Business Sectors

Contents

Register to read more articles.

Without Russian supply, Poland looks to US LNG and Norwegian gas

With gas imports from Russia halted, PKN Orlen will use new gas interconnectors and LNG supplies under long-term contracts with US-based producers to help meet Poland’s energy demands

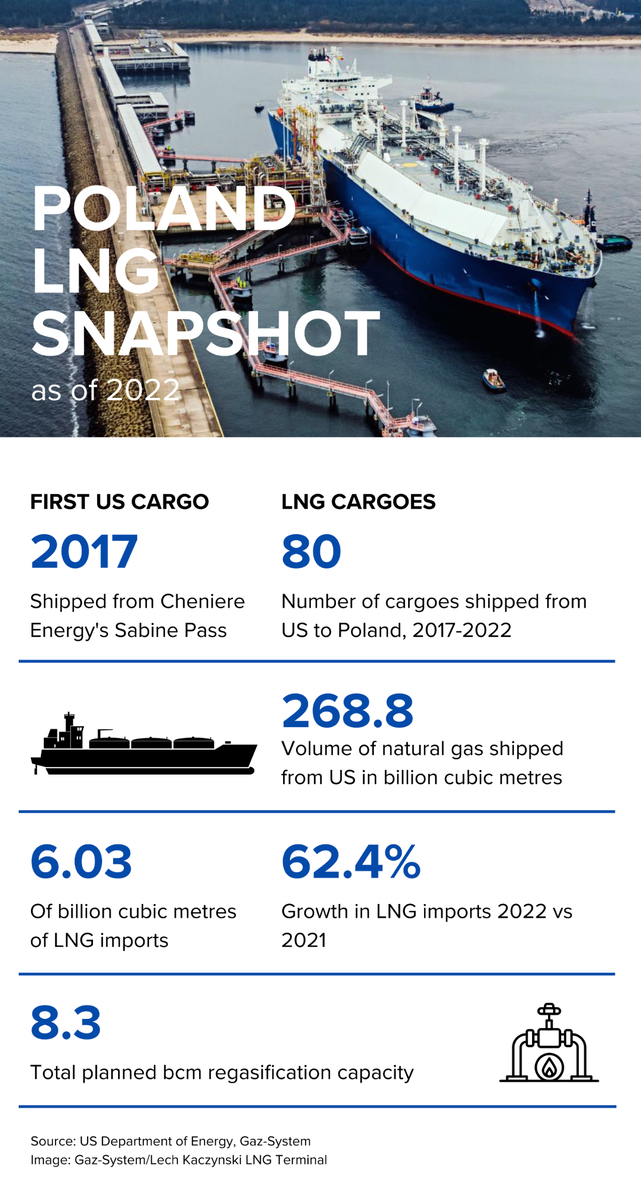

Starting with the first cargo delivered in 2017, LNG imports from US producers have helped Poland reduce its dependence Russian gas. With Russian pipeline gas imports halting in 2022, PKN Orlen’s LNG imports jumped more than 50% year-on-year as the Polish energy company looked to ensure the country’s energy security, with US exporters playing a pivotal role.

LNG and pipeline deliveries from Norway and Lithuania accounted for over 50% of all gas imported by Poland’s PGNiG, with almost 25% coming from the US, according to PKN Orlen.

These increased LNG and gas imports were underpinned by increased offtake capacity at the President Lech Kaczyński LNG terminal in Świnoujście, Poland, and new cross-border connections, including the Baltic Pipe running between Poland and Norway, where the Orlen Group owns gas assets.

Accelerating the urgency of these new sources of natural gas was the suspension of Russian gas imports in April 2022. Gazprom halted pipeline transmissions on 27 April, after PGNiG rejected its demands to change the settlement currency under the Yamal contract to the rouble, which was in violation of the contract’s provisions.

At 2.90 billion cubic metres (bcm), gas imports from Russia accounted for about 20% of the total, down from 9.90 bcm or 61% in 2021.

To alleviate energy shortages caused by its pivot from Russian gas, Poland increased imports of LNG, signed contracts for the purchase of Norwegian gas, and began importing gas from Lithuania and Slovakia, notes PKN Orlean chief executive and management board president Daniel Obajtek.

“Looking ahead, 2023 will be the first full year without any gas imports from Russia, which will be replaced by deliveries via the Baltic Pipe and LNG supplies under long-term contracts with US-based producers,” says Mr Obajtek.

In 2022, LNG was a significant part of PKN Orlen’s gas imports. At 6.04 bcm, LNG deliveries accounted for as much as 43% of the group’s total imports – a more than 50% increase from 2021, when LNG deliveries amounting to 3.94 bcm represented 24% of all gas supplied to PKN Orlen. The surge in LNG imports was a response to the European gas crisis resulting from the Russia-Ukraine war. The group in particular increased LNG deliveries from the US, which totalled approximately 3.40 bcm after regasification in 2022.

In 2022, the Baltic Pipe and the Poland-Lithuania and Poland-Slovakia interconnectors allowed the Orlen Group to import about 1.26 bcm of natural gas from these new sources, accounting for roughly 9% of the company’s total imports.

Launched in Q4 2022, the Baltic Pipe allows gas imports from the Norwegian Continental Shelf, where Orlen holds 98 licences and produces hydrocarbons from 17 fields.

In May 2022, the Poland-Lithuania Gas Pipeline was placed in service, enabling Orlen to import 0.55 bcm of natural gas from the Klaipėda regasification terminal, which received eight LNG cargoes starting in May 2022.

Another new source of supply was established through an interconnector with Slovakia, from which Orlen imported 0.03 bcm of gas in 2022.

The total volume of the Orlen Group’s gas imports in 2022 was 13.91 bcm, down 14% year-on-year, which was primarily attributable to lower demand from Polish customers. Poland’s Ministry of Climate and Environment estimated that gas consumption in country in 2022 fell by 17% year-on-year.

US LNG deal

In its latest agreement with a US LNG producer, PKN Orlen signed a 20-year sales and purchase agreement in January with Houston-based Sempra Infrastructure for 1 mta from the Port Arthur LNG Phase I Project on a free-on-board basis. Sempra is now moving ahead with the 13-mta project after taking a positive FID in March.

As the deal is on an FOB basis, PKN Orlean will supply its own longhaul shipping for the LNG cargoes. The group has had eight LNG carriers ordered for its exclusive use. Société Générale has completed the financing and delivery of 174,000-m3 LNG carrier Lech Kaczyński, the first in this series.

One of Europe’s leading financial services groups, Société Générale was advised by the international law firm Watson Farley & Williams (WFW) and its cross-border team on the highly complex and structured transaction.

Delivered in December 2022 by South Korea’s Hyundai Heavy Industries (HHI), the LNG carrier is subject to financing by way of crédit-bail, partially backed by export credit agency Korea Trade Insurance Corp. The vessel is bareboat chartered to an affiliate of Norway’s Knutsen Group and time-chartered to PGNiG. One of the first cargoes lifted by Lech Kaczyński was from Cheniere’s Sabine Pass LNG export facility in the US in February. PGNiG has chartered Lech Kaczyński to transport cargoes from the US to Poland for 10 years.

The terms of the financing were not disclosed, but it is believed when Lech Kaczyński and its sister vessel were ordered at HSHI in 2020, the unit cost was US$187.5M – about US$70M lower than today’s prices.

As we previously reported during week 11, 2023, Greece’s Capital Gas inked a deal with HSHI for two 174,000-m3 LNG carriers, priced at US$259.5M each. Both vessels have a delivery date of September 2026. Before midyear, the price tag for a standard-sized LNG newbuilding will likely top US$260M.

The Evangelos Marinakis-controlled Capital Gas increased its newbuilding programme to 13 with the latest LNG order, with six being built at HHI and seven at HSHI.

The US$519M deal was part of a busy week 11, 2023 that featured “the relentless march of gas business,” said BRL Newbuilding Contract Weekly. Seven LNG newbuilds were ordered during the week, five at Chinese shipyards and two at South Korea’s HSHI.

“Even now observers predict many more ships will be required in the next decade to satisfy demand and the eco debate over the rush to decarbonisation reduction towards a zero goal by 2050,” said BRL.

With 24 LNG newbuilds ordered in 2023 as of week 11, the global orderbook was pushed to 397 ships, according to BRL data.

Riviera Maritime Media’s Maritime Decarbonisation Conference, Asia will be held 19-21 April 2023 in Singapore. Use this link for further information and to register your interest

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.