Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

Aker BP submits PDO for Trell & Trine discoveries

Aker BP and its partners Petoro and LOTOS Exploration & Production Norge have submitted a plan for development and operation (PDO) for the Trell & Trine discoveries to Norway’s Ministry of Petroleum and Energy

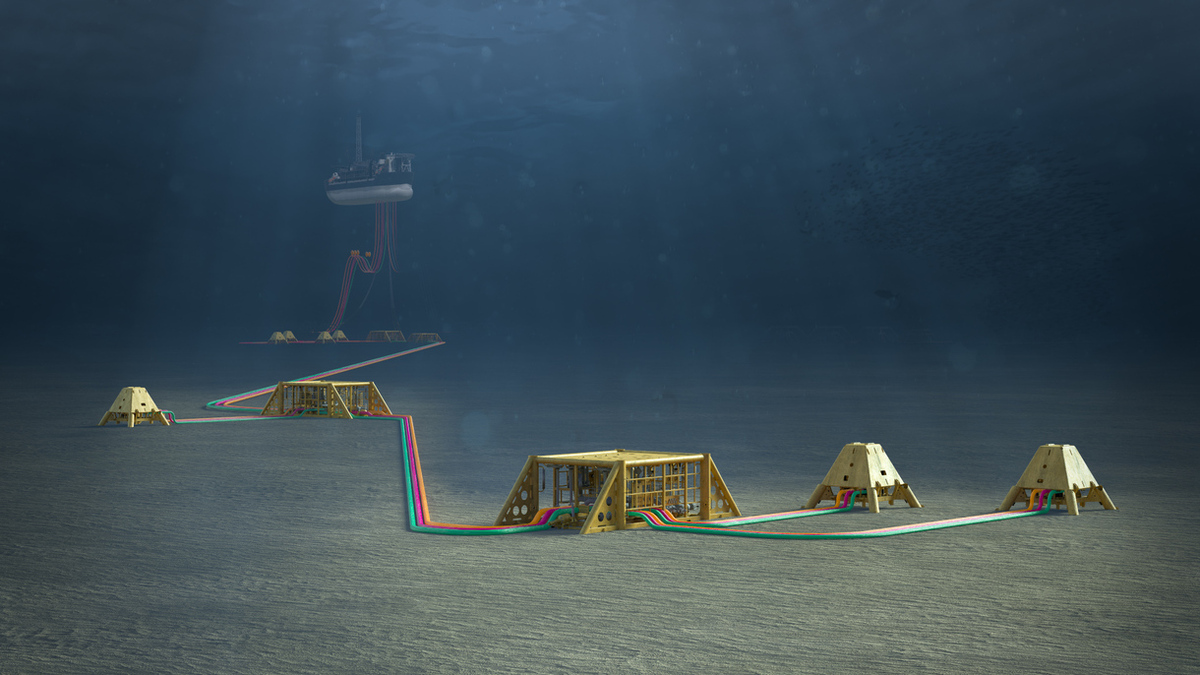

The Trell & Trine development is planned with three wells and two new subsea installations (manifolds) to be tied back to existing infrastructure on East Kameleon and further on to the Alvheim FPSO. The Trell and Trine discoveries are located 24 km east of the FPSO.

The project will require an investment of roughly Nkr6Bn (about US$630M) with production scheduled to commence Q1 2025.

This development will utilise the planned extended lifetime for the Alvheim field where Aker BP serves as operator.

One of the three wells is Trell Nord, which is not yet proven, but Aker believes has a high likelihood of discovery. When the Trell production well is drilled, the plan is to first prove hydrocarbons in Trell Nord, then drill the wells in Trell and Trine. The programme will conclude with the production well in Trell Nord. Recoverable resources are estimated at approximately 25M barrels of oil equivalent.

The development will be carried out in co-operation with Aker BP’s alliance partners.

The Alvheim field consists of the Kneler, Boa, Kameleon and East Kameleon structures, subsequently joined by the Viper-Kobra structures and the Gekko discovery. Alvheim area includes satellite fields Bøyla, Vilje, Volund and Skogul. All of these fields are produced via the Alvheim FPSO.

When the Alvheim development was approved, the recoverable resources were estimated at just under 200M barrels. Since then, close to 550M barrels have been produced from the Alvheim area.

“Trell & Trine is the third PDO submission in the Alvheim area in just one year, following close on the heels of Frosk and Kobra East & Gekko. This is yet another confirmation of a success story on Alvheim that we and our partners can be proud of,” said Aker BP chief executive Karl Johnny Hersvik.

Aker added that the three PDO submissions in the Alvheim area were “good examples of how the temporary changes in the petroleum tax system, adopted in June 2020, help generate activity on the Norwegian shelf.”

In June 2020, the Norwegian parliament enacted temporary changes in the country’s petroleum tax act to help oil and gas firms execute planned investments. The decision changed rules for depreciation and uplift, as well as the treatment of tax losses, for a limited period.

The LNG Shipping & Terminals Conference Europe will be held 16-17 November 2022. Register your interest and access more information here

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.