Business Sectors

Events

Marine Coatings Webinar Week

Contents

Register to read more articles.

Why methanol and LNG dominate in dual-fuelled container ships – for now

Orders for alternative-fuelled newbuilds hit record levels in 2024, with container ships accounting for more than half of the tonnage, led by methanol and LNG dual-fuel box ships

As new EU and international regulations impose stricter CO2 and greenhouse gas (GHG) emissions standards on container shipping, owners have accelerated investments in newbuilds with dual-fuel engines capable of burning either methanol or LNG.

By the end of November, ordering for alternative fuel-capable tonnage during the year (55.7M CGT) had surged past the record levels of 2022 (47.2M CGT) by 18%, with the container ship sector accounting for more than half of the tonnage, according to Clarksons’ World Shipyard Monitor.

“EU shipping emissions regulation will step up in January 2025, with the share of applicable shipping emissions covered by the EU ETS increasing from 40% to 70% and FuelEU Maritime coming into force,” said the shipbroker.

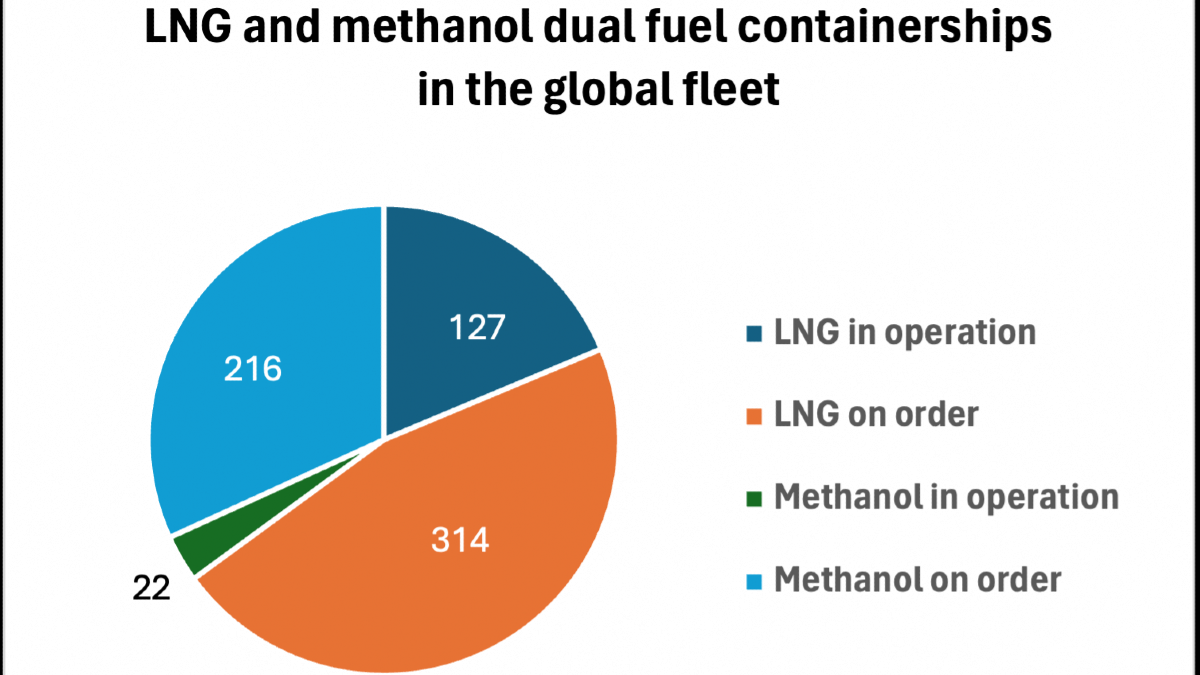

When it comes to selecting alternative fuels in the liner sector, LNG and methanol have emerged as the clear choices. There are 127 LNG dual-fuel container ships in operation and another 314 on order or under construction, while there are 22 methanol dual-fuel box ships sailing and another 216 on the order books.

One of the big believers in LNG is France’s CMA CGM. In reporting its Q3 2024 results, CMA CGM said it had committed US$18Bn to order 131 vessels capable of running on low-carbon energy (biomethane, biomethanol and synthetic fuels). The ships will be operational by 2028; 12 of these new vessels, powered by liquefied gas (LNG, biomethane, e-methane), joined the fleet in Q3 2024.

“EU shipping emissions regulation will step up in January 2025”

In May, China’s Dalian Shipbuilding began construction on the first of 12 15,000 TEU methanol-burning vessels for CMA CGM, for which Wärtsilä will supply the engines, while in a US$3.06Bn deal the French liner group has also ordered four 23,000-TEU container ships that will run on LNG. Although it is not all down to the fuel, CMA CGM estimates that the new ships will beat IMO’s Energy Efficiency Design Index (EEDI) by 60 %. They will also feature large propellers and high-efficiency rudders.

According to CMA CGM, compared to fuel oil-powered ships, the natural gas-powered box ship cuts CO2 emissions by 20%, NOx by up to 85% and particulate and sulphur emissions by 99%.

In early December, Maersk completed agreements with three shipyards for 20 container ships, all of them ready for conventional and LNG fuels, that will be delivered between 2028 and 2030. A heavyweight order by any standards, these newbuilds will vary in size between 9,000 and 17,000 TEU for a combined capacity of about 300,000 TEU. Meantime, Maersk has finalised the chartering of a range of methanol and LNG-burning vessels, with a total capacity of 500,000 TEU.

Maersk is also evaluating the economics of dual-fuel retrofits. November marked the return of Maersk Halifax to the trans-Pacific trade, following a ground-breaking 88-day retrofit that boosted its capacity and converted it into a methanol dual-fuel vessel. Performed at China’s Zhoushan Xinya shipyard, the speedy makeover of the Hong Kong-class, 15,690-TEU vessel demonstrated the viability of retrofitting existing diesel-powered vessels to alternative fuel use.

As Maersk’s head of fleet management and technology, Leonardo Sonzio, explains, MAN Energy Solutions (MAN ES) converted the two-stroke engine while new fuel tanks, a fuel preparation room and fuel supply systems were installed. The ship was also extended by 15 m to 368 m, boosting its capacity to 15,690 TEU.

Maersk is chasing a target of net-zero emissions by 2040 and has spent a lot of time exploring the potential of retrofits, for which Maersk Halifax is a test bed. “In the coming year, we will learn from this first conversion of a large vessel,” notes Mr Sonzio. “Retrofits of existing vessels can be an important alternative to newbuilds in our transition from fossil fuels to low-emission fuels.”

US shipowner Matson has gone for LNG for its three new Aloha class, 3,600-TEU container ships destined for its Hawaii and China-Long Beach Express services. Due for delivery in 2026 and 2027, construction on these Jones Act-complaint vessels started in the Hanwha Philly Shipyard in September. Under chairman and chief executive Matt Cox, Matson has set a goal of cutting Scope One GHG emissions by 40% by 2030.

And as previously reported in November, Hapag-Lloyd struck a shipbuilding deal valued at US$4Bn for the construction of 24 LNG dual-fuel container ships that are ‘ammonia ready’ with two Chinese shipyards.

Of these, 12 newbuildings – each with a capacity of 16,800 TEU – will be built by Yangzijiang Shipbuilding Group to expand the capacity of current services. An additional 12 ships, each with a capacity of 9,200 TEU, have been ordered from New Times Shipbuilding Co to replace older units in the Hapag-Lloyd fleet.

“Retrofits of existing vessels can be an important alternative to newbuilds”

All the newbuildings will be equipped with low-emissions, high-pressure LNG dual-fuel engines. In addition, these vessels can be operated using biomethane, which can reduce CO2e emissions by up to 95% compared with conventional propulsion systems. Hapag-Lloyd will take delivery of the new vessels between 2027 and 2029.

Green-fuel deal

Although anxieties over adequate supplies of green fuels remain, progress is being made. In November, Hapag-Lloyd joined Maersk, its liner partner from 2025, in striking a deal with China’s Goldwind for 250,000 tonnes of green methanol a year. Hapag-Lloyd estimates that the deliveries, a blend of bio and e-methanol, will slash GHG emissions by at least 70 %. The group says the contract “will secure a significant proportion of our requirements for green fuels [and] bring us an important step closer to our goal of achieving net-zero fleet operations by 2045.”

CMA CGM signed an MoU with Suez to step up biomethane production in Europe and the low-carbon transition of maritime shipping. The MoU outlines the production of up to 100,000 tons of biomethane per year by 2030.

Ammonia gets closer

Meanwhile, it appears ammonia has some way to go. Although its high energy density and low viscosity mark it as a viable dual-fuel option, there is currently no large big-bore engine operating on it yet. But that could change soon. In early December, MAN ES started full-scale testing of a two-stroke ammonia-fuelled engine at its Copenhagen research centre. Technically known as ME-LGIA (for liquid gas injection ammonia), this latest phase follows over 12 months of testing on a single-cylinder engine. “It’s a significant milestone to be able to step up to full-scale engine testing,” points out Ole Pyndt Hansen, MAN’s head of two-stroke research and development. Testing will continue through 2025.

“ME-GI two-strokes enjoyed a bumper 2024”

While the market awaits the ME-LGIA, MAN’s ME-GI two-strokes enjoyed a bumper 2024 as the building boom for very large container vessels showed no sign of abating. In August, 12 of its Mark 10.5 engines were ordered by China’s New Times Shipbuilding for 12 18,000-TEU newbuilds commissioned by Singapore-based Eastern Pacific Shipping. At the time, MAN’s head of two-stroke sales and promotion, Thomas Hansen, revealed that the engine has been specified for “more than 60 very large container vessels in just the past two months”. An engine for the future, the ME-GI can also operate on bio-methane and synthetic natural gas, assuming sufficient supply.

In another step forward for ammonia, HD Hyundai Heavy Industries and Lloyd’s Register in October signed an approval in principle to develop the design of a 365-m, 15,300 TEU vessel driven by two small-bore engines that are currently available on the market. It is a twin-skeg design in which the ammonia fuel tanks are located ahead of the engineroom and far from the deck house as a safety measure.

Fuel experts continue to be confident that ammonia remains highly suitable for dual-fuel engines in long-range shipping but, as Lloyd’s Register notes, ammonia’s wide-spread adoption is hampered by a shortage of suitable bunkering, safe-handling equipment and other essential facilities. Encouragingly, renewables investor Copenhagen Infrastructure Partners has just signed a memorandum of understanding for two ammonia-fuelled carriers capable of ship-to-ship bunkering. The biggest of these will be Faerder Tankers’ 50,000-m3 vessel, due for launch in late 2028. The investor’s Niels Lindegaard, senior business advisor, says it is in advanced discussions with major shipping operators to develop very large ammonia carriers.

And in another collaboration with MAN ES, Eastern Pacific has also gone to China and South Korea for six ammonia-burning dual-fuelled ships – four Newcastlemax bulk carriers and two very large ammonia carriers, slated for delivery from 2026 onwards.

Until then, it seems that methanol and LNG will lead the charge towards zero emissions in container vessels.

Related to this Story

Ponant partners on integrated energy system

Events

Marine Coatings Webinar Week

Maritime Environmental Protection Webinar Week

Ship Recycling Webinar Week

© 2024 Riviera Maritime Media Ltd.