Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

Boskalis and Rezayat Group review Smit Lamnalco positions

Boskalis has confirmed rumours it is reviewing its position in tug and offshore support vessel (OSV) owner Smit Lamnalco as part of its ongoing departure from the sector

The Netherlands-headquartered group wants to focus on dredging, salvage and heavy-lift transportation in the future.

Boskalis said in a statement on 15 December 2021 it “has embarked on a review of its position as a shareholder in the strategic joint venture Smit Lamnalco.”

It has held a 50% stake in Smit Lamnalco since 1964 with the remaining shares held by the Rezayat Group. Boskalis said the Rezayat Group was also reviewing its position in the joint venture.

“An update of this review will be provided by Boskalis as soon as there is reason to do so,” the statement said.

Smit Lamnalco provides marine support with a diverse fleet of harbour tugs, terminal tugs and OSVs operating in remote locations over four continents. Its fleet supports oil and gas terminals and ports around the world with escort and harbour tugs.

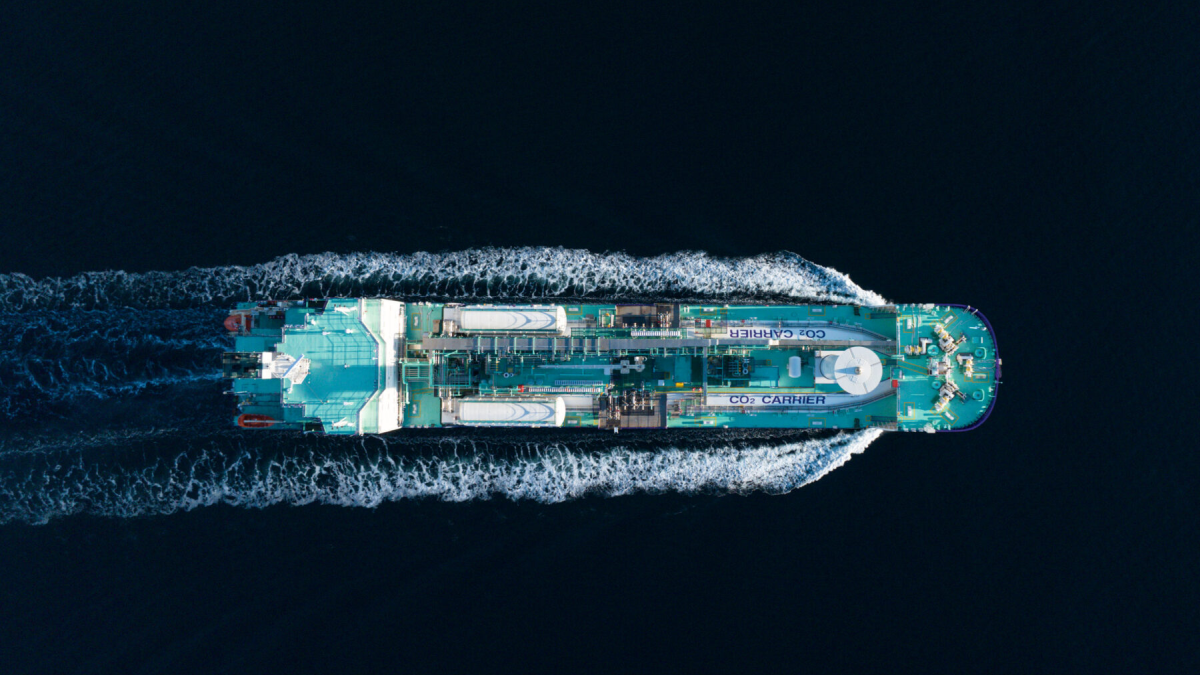

Smit Lamnalco operates OSVs with dynamic positioning to DP1 and DP2 class to provide a wide range of offshore support duties around floating production facilities such as floating production storage and offloading vessels, floating LNG production, storage and offloading units and storage and regasification ships. Smit Lamnalco’s OSVs and tugs also support single-point moorings for tanker loadings.

The joint venture also operates crew and pilot boats, supporting its core business.

Its harbour tugs range in overall length between 24 m and 36 m with bollard pulls of 40-90 tonnes and its OSVs are from 40 m to 65 m in overall length and have bollard pulls up to 120 tonnes.

Smit Lamnalco operates 160 vessels in 25 countries and employs around 2,500 people with 42 different nationalities. Some of these employees work for an inhouse technology and newbuild team, which enables Smit Lamnalco to evaluate and improve performance over its fleet and include lessons learned in its newbuild vessels.

Boskalis has been systematically removing itself from tug ownership in recent years. Its Smit subsidiary partially owned hundreds of tugs through joint ventures with leading regional and global players.

In November, Keppel Smit Towage (KST), a joint venture between Boskalis and Keppel Group with operations in Singapore and Malaysia, was sold to Rimorchiatori Mediterranei, a subsidiary of Italy-headquartered Rimorchiatori Riuniti Group.

Under the terms of the agreement, Boskalis expects to receive approximately €80M (US$91.5M) in cash for its 49% equity stake. It said net profit from its share in KST and Maju over the last two years was €4M (US$4.6M) per annum.

Two years ago, joint venture Kotug Smit Towage, with harbour tugs operating in northern Europe, was sold to Boluda Towage.

Boskalis continues to operate in the global maritime salvage and wreck removal sector through Smit Salvage.

Despite the uncertainty in ownership, Smit Lamnalco continues to invest in its tug and OSV fleet to meet project requirements. OSD-IMT is designing a multipurpose vessel for Smit Lamnalco to support a floating LNG production unit in Mozambique.

Uzmar Shipyards in Turkey will construct the vessel to a MPV4600 design. Uzmar is also building three azimuth stern drive escort tugs for Smit Lamnalco’s operations in east Africa. These 42-m tugs are being built to Robert Allan’s RAstar 4200 design and Bureau Veritas class. The first of these was completed in November and the second is not far behind, having been launched in August.

Further information was requested from Boskalis about the Smit Lamnalco review, but a spokesman for the company replied, "We are currently not providing additional information to what the exact options are. We have embarked on the review and will provide an update when more details are known."

Smit Lamnalco LNG business and project director Andrew Brown provided perspective on the challenges of supporting LNG carriers at port and offshore terminals during Riviera Maritime Media’s LNG Ship/Shore Interface Conference, Europe 2021,

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.