Business Sectors

Events

Contents

Register to read more articles.

Can the SHIPS Act pump new life into an aging American OSV fleet?

While the legislation aims to revitalise a sagging American shipbuilding base to construct new US-flag oceangoing ships, are there opportunities to rebuild an aging Jones Act platform supply vessel fleet, too?

With the Trump Administration and Congress fully behind revitalising American shipbuilding, one of the sectors that could benefit is the aging fleet of US-flag platform supply vessels (PSVs).

“The average age of the active fleet is more than 14 years old,” pointed out Clarksons Platou (Offshore) marine assets lead, Tyler Boje.

But Mr Boje said several hurdles exist to renewing the Jones Act-compliant offshore support vessel (OSV) fleet. During a session at IPF 2025, Virginia Beach, Virginia on 30 April, he said high newbuilding prices, limited available US shipyard capacity, and protracted build times that average more than three years are among the biggest of these.

On the commercial side, term rates for dynamically positioned class-2 PSVs are not as good as they appear either. “The current term rates have generally surpassed the previous peak levels observed in 2013 but without accounting for inflation,” he said.

Dwindling shipyard capacity

Since the last building boom on the US Gulf Coast, shipyard capacity to build high-spec PSVs has also atrophied and consolidated, with ownership now resting in the hands of fewer companies. Mr Boje estimated Edison Chouest Offshore (ECO) shipyards has built 136, or 63%, of the 217 DP2-class PSVs in the Jones Act fleet. It also built and operates ECO Edison, the first US-flag service operations vessel (SOV) for the US offshore wind market, and is building another, ECO LIberty.

“The SHIPS Act presents a fantastic opportunity”

One of the world’s largest OSV owners, ECO, owned by the Chouest family, controls a large chunk of the shipbuilding and repair capacity on the US Gulf Coast through its own shipyards and those of Bollinger Shipyards. ECO has two shipyards in Louisiana, one in Mississippi and one in Florida, as well as one in Brazil, while Bollinger Shipyards has 10 shipyards in Louisiana and Mississippi. Bollinger counts the US Navy, Coast Guard and Army among its best customers.

In May it received approval from the US Coast Guard to begin full production on the US Coast Guard Polar Security Cutter (PSC) programme. The first heavy polar icebreaker in the class will be delivered in May 2030.

Beyond ECO and Bollinger, the other top five builders that have constructed DP2-class PSVs are Master Boat Builders, Coden, Alabama, Eastern Shipbuilding Group, Panama City, Florida and Thoma-Sea, Houma, Louisiana.

SHIPS Act

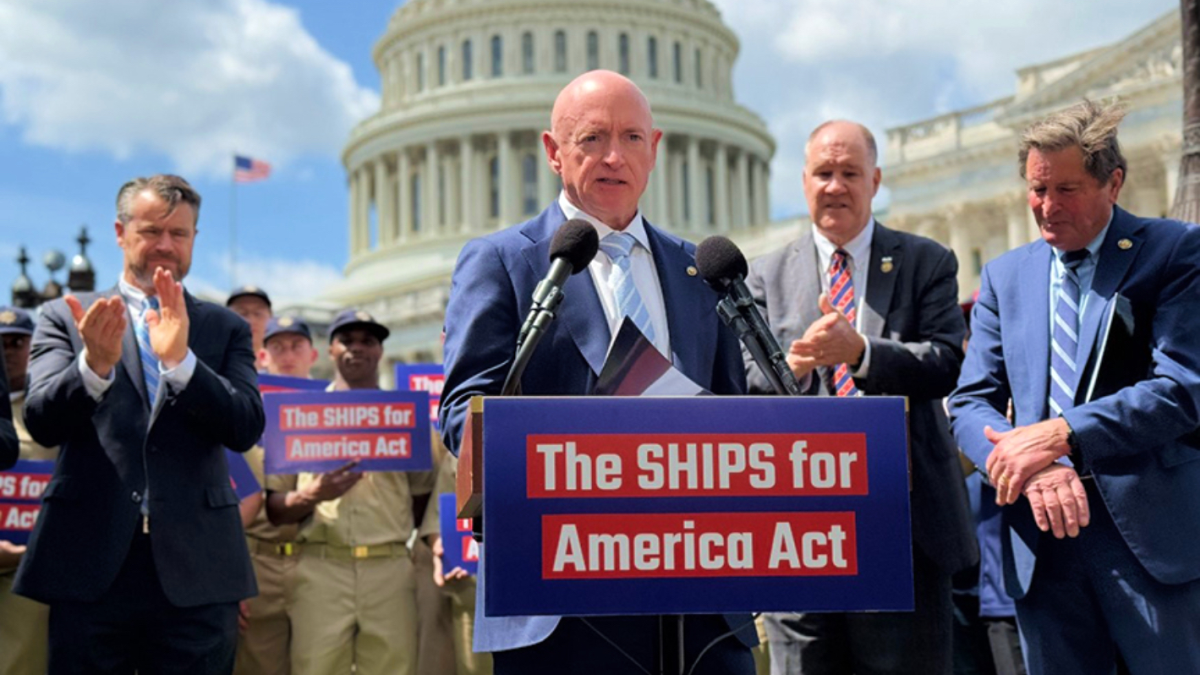

In a bit of uncanny timing, the session was held on the same day that the bipartisan, bicameral legislation, the Shipbuilding and Harbor Infrastructure for Prosperity and Security (SHIPS) for America Act was reintroduced in Congress. Sponsored by US Senators Mark Kelly (D-Arizona) and Todd Young (R-Indiana), US Representatives John Garamendi (D-California), and Trent Kelly (R-Mississippi), the SHIPS Act sets out to revitalise the American shipbuilding industrial base to support the construction of government and US-flag vessels. First introduced in December 2024, the legislation has gained backing following the release of the US Trade Representative’s findings on China’s targeting of global shipbuilding for dominance, and President Trump’s executive order, Restoring America’s Maritime Dominance. The SHIPS Act sets a target of building 250 US-flag ships in 10 years. This commercial fleet would be capable of supporting the transport of US government and military cargo.

ECO vice president, Michael Braid, said the SHIPS Act presents “a fantastic opportunity for running new tonnage into multiple different sectors.”

This will require “legislative support to incentivise shipowners and allow for charterers to come in or engage on a JV basis,” he noted, with “stimulus behind shipbuilding, not just for governmental but also traditional shipping plays.”

Added Mr Braid: “It’s a huge opportunity, not just us, but all of the yards in the US.”

“There’s going to be some spill over from defense to support more building of commercial hulls at shipyards,” observed ThayerMahan vice chairman and president, offshore energy, Richard Hine. He sees opportunities for “low-hanging Navy missions” to be supported “by modified commercial vessels that can be built faster.”

But Mr Boje sees the potential for a “pull back and forth” at shipyards that serve both commercial and government contractors. He said such yards tend to “prefer more lucrative government contracts. It all depends on how the legislation is written and what incentives are in place for the commercial side.”

Offshore’s role in MSC fleet

OMSA president and chief executive, Aaron Smith, tells us that OSV designs are well represented in the Navy’s Military Sealift Command (MSC) fleet.

He said there are “13 vessels owned by, commissioned by, operated by, or based upon the design and using the technologies developed by offshore energy vessel operators.” Mr Smith said the distinction was necessary because some of his members’ vessels have been chartered or acquired by MSC, and some are MSC owned and operated but based upon the design of multi-purpose support vessels built by OMSA-member shipyards that constructed similar vessels for commercial use.

In his public testimony in the proposed action in the Section 301 Investigation of China’s Targeting of the Maritime, Logistics, and Shipbuilding Sectors for Dominance conducted by the US Trade Representative, Mr Smith flagged how Chinese shipyards are using knowledge gained in the construction of offshore energy vessels to potentially support military operations.

He cited the jack-up installation vessel, Wind Pace, owned by Cadeler and built by COSCO Qidong Shipyard. Mr Smith testified that the same jacking technology used in the design of Wind Pace to provide a stable work platform to install monopiles and wind turbine generators is used in “new jack-up bridging barges that have been produced by Guangzhou Shipyard for the Chinese military and are intended to serve as an expeditionary pier, akin to the Mulberry Harbours manufactured in the United Kingdom and transported to Normandy to assist in establishing a logistical harbour following the D-Day invasion.”

Related to this Story

Events

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

© 2024 Riviera Maritime Media Ltd.