Business Sectors

Events

Ship Recycling Webinar Week

Contents

The fragile equilibrium of LNG demand growth in Asia

The Asian LNG market is in a precarious balance between growing demand and constrained supply, shaped by climatic variations, geopolitical influences, and infrastructure challenges

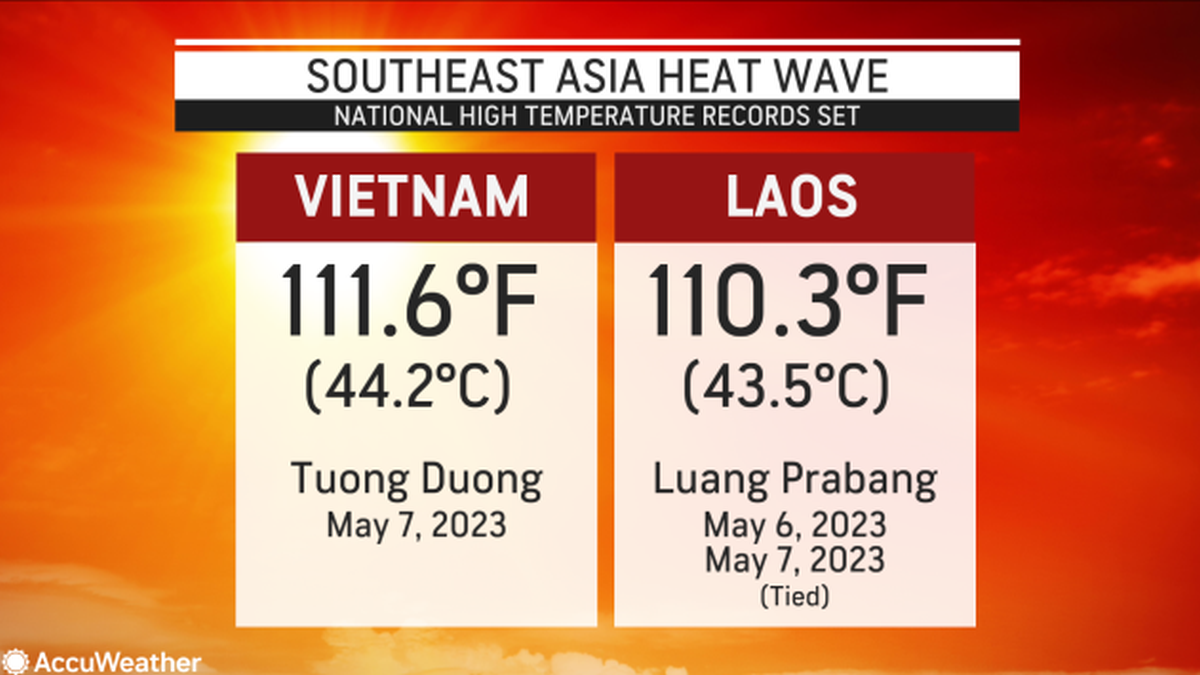

One of the most prominent factors influencing LNG demand in Asia is extreme weather. The record-breaking heatwaves in 2024 significantly increased gas-fired power generation, particularly in Japan and India, despite stiff competition from coal and renewables. In Japan, for instance, coal-fired power plants reached their peak capacity during the hottest months, leaving gas-fired power to fill the remaining demand gap.

“In the later part of the summer, we saw what seemed to have been a record high in gas generation in August, at the peak of the heatwave,” said Matthew Drinkwater, gas and power analysis manager at Argus Media. He noted that this dynamic will likely continue into 2025, with demand spikes driven by seasonal temperature extremes. However, broader trends indicate a declining reliance on LNG as nuclear restarts and renewable capacity expansions gain momentum.

China: a cautious approach to LNG imports

China remains a key player in Asia’s LNG market but is increasingly selective in its LNG procurement strategies. The country favours pipeline imports and domestic production over spot market purchases, except when price conditions present arbitrage opportunities. “There isn’t a huge incentive a lot of the time for particularly China’s state-owned companies to pick up additional LNG in the spot market,” explained Mr Drinkwater. “It has ample supply from pipelines, long-term contracts, and rapidly increasing domestic production.”

China’s spot purchases tend to fluctuate based on price competitiveness. When imported LNG is cheaper than domestic trucked LNG, second- and third-tier firms take advantage of arbitrage opportunities, driving up import volumes. However, when spot LNG becomes more expensive, imports decline back into five-year range norms.

Furthermore, China has secured long-term contracts covering over 50M tonnes per annum (mtpa), limiting its reliance on fluctuating spot prices. Any further demand growth will likely be met through additional pipeline imports, particularly from Russia’s Power of Siberia and Central Asian exporters.

Japan and South Korea: declining demand and nuclear expansion

Japan’s LNG consumption is on a downward trajectory as nuclear power plays a larger role in the energy mix. “The broader trend that we’ve been seeing is actually towards a reduction in energy consumption,” said Mr Drinkwater. Several nuclear reactors, inactive for over a decade, have restarted, further reducing the need for gas-fired power.

South Korea’s LNG demand remains stable for now but could see declines in the long term as the government prioritises nuclear expansion. Five new reactors are planned for operation by 2033, reducing the share of gas in the country’s power mix. As a result, LNG import growth will likely plateau despite periodic demand spikes driven by seasonal temperature extremes.

India: Sensitivity to LNG prices and economic factors

India’s LNG market is characterised by price sensitivity, with fluctuating demand based on affordability. “Some incredibly hot weather during the spring helped support Indian LNG demand, but as prices climbed over the second half of 2024, appetite for imports was dampened,” Mr Drinkwater noted.

High prices prompted a switch to alternative fuels, with refineries increasing LPG consumption and city gas distribution networks reverting to propane. This price-driven volatility is expected to persist in 2025 until LNG prices stabilise. India’s new regasification terminals and pipeline expansions may enhance the accessibility of LNG, but its demand growth remains contingent on global pricing trends.

Southeast Asia: infrastructure challenges and policy constraints

Southeast Asia presents a mixed outlook for LNG demand growth. While countries like Vietnam and the Philippines have expanded regasification infrastructure, delays in LNG-to-power projects and contractual uncertainties limit immediate demand increases.

Vietnam, for example, received its first LNG shipment in 2023, yet power plant commissioning delays hinder full-scale adoption. “Even though Vietnam has outlined an ambitious LNG-to-power programme, realising these plans remains a challenge,” said Dainius Sivickis, head of business development at KN Energies.

The Philippines faces similar hurdles. LNG imports began in 2023, but regulatory challenges in securing power purchase agreements complicate sustained demand growth. Meanwhile, Thailand has sought to minimise LNG imports, balancing gas-fired generation with domestic energy sources.

Supply constraints and shipping bottlenecks

Despite demand growth, LNG supply in Asia faces critical constraints. New liquefaction projects are delayed, with only 14M tonnes of new supply expected in 2025 — far below the projected 45M tonnes of new capacity.

Shipping bottlenecks further exacerbate supply challenges. “LNG shipping was caught in a highly imbalanced market in 2024, with fleet growth outpacing liquefaction capacity,” said Drewry Maritime Research senior maritime research, Pratiksha Negi. Although new vessels are entering service, logistical challenges remain, particularly with rising geopolitical tensions affecting trade routes. Ms Negi further elaborated that while new vessels are being commissioned, supply chains remain vulnerable to geopolitical disruptions, with the potential for rerouted cargoes and increased freight costs impacting the overall market stability. According to Ms Negi, LNG carriers are expected to face longer voyages and constrained availability, which could delay deliveries, particularly during peak demand periods.

Ms Negi also pointed out that floating storage dynamics might play a larger role in 2026, as increased LNG supply could incentivise traders to store cargoes at sea. “If LNG supply starts to exceed immediate demand, we may see the re-emergence of floating storage as a strategic option, particularly with freight rates at record lows,” she noted.

Her insights suggest that while 2025 will still see tight shipping conditions, 2026 could mark a shift in LNG trade flows, where surplus cargoes are stored for future arbitrage opportunities. However, this scenario hinges on whether planned liquefaction projects start production on schedule.

Storage and market risks

European storage dynamics also impact Asia’s LNG outlook. Lower Russian gas flows have increased Europe’s reliance on LNG, drawing cargoes away from Asian markets. Storage withdrawals are at high levels, reducing flexibility in case of unexpected demand surges.

Argus Media fundamentals analyst, David Luff, highlighted the issue: “We are in a position where storage has been the lever that Europe has had to pull on in order to meet demand. This has significantly raised the volume of LNG flowing to Europe rather than Asia.”

As a result, Asia’s LNG market remains vulnerable to supply chain disruptions. If new liquefaction capacity does not ramp up as expected, or if geopolitical events disrupt trade routes, Asia may face tighter supply conditions and increased price volatility.

Related to this Story

Events

Ship Recycling Webinar Week

International Bulk Shipping Conference 2025

Tankers 2030 Conference

Maritime Navigation Innovation Webinar Week

© 2024 Riviera Maritime Media Ltd.