Business Sectors

Contents

Register to read more articles.

Will tonne-mile demand support tanker rates?

High energy prices, aggressive interest rate hikes, and uncertainties in the Russia-Ukraine conflict are expected to result in slow economic growth, impacting the global shipping industry, and particularly the tanker market

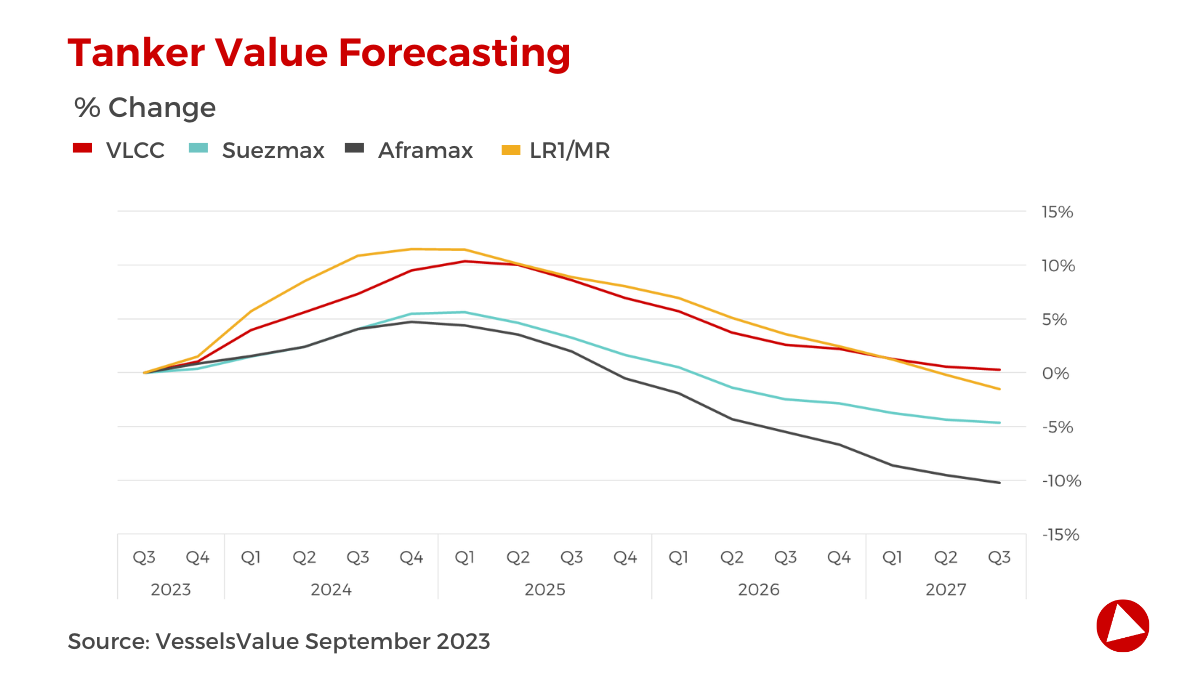

In the latest VesselsValue Shipping Market Outlook - End Q3 2023 Forecast Values it is predicted slow economic growth in Western economies, driven by high energy prices and aggressive interest rate hikes, could have a ripple effect on Asia.

This economic slowdown, coupled with inflation and the implementation of tightening monetary policies, is likely to affect consumer sentiment and investment spending. Furthermore, it is difficult to anticipate the duration and ramifications of the ongoing Russia-Ukraine conflict and any potential escalation or de-escalation, along with trade sanctions and embargoes, adding further uncertainty to the market’s future.

Specifically focusing on the tanker segment, VesselsValue indicates Russian exports of crude oil and products are expected to decline. However, this decrease in Russian supplies is anticipated to be offset by sourcing from alternative suppliers such as the Middle East Gulf, the United States and Latin America.

The increased demand for tonne-mile shipments from these suppliers is expected to support tanker rates in the future.

While the overall tanker market has experienced a slight increase in newbuilding activity, the number of orders placed over the past two years has remained relatively low. Combined with expectations of a modest increase in scrapping activity, this has helped maintain a healthy market balance.

Currently, the orderbook stands at a mere 5% of the total fleet and saw a slight increase during the third quarter.

VesselsValue noted that International Maritime Organization’s enforcement of greenhouse gas emissions targets in 2023 is expected to impact fleet efficiency. As companies strive to meet these targets, fleet trading capacity is expected to be affected, offering potential benefits from 2023 onwards.

Looking ahead, the market’s outlook for tonne-mile demand remains positive, assuming oil demand is not significantly affected by the ongoing high oil prices and inflation in Western economies.

Furthermore, the easing of China’s strict zero-Covid policy is expected to restore its position as a leading driver of oil demand, providing additional support to tanker markets.

To summarise the report, VesselsValue believes the shipping market faces challenges stemming from slow economic growth, geopolitical uncertainties and volatile oil prices. However, the industry also holds potential for growth, with opportunities for tanker rates and fleet efficiency improvements on the horizon.

Sign up now for the International Tanker Shipping & Trade Conference, Awards & Exhibition 2023 which will be held 7-8 November 2023 in Athens, Greece. Use this link for further information and to register your interest.

Related to this Story

Events

Offshore Support Journal Conference, Middle East 2025

Maritime Regulations Webinar Week

© 2024 Riviera Maritime Media Ltd.