Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

US-China truce: soya bean trade revival and bulker market implications

Analysts do not expect a significant immediate impact on the dry bulk market following a US-China arrangement aimed at reviving this year’s subdued soya bean trade

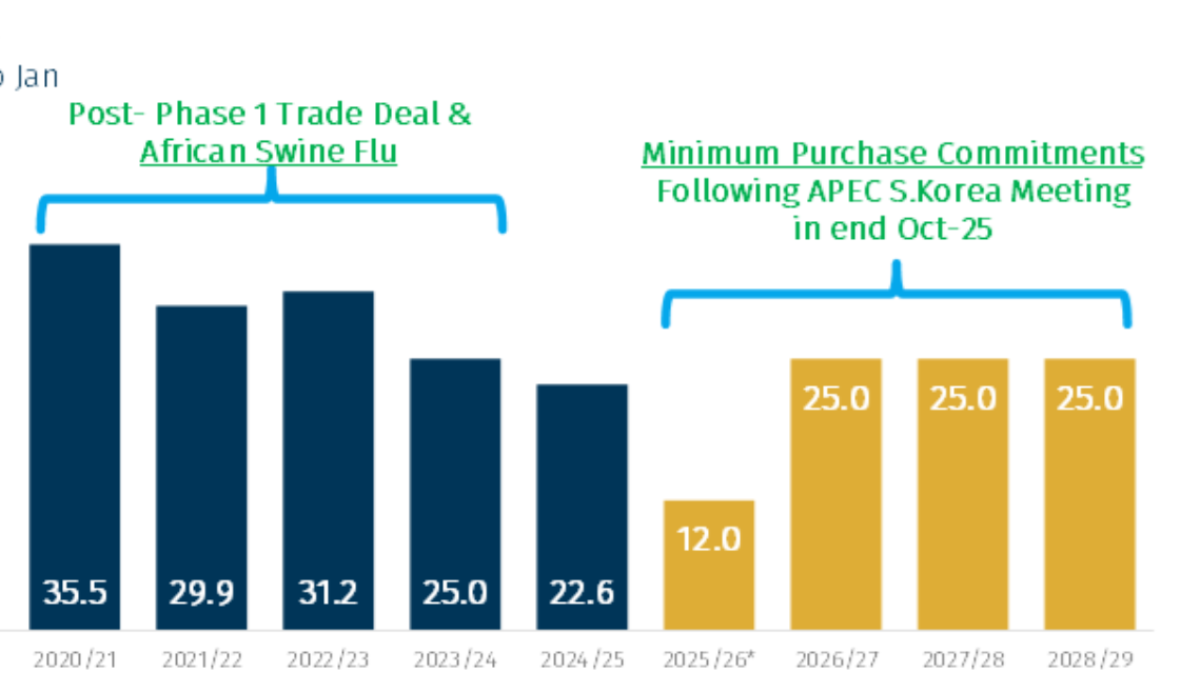

On 1 November, the White House announced that China will purchase at least 12M tonnes (mt) of US soya beans during the final two months of 2025, and a minimum of 25 mt annually in 2026, 2027 and 2028. In addition, China is expected to resume purchases of US sorghum and hardwood.

However, Beijing has yet to confirm any such commitments. Reports last week indicated that a Chinese state-owned entity had begun purchasing three cargoes of US soya beans – the country’s first acquisitions from this year’s US harvest. During the height of the US-China trade war, Beijing diversified its sourcing, increasing imports from Brazil and Argentina.

BRS Shipbrokers head of dry bulk research, Wilson Wirawan, told Riviera that an initial reading of the announcements suggests China’s prospective commitments remain below the peaks seen during 2021–2023.

He added that switching back from Brazilian to US soya bean origins would result in a systematic reduction in tonne miles, assuming China’s total seaborne soya bean demand remains stable.

Logistical and commercial doubts

In a report, SSY head of futures research William Tooth and dry bulk analyst Vriddhi Khattar noted that China has a limited near-term need for large US soya bean imports. According to SSY, domestic inventories – currently around 43 mt – are sufficient to cover crush demand through November, leaving only a modest 5 mt shortfall through February–March 2025.

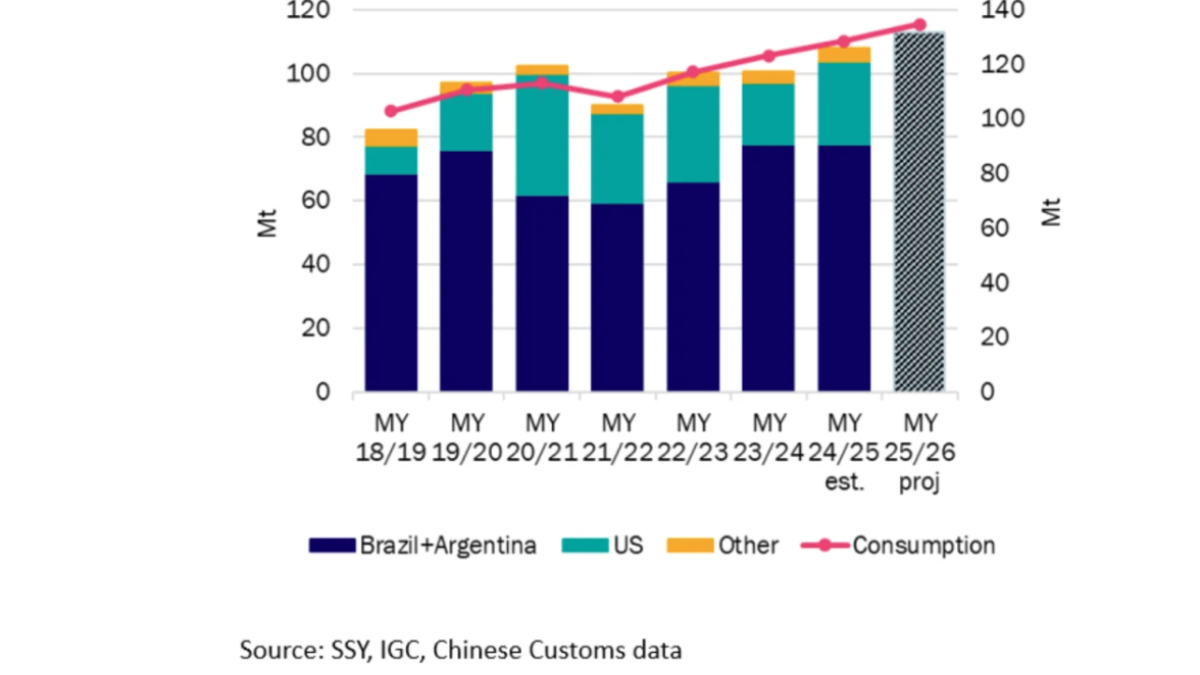

“With another bumper Brazilian crop projected for early 2026, potentially exceeding 155 mt, China’s reliance on South American beans looks set to persist,” SSY said. Brazil and Argentina together have supplied nearly all of China’s soya bean requirements in the 2024/2025 marketing year – 78 mt out of 108 mt imported so far.

The shipbroking firm also highlighted the commercial disadvantage of US soya beans compared with Brazilian supply. Analysts pointed to a narrower US–Brazil FOB price gap, which, coupled with tariffs still in place, renders US cargoes uncompetitive. In addition, negative crush margins in China and the expansion of US domestic crushing capacity further constrain the potential for an export recovery.

“Until there is clarity on any tariff suspension or trade policy adjustment, there is little commercial incentive for Chinese crushers to turn to US supply,” SSY added.

Analysts have also questioned whether shipping 12 mt of soya beans before year-end would be feasible, as this would require a pace of 1.33 mt per week over the next nine weeks.

“Historical shipping rates suggest this pace would not be completely unrealistic, but it would be towards the upper end of historical performance,” SSY noted, referring to a five-year average of 1.28 mt per week.

To sustain such a pace, SSY said, Panamax availability in the North Atlantic would likely tighten, with the regional fleet currently standing at 437 vessels, down from 476 a year ago. Most US soya bean exports – roughly 80% – typically move through the US Gulf, though low Mississippi River water levels continue to drive up barge rates and could constrain throughput.

“In that optimistic scenario, short-term Panamax demand could strengthen, supporting a brief spike in Atlantic basin rates and volatility,” SSY concluded.

Connect with industry leaders across the Asian and Middle Eastern maritime sectors through Riviera’s premium events. Located conveniently in Singapore, we provide unparalleled access to the heart of the Asian maritime market.

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.