Business Sectors

Events

Contents

Register to read more articles.

Petrobras’ OSV newbuild bonanza puts ethanol in spotlight

By 2026, the Brazilian oil major wants to charter 52 OSV newbuilds, many specified with batteries. This conversion to sustainable fuels, like ethanol, is driving engine research by Wärtsilä

Petrobras’ OSV newbuild bonanza keeps growing, along with Brazil’s ambitions for offshore oil and gas production, shipbuilding and green technology. Speaking at the New Industry Brazil Forum in Rio de Janeiro in May, the Brazilian oil major’s chief executive, Magda Chambriard, announced plans to invest in 48 new OSVs by the end of 2026 with at least 40% local content. “We need the industry to be prepared to serve us,” she said.

But within days, those ambitions grew further. At an event attended by Brazilian president Lula at Port of Itajaí on 29 May, Ms Chambriard revised the target to 52 new OSVs to be built and chartered by the end of 2026, with local sources estimating the value of contracts at US$5.1Bn. This fleet expansion is part of a broader investment plan, valued at US$21Bn, to revitalise the country’s shipbuilding industrial base and offshore industry.

Overall, Petrobras says it needs to charter about 200 OSVs by 2028 to back its offshore oil and gas expansion plans. To fill its vessel requirements, it is dangling lucrative, long-term contracts for existing foreign-flagged OSVs and making commitments for Brazilian-flagged newbuild vessels These newbuilds will be constructed at local shipyards, generating in-country value through increased employment and local content, and it is looking to American, European and Asian investors to support the effort.

Record investment

At a 6 May board of directors of the Merchant Navy Fund of the Ministry of Ports and Airports, the Brazilian government approved its largest single investment yet – R$22.0Bn (US$3.9Bn) – for 26 projects for the construction of newbuilds, repairs, vessel retrofits, shipyard expansion and new port infrastructure.

“We are breaking another record with the approval of this large volume of investments to leverage and strengthen the naval industry and the waterway sector,” said Ports and Airports Minister, Silvio Costa Filho. “This shows that the federal government has once again prioritised this sector, which is essential for the country’s development. During President Lula’s administration, we have already approved more than R$60.0Bn (US$10.6Bn) in modernisation and construction projects in the naval sector,” he said.

New ROV support vessels

Among the approved shipbuilding projects are Petrobras’ request for the construction of eight liquefied petroleum gas (LPG) tankers, worth R$4.1Bn (US$723M), and the DOF Subsea Brasil Serviços project for the construction of four ROV support vessels (RSVs), worth R$3.2Bn (US$564M). Though not mentioned by the ministry, BRAM Offshore was the low bidder in the Petrobras commercial tender rankings to construct four RSVs. Chouest’s Navship Shipyard is specified to build the eight RSVs for DOF and BRAM Offshore.

Newbuild plans taking shape

Petrobras’s newbuild OSV plans are coming together, and sustainable fuels like biofuel, including renewal diesel and ethanol, and batteries, figure strongly in the vessels’ specs. In December 2024, it awarded contracts worth US$2.7Bn to BRAM Offshore and Starnav Servicos Maritimos to build a series of diesel-electric hybrid battery-powered PSVs. Each Brazilian owner will construct six vessels locally and operate them under 12-year charter agreements with Petrobras. BRAM Offshore is building its PSVs at Navship, while Starnav’s newbuilds will be constructed at its Detroit Brasil Shipyard.

And earlier this year, contracts were awarded to Starnav and Compagnie Maritime Monégasque (CMM) for the construction and charter of 10 oil spill response vessels (OSRVs). These hybrid-battery-powered OSRVs will be under 12-year charters, during which they would be potentially upgraded to operate on ethanol.

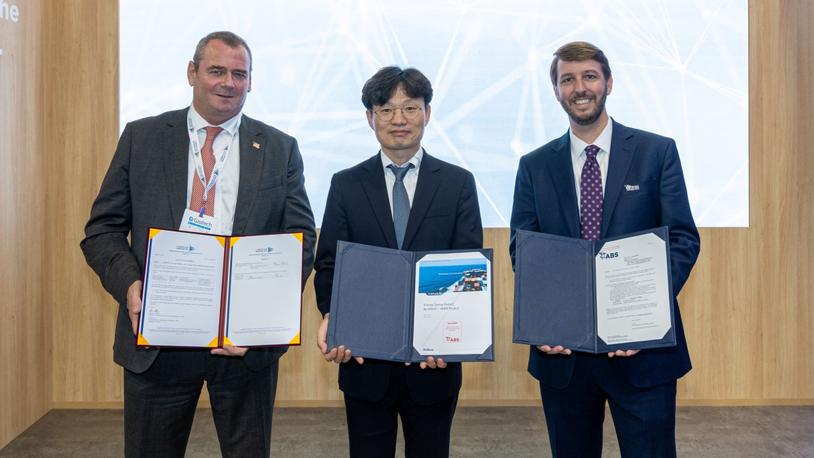

CMM selected Norway’s Kongsberg Maritime to provide ship design and equipment packages for its vessels. These OSRVs will be based on UT 7420 designs, with hybrid propulsion systems that will apparently contribute to a substantial improvement in fuel efficiency.

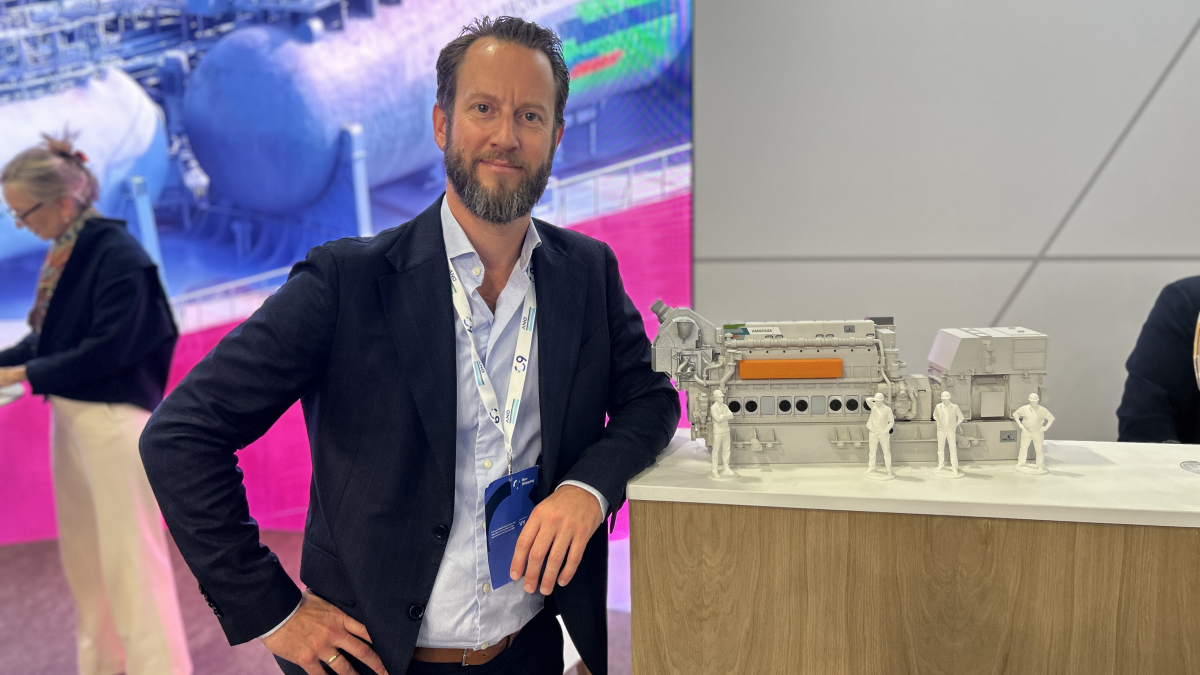

CMM is co-operating with Wärtsilä to use its four-stroke, medium-speed, multi-fuel engines for a series of OSVs. The Finnish engine designer has tested ethanol as the primary fuel in a full-scale Wärtsilä 32 engine at its Vaasa facility. These tests reportedly showed the engine’s capability to operate efficiently on a range of fuels, including diesel, biodiesel, HFO, methanol and ethanol.

The work builds on research that Wärtsilä began with Brazilian energy company Raízen in 2023 to identify potential decarbonisation solutions to ship designers and shipowners, as well as to provide guidance regarding regulations and compliance requirements for the use of cellulosic ethanol as fuel.

To further its research, Wärtsilä partnered with Energetica Suape II in March to use ethanol to produce clean power for electricity. Wärtsilä will conduct up to 4,000 hours of tests on its methanol Wärtsilä 32M engine over two years, starting April 2026. These tests are a significant movement towards using ethanol as an energy fuel in the country.

Fuel flexibility is at the heart of the design of the W32M engine, which can operate efficiently on methanol, HFO, MDO and liquid biofuel. A variable inlet valve closure unit minimises NOx levels at high loads and lowers fuel consumption.

Methanol combustion produces 50% less NOx than fuel oil, making the W32 methanol engine compliant with IMO Tier II limits. Using selective catalytic reduction, such as Wärtsilä’s nitrogen oxide reducer, the engine meets IMO Tier III. Using green methanol —produced with renewable electricity — can reduce well-to-wake greenhouse gas (GHG) emissions by around 80%.

Getting ethanol ready

Ethanol as a marine fuel presents a compelling business case, particularly in Brazil, Wärtsilä Norway, head of offshore SGA, Jon Inge Buli, says. “We have tested ethanol on our methanol engine, and with some adjustments it operates well,” he notes.

Brazil is second only to the US in the production of ethanol, with a long history of using the alcohol-based fuel in the country’s flexible-fuel vehicles. Much of Brazil’s ethanol is produced from sugarcane.

Mr Buli revealed some of Wärtsilä’s key findings in testing ethanol in its engines, while detailing special considerations for converting an OSV to operate on the fuel and the use of battery technology to underpin fuel savings.

When constructing an ethanol-ready OSV newbuild, Mr Buli suggests it would be more financially attractive to undertake the heavy lifting early in the new construction process, rather than later during the vessel’s 12-year charter. “The initial capex you have now will be far less than you might have at a later stage,” he says. “Similar to how the Wärtsilä 32 engine operates with methanol fuel, ethanol operation capability requires a fuel supply system that includes an ethanol fuel pump unit to be put in place,” he says.

When it comes to methanol as a marine fuel, Mr Buli says: “You need slightly more storage capacity and fuel to get the same power output as ethanol, as it’s lower heating value is higher. Ethanol is closer to diesel than methanol; however, both fuels have a future in the offshore industry.

“Since the launch of the Wärtsilä 32 methanol engine in 2022, Wärtsilä plans to expand its methanol capabilities to additional engines in its engine portfolio in the coming years.”

But for the owner the choice comes down to fuel availability, says Mr Buli. He says, it makes sense to use methanol in Europe but have the flexibility to run on ethanol if the asset must be redeployed to Brazil.

The alternative fuel picture should become a little clearer when IMO MEPC meets for an extraordinary meeting in October to decide on the adoption of the IMO Net-Zero Framework. “What does IMO do in October?” asks Mr Buli. “The carbon intensity factor of ethanol will have to be decided by IMO if they accept it as a viable alternative fuel.”

Batteries come to Brazil

Besides the ground-breaking employment of ethanol, a potential game changer for the Brazilian offshore market is that Petrobras will allow PSVs equipped with batteries to operate with a closed bus structure. Mr Buli points out that engines are much more fuel efficient when operating at loads of 50% or more. “Instead of running all your engines at lower, less efficient loads, a closed bus structure allows the vessel to operate a single engine at more efficient operating ranges. You can operate them in the sweet spot, allowing the vessel’s batteries to take the peak loads,” he explains.

This yields opex benefits, notably lowering operating hours on the vessel’s engines, reducing GHG emissions and yielding significant fuel savings. Mr Buli says fuel savings will vary based on the vessel’s operating profile but could be 25% or more. While batteries represent a significant investment, Mr Buli says Wärtsilä is looking at system designs that would reduce the number of gensets, mitigating capex concerns, while maintaining opex benefits for owners.

“It’s a no brainer,” says Mr Buli. “All offshore vessels should have batteries.”

Want to know more about ethanol? Mr Buli will be one of the presenters at Riviera’s Offshore Support Journal Conference, Americas,which will be held in Rio de Janeiro, 7-8 October 2025. Click here to register your interest in this industry-leading event.

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.