Business Sectors

Events

Ship Recycling Webinar Week

Contents

Register to read more articles.

Shipping targets hidden steel emissions with new regulatory framework

The Sustainable Shipping Initiative suggests ways to reduce greenhouse gas emissions from the steel used in ship construction in its new report

The maritime sector faces mounting pressure to address a substantial yet overlooked source of greenhouse gas emissions: the steel used in ship construction. According to new analysis from the Sustainable Shipping Initiative (SSI), steel production for shipbuilding generated 72.2M tonnes of carbon dioxide equivalent in 2021-2022, representing approximately 4% of total emissions from international shipping.

The findings, published in the SSI’s August 2025 report Green Steel – Insight Brief: Bringing steel into shipping’s climate strategy through lifecycle and regulatory action led by Dr Michaela Dommisse of the Sustainable Ocean Shipping Hub Australia at the University of Western Australia, expose a critical gap in current decarbonisation efforts. While the industry focuses primarily on operational fuel consumption, it ignores substantial lifecycle emissions embedded in vessel materials. Steel accounts for 75-85% of a ship’s weight and generates significant upstream emissions from mining, production, transport and recycling – processes typically excluded from regulatory frameworks.

Current practices suggest the problem will worsen. If present methods continue, emissions from shipbuilding steel could rise 25% by 2050, with most production still occurring in China, South Korea and Japan using carbon-intensive processes. Ships built today are expected to remain in service until around 2050, meaning today’s material choices will shape the sector’s environmental footprint for decades.

The analysis identifies three pathways for reducing steel-related emissions, though each faces distinct obstacles. Virgin green steel, produced using hydrogen-based direct reduction and renewable-powered electric arc furnaces, remains technically feasible but commercially unviable. Production depends on high-grade ore and low-cost green hydrogen, both geographically limited and up to 10 times more expensive than fossil alternatives. Green steel comprises less than 1% of global production, and shipping lacks the scale to absorb premium costs.

A study cited in the report showed that replacing conventional steel with green steel could raise the cost of a 40,000-dwt bulk carrier by 10-12%, representing millions of dollars in additional costs for a sector operating on 5-10% margins. Unlike the automotive industry, where premium costs can be absorbed downstream or passed to consumers, shipping has more limited flexibility due to freight rates’ inability to adjust quickly enough to offset higher capital costs.

Recycled steel presents a more immediate opportunity. The material is nearing cost parity with conventional steel and is already being used in oceangoing vessels, with further newbuilds in development. Ship recycling over the next decade could release up to 150M tonnes of marine-grade steel. However, mixed scrap metal often contains contaminants such as copper, tin and antimony, which can reduce weldability, ductility and fatigue resistance – properties that are essential in shipbuilding applications.

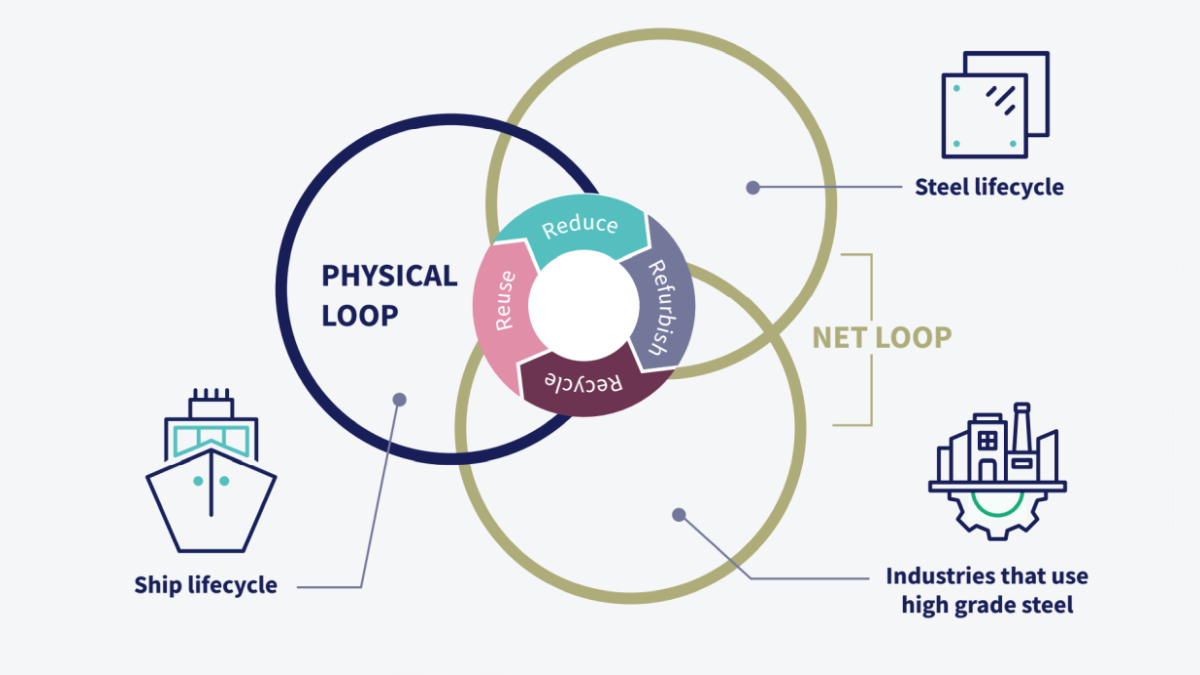

Circular design strategies offer the most scaleable near-term solution. These include modular layouts and design for disassembly, which preserve material value and reduce demand for new steel. The report notes "real-world demonstrations have shown that these approaches are technically viable across construction, operation and dismantling, but adoption remains fragmented without common standards, traceability, or procurement co-ordination."

The SSI proposes extending the International Maritime Organization’s 2023 greenhouse gas strategy to include embodied material emissions, starting with steel. This would provide a practical emissions-reduction pathway at a time when fuel-based solutions remain limited. Two regulatory tools are suggested: the Material Intensity Indicator, measuring steel-related lifecycle emissions, and the Lifecycle Design Index, assessing circularity in vessel design including recycled content, traceability and reuse readiness.

Both tools align with existing IMO instruments such as the Carbon Intensity Indicator and Energy Efficiency Existing Ship Index, making integration practical. The framework would enable lifecycle emissions reductions, support high-value steel reuse and open pathways for carbon pricing, sustainable finance and climate-aligned procurement.

Early market momentum is emerging despite limited scale. In 2025, Bright Queen and Prima Verde became the first oceangoing vessels constructed using JGreeX recycled-content steel, certified by ClassNK. These builds demonstrate the viability of certified recycled steel in shipbuilding, though transparency concerns remain as emissions reductions calculated using mass balance approaches were not disclosed.

The Japan Iron and Steel Federation has partnered with five Japanese shipowners to jointly commission nine dry bulk vessels using certified recycled steel, bringing JFE Steel’s total delivery of JGreeX to approximately 36,000 tonnes. This collaborative procurement model distributes cost premiums across multiple actors and demonstrates how shared investment can overcome financial barriers.

The SSI’s research outlines a five-step implementation roadmap progressing from voluntary data collection to full regulatory adoption. The pathway begins with encouraging early adopters to report steel lifecycle data, moves through definition and standard alignment with frameworks like ResponsibleSteel, integrates with existing IMO systems, formally adopts regulations under Marpol Annex VI, and finally links performance to carbon pricing and finance mechanisms.

Stakeholders across the supply chain face immediate and longer-term actions. Shipyards and classification societies are encouraged to pilot new tools and develop reuse-readiness criteria, while shipowners should request recycled or low-emissions steel in tenders and set procurement targets aligned with lifecycle emissions goals. Steel producers must explore certification pathways for marine-grade recycled steel, and recyclers should begin documenting recovered steel by grade and origin.

The potential economic impact is substantial. The report calculates if 30,000 tonnes of steel is reused per vessel and each tonne avoids one tonne of CO2, this represents 30,000 tonnes of CO2 saved. At a carbon price of US$100 per tonne, this equates to US$3M in avoided emissions per ship, creating powerful incentives for lifecycle traceability and reuse.

The analysis concludes that extending regulatory frameworks to include material emissions would not only scale existing circular practices but also co-ordinate demand for high-quality recovered marine-grade steel. As the report states, "The tools and supply now exist. What is needed is co-ordinated action to bring circular steel from the margins to the mainstream of maritime decarbonisation."

The challenge lies in overcoming two persistent barriers: the absence of regulatory mechanisms to scale proven circular practices, and the failure to co-ordinate demand and supply for high-quality recovered marine-grade steel. With up to 150M tonnes of steel expected to be released from ship recycling by 2032, the opportunity for systematic change has never been greater.

Green Steel – Insight Brief: Bringing steel into shipping’s climate strategy through lifecycle and regulatory action launches on Thursday 18 September.

Riviera’s Maritime Decarbonisation Conference, Europe will be held in Amsterdam Schipol Airport, 30 September to 1 October 2025. Click here to register your interest in this industry-leading event.

Related to this Story

Events

Ship Recycling Webinar Week

International Bulk Shipping Conference 2025

Tankers 2030 Conference

Maritime Navigation Innovation Webinar Week

© 2024 Riviera Maritime Media Ltd.