Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Sinokor purchases reshape VLCC operator rankings

Signal Ocean analysis says Sinokor now controls 78 spot-trading VLCCs, rising to 88 this quarter, after confirmed acquisitions

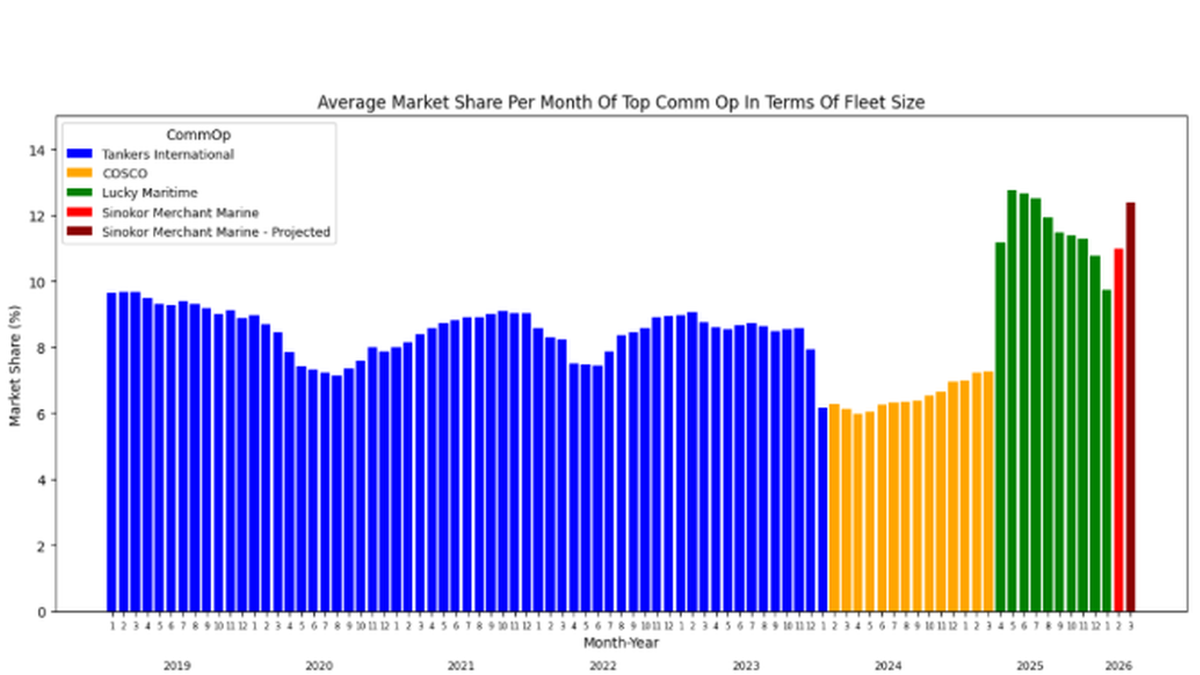

Signal Ocean has set out how Sinokor Merchant Marine has expanded its VLCC commercial footprint, describing the company as “the largest commercial operator in terms of fleet size” as it absorbs a wave of secondhand purchases and time-charter additions.

In a Market Insights note dated 18 February 2026, Signal Ocean said it has tracked intensifying market talk from mid-December 2025 before greater clarity began to emerge in January 2026, with Sinokor identified as the principal buyer behind a substantial number of VLCC transactions.

It added that reported totals in circulation “varied considerably, with market estimates ranging from 20 to as many as 50 units”.

Signal Ocean said, “As of today, we have confirmed 36 acquisitions through cross-referencing multiple market reports with The Signal Ocean Platform (TSOP) vessel lists”, adding that “approximately 26 vessels have already been delivered, while a further 10 are scheduled for delivery within the current or early next quarter”.

The note added that the total may increase further as additional transactions are finalised and pending deliveries are completed.

The buying programme is linked with a firmer asset-price backdrop, “The valuation for a 10-year-old VLCC has experienced a 24% annual increase, reaching its highest value in the last decade.”

On methodology, Signal Ocean said its assessment of the VLCC fleet “includes only active, compliant, non-sanctioned vessels with identified commercial operators.”

It added, “Based on conservative estimates, Sinokor currently controls approximately 78 VLCCs active in the spot market,” and this is expected to rise to at least 88 vessels within the current quarter, while market reports indicate the fleet could ultimately exceed 100 units, “…potentially reaching 120–130 vessels.

At the 88-vessel level, Signal Ocean said Sinokor becomes the largest commercial operator in the VLCC segment,” accounting for roughly 24% of the spot-trading fleet and approximately 12% of the total global VLCC fleet.

The note characterised this as “an unprecedented level of concentration for a single commercial entity in this market.”

To place that shift in context, Signal Ocean said that Tankers International dominated the segment through the end of 2023, with COSCO Shipping Energy Transportation emerging as the largest operator in 2024.

In 2025, Sinokor and Trafigura jointly marketed their vessels under the Lucky Maritime platform, a partnership that was dissolved in January 2026.

Signal Ocean also highlighted the age profile of the enlarged fleet, noting that TSOP data shows Sinokor’s VLCC fleet has an average age of 12.6 years, with roughly 70% of its vessels older than 10 years, compared with an overall VLCC fleet average age of 13.2 years.

Sign up for Riviera’s April 2026 International Chemical and Product Tanker Conference:

- Register to attend here: The International Chemical and Product Tanker Conference 2026, London.

- View the latest issue of Tanker Shipping & Trade here: Tanker Shipping & Trade.

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.