Business Sectors

Contents

Register to read more articles.

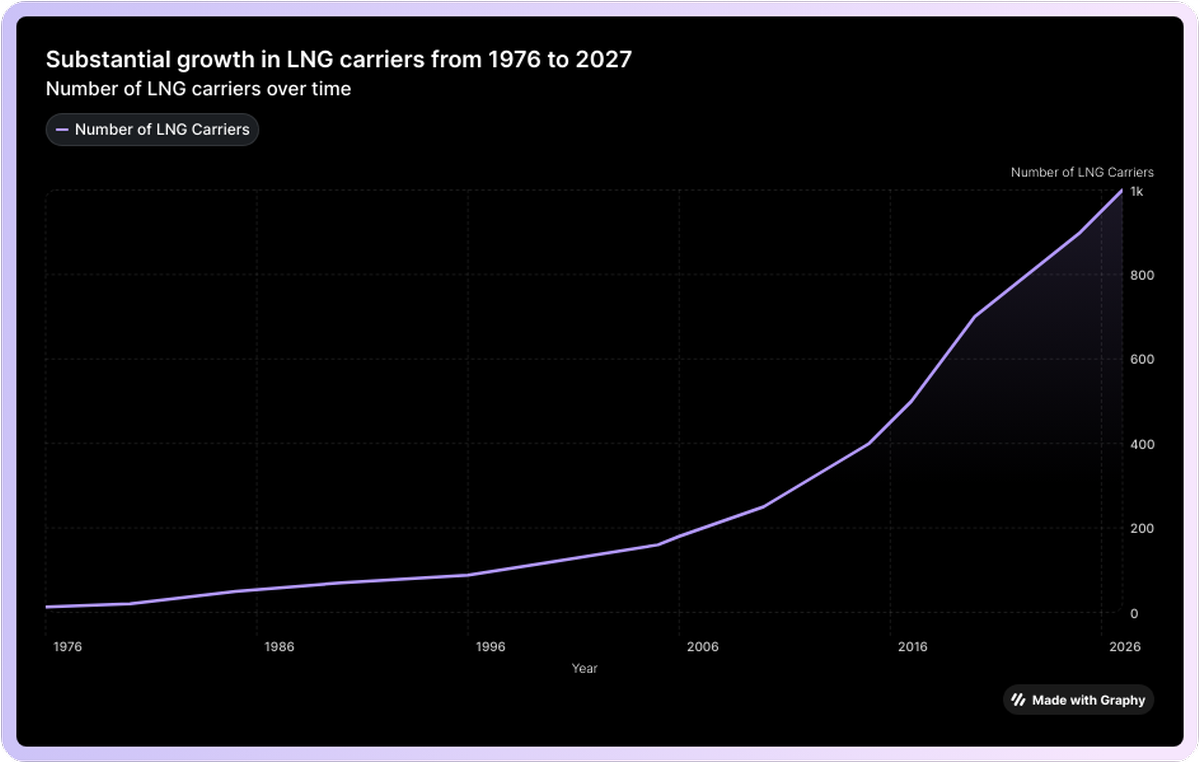

Exponential growth: LNG carrier fleet set to double over 10 years to 2027

The global LNG carrier fleet is accelerating towards its 1,000th vessel, with deliveries peaking and 328 vessels on order

When Riviera reported on the entry of the 500th LNG carrier into active service in June 2017, the milestone stood as a reflection of the fleet’s steady evolution since the 1960s. At that time, growth had been methodical. From just 13 carriers in 1976, the fleet expanded to 88 by 1996, and then doubled to 180 by 2006. The 500-vessel threshold came as part of a sustained surge, with the final 100 vessels delivered in under three years.

Less than 10 years later, the LNG shipping industry is preparing for a doubling of the fleet size again. Based on current data from Clarkson Research Services (CRS), the 1,000th LNG carrier is expected to enter service by June 2027. As of July 2025, the global LNG carrier fleet included 747 in-service vessels and 328 on order. The timeline to reach the 1,000th vessel can now be pinpointed.

Unlike the arrival of the 500th LNG carrier in 2017, the current fleet growth is being driven by a large front-loaded orderbook. In 2025 alone, 36 new LNG carriers have already been delivered. Looking ahead, 100 vessels are scheduled for delivery in both 2026 and 2027, followed by a tapering off of deliveries into the early 2030s. If current schedules are maintained, the 1,000th LNG carrier will be delivered during the second quarter of 2027.

The pace and composition of this fleet expansion reveals a more consolidated and technologically-focused landscape than in previous decades. The majority of vessels on order will be delivered by a handful of Asian yards, equipped with a narrower range of containment and propulsion systems.

The upper tier of LNG carrier construction remains tightly held. Samsung Heavy Industries accounts for 243 vessels either in service or on order, followed by Hyundai Heavy Industries Ulsan (179), Daewoo (177), Hudong Zhonghua (101), and Hyundai Samho (92). These five shipbuilders alone are responsible for more than two-thirds of all LNG carriers on order.

Looking just at the membrane-type LNG carriers, GTT’s Mark III Flex containment system appears on 377 vessels, while earlier Mark III and NO 96 variants remain in wide use. The latest evolution, NO 96 Super+ and NO 96 L03+, are now making their way into the orderbook, with a combined 66 vessels fitted with these systems.

A further evolution is evident in main engine selection. From a fragmented landscape a decade ago, the industry has largely consolidated around WinGD two-stroke dual-fuel designs. According to the CRS data, 376 vessels are equipped with WinGD engines. The next most common providers, Everllence (MAN ES - B&W) and Wartsila four-stroke, account for 276 and 211 vessels respectively. Kawasaki and Mitsubishi engines also remain in circulation but represent a declining share.

“ it took over 40 years to reach 500 vessels, the next 500 LNG carriers will be added to the fleet in just under a decade”

But the actual 1000th LNG carrier might not be one of the deep-sea giants working the long-haul trades against long-term charters. The 1000th LNG carrier might be part of the dedicated LNG bunker vessel fleet, a genre that was not around when the 500th vessel was delivered.

The dedicated LNG bunkering segment has expanded rapidly over the past five years, transforming from a niche market into an embedded part of the LNG infrastructure chain. Several of the vessels now classed as LNG carriers are purpose-built for ship-to-ship bunkering operations, serving dual-fuel cruise ships, container vessels, and other large gas consumers. This specialised sub-fleet continues to grow in parallel with global LNG-fuel adoption, particularly in northern Europe, the Mediterranean and selected Asian hubs.

What began as a slow and experimental mode of transport is now a major segment of the global shipping industry. In its 2017 analysis, Riviera noted the rapid gains made between 2013 and 2017 as short-term charter rates supported speculative ordering and the build-up to Qatar’s second wave began. In 2025, the LNG carrier orderbook is being driven by long-term project-linked charters, backed by upstream investments and sovereign energy strategy.

This shift has translated into a relatively narrow technical base, in terms of both builders and propulsion systems. At the same time, the fleet is growing faster than ever. While it took over 40 years to reach 500 vessels, the next 500 LNG carriers will be added to the fleet in just under a decade.

While the 1,000th LNG carrier is expected to enter service by June 2027, this outcome depends on the ability of shipyards to maintain schedule discipline across a tightly packed pipeline. With more than 200 LNG carriers set to deliver in 2026 and 2027 alone, the capacity of South Korean and Chinese yards will be tested, particularly as they manage overlapping commitments in the container, LPG and ammonia sectors.

“even minor slippages in construction or trials could affect the timing of the 1,000th vessel’s entry into service”

Unlike in previous growth cycles, yard availability is already constrained through 2028, raising the potential for deferrals in delivery dates. In this context, even minor slippages in construction or trials could affect the timing of the 1,000th vessel’s entry into service. Some owners are believed to be negotiating flexible delivery windows or staggering charters accordingly.

While no such scheduling risk is flagged in the CRS dataset, the clustering of orders among five builders highlights a potential bottleneck. By contrast, the earlier fleet build-up from 2013 to 2017 was more evenly distributed and occurred alongside less congested yard schedules. The compressed nature of today’s newbuilding queue means the fleet’s forward trajectory is more vulnerable to delay, even as it approaches a round-number milestone. After that, all eyes will be on a 1500th LNG delivery, which could well be constructed in the US, if current plans come to fruition.

Riviera’s LNG Shipping & Terminals Conference will be held in London on 21-22 October 2025. Use this link to register your interest and attend the event.

Related to this Story

Events

International Bulk Shipping Conference 2025

Tankers 2030 Conference

Maritime Navigation Innovation Webinar Week

© 2024 Riviera Maritime Media Ltd.