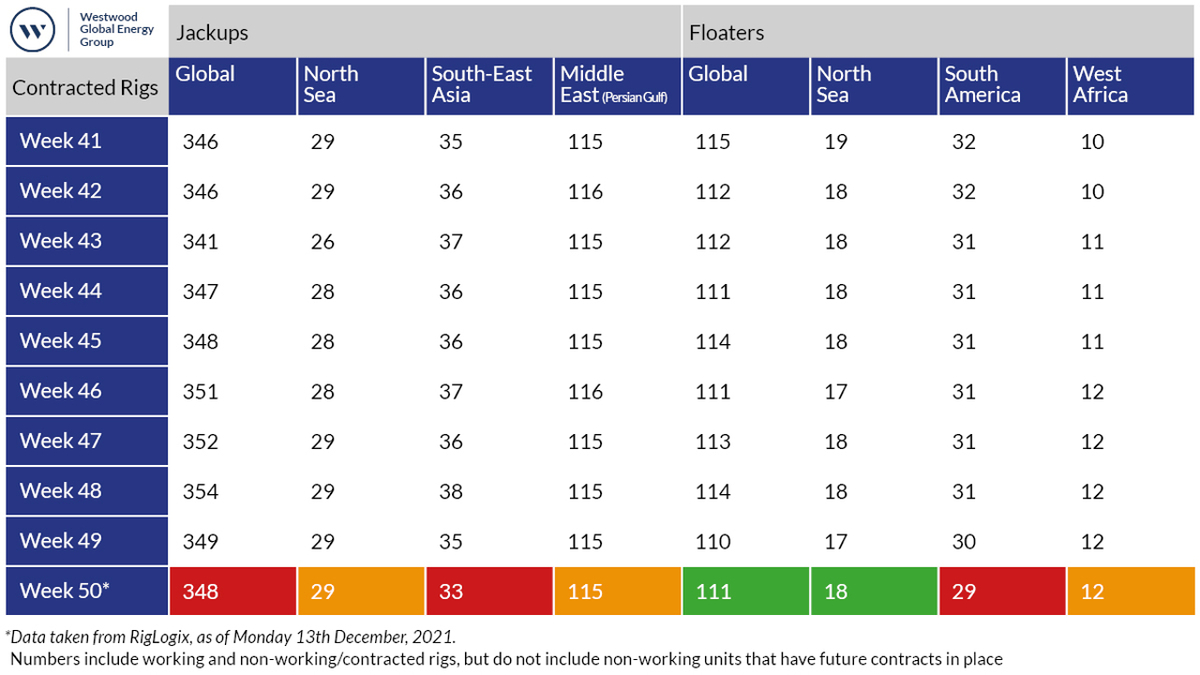

With the year winding down, offshore global jack-up drilling contracting slipped thanks to lower activity in southeast Asia, while floater activity rose for week.

Westwood Global Energy’s RigLogix reported 348 offshore jack-up rigs were contracted for week 50 2021, one unit less week-on-week. Jack-up levels in the North Sea and Middle East remained stable, while southeast Asia fell two units to settle at 33.

Meanwhile, floater activity gained one unit week-on-week, with 111 units under contract, 18 of which were in the North Sea, 29 in South America and 12 in West Africa.

Related to this Story

Women in Maritime Today: Elin Saltkjel says no day working in maritime is dull

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.