Business Sectors

Events

Contents

First US wind turbine installation vessel moves closer to reality

US utility to invest in first US installation vessel to support largest single offshore wind project

US utility Dominion Energy plans to build the first Jones Act-compliant offshore wind turbine installation vessel (WTIV) to support the nascent US offshore wind market.

Dominion Energy’s newbuild plans were unveiled by company chief executive Thomas Farrell during a first quarter conference call in May. During the conference call, Mr Farrell explained Dominion Energy is part of a consortium formed to build the vessel, which would support leading offshore wind developers in the US market, not just its own projects.

Dominion Energy did not reveal any additional details about its consortium partners. Funding needs to be finalised among consortium participants for the WTIV, which will enter service in 2023.

Dominion Energy’s plans call for an US$8Bn, 2,600-MW windfarm, the largest single offshore wind project in the US. Development will be in three phases, each of which will involve the installation of about 70 turbines with a capacity of 880 MW. Dominion Energy could double the capacity of the windfarm to 5,200 MW by 2035.

Initially, it is planning to complete the Coastal Virginia Offshore Wind (CVOW) demonstration project, with two 6-MW wind turbines on a site 43 km off Virginia Beach by the end of 2020. Those two 6-MW turbines will be installed by Denmark’s Ørsted.

Mr Farrell said the newbuild Jones Act WTIV would be capable of handling all existing and next-generation offshore wind turbines of 12 MW and larger. Next-generation wind turbines, such as the 12 MW capacity GE Haliade-X, have rotor diameters of 220 m and heights of 260m.

By contrast, the five Haliade 150 6-MW wind turbines employed at Block Island Windfarm off of Rhode Island have a rotor diameter of 150 m.

While Dominion Energy did not want to comment further on the WTIV newbuild, some hints may be found from other vessels being built worldwide. One design approach to handling new-generation wind turbines is the GustoMSC SC-14000XL jack-up vessel ordered by Japan’s Shimizu Corporation in August. Being built by Japan Marine United (JMU), the GustoMSC SC-14000XL will be the largest self-elevating platform (SEP) for offshore wind installation to date in Japan and will be capable of installing next-generation wind turbines with a capacity of over 12 MW.

“Converting existing vessels may not be the best fit for future markets”

Dutch marine engineering firm GustoMSC, part of NOV, worked closely with Shimizu to tailor the GustoMSC SC-14000XL jack-up design and variable speed drive (VSD) jacking system to its requirements. This also marks the first time a WTIV will be equipped with a telescopic leg encircling crane from GustoMSC. With a maximum lifting capacity of 2,500 tonnes, this crane offers a combination of high hoisting capability for turbine installation (1,250 t at 161 m) and heavy load capability for foundation installation (2,500 t at 121 m). Using its four legs, the self-elevating WTIV will be insulated from the ocean surface, ensuring wave-resistant stable operations in depths ranging from 10 to 65 m.

“We think the SC-14000XL will offer Shimizu a strong competitive edge in the upcoming windfarm construction market in Japan and Asia,” said Shimizu general manager engineering Takeschi Sekiguchi. Mr Sekiguchi said Shimizu will need to install 8 MW wind turbines and monopile foundations effectively and install 12 MW wind turbines adequately. This will require “a large SEP which offers sufficient capability to operate with high availability. The SC-14000XL with a telescopic crane is the answer to this,” he said.

Shimizu reported it was investing US$465M in the vessel, which will be 142-m long, 50-m wide, and will have a total tonnage of 28,000 and accommodate 130.

Fukada Salvage & Marine will manage and operate the jack-up vessel. JMU is expected to deliver the WTIV in October 2022.

In 2017, GustoMSC prepared a study on a designing, building and operating a Jones Act-compliant WTIV for state agencies from New York, Massachusetts and Rhode Island. To satisfy the requirements for the WTIV, GustoMSC tailored its popular design, the NG-9800C, to the demands of the US offshore wind market. Designated the GustoMSC NG-9800C-US, the vessel was conceived with a length of 127.8 m, beam of 42 m, accommodation for 90, with a crane capacity of 1,500 tonnes. As designed, however, the WTIV was contemplated for handling smaller 8-MW capacity wind turbines, with rotor diameters of 175 m. The estimated cost of the vessel was US$222M, with a build time at a US shipyard of about 34 months – a much longer timeline than the one proposed by Dominion Energy.

Dutch owner Jan De Nul is investing in two installation vessels that will be able to handle the latest generation of ‘super-sized’ wind turbines. One of these, Voltaire, has been contracted to install a total of 2,400 MW of GE`s 12-MW Haliade-X wind turbines on the Doggerbank Wind farm in the UK, with installation scheduled in 2023 and 2024. Equipped with a main crane with a capacity of 3,000 tonnes, it will be delivered by COSCO Shipping Heavy Industry in 2022.

The other offshore installation vessel, Les Alizés, is being built by China Merchants Industry Holdings Co Ltd (CMIH) shipyard, located in Haimen, Nantong City, China. Unlike the self-elevating Voltaire, Les Alizés is a dynamic positioning class 2-capable crane vessel able to support floating wind turbines. With delivery in 2022, Les Alizés will have a main crane with a 5,000-tonne capacity.

Shortage of large WTIVs

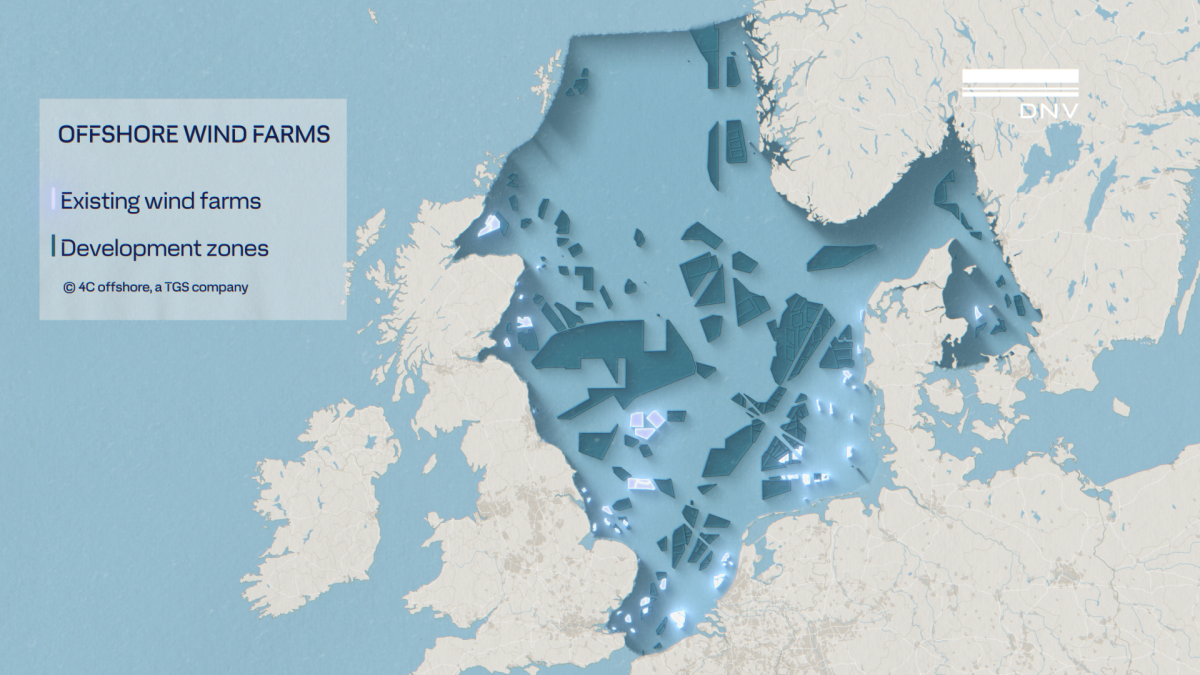

Such large construction and heavy-lift vessels are in short supply for large offshore windfarm development and oil and gas decommissioning projects.

Speaking at the Offshore Support Journal Subsea Conference in London in February, Ulstein Design & Solutions sales manager Nick Wessels said current demand projections for renewable energy and decommissioning work reveal a shortage of heavy-lift vessels through the 2020s.

Based on Ulstein’s analysis, Mr Wessels said more than 13,500 monopile installations are guaranteed to 2030 – with most in Europe and Asia – and over 10,000 more are in the planning stage with an unspecified date. Assuming two days per monopile and 70% utilisation, the 13,500 monopiles that have an installation date set require at least 10 heavy-lift vessels full time until 2030, according to Mr Wessels.

By 2022, Ulstein estimates there will be about 50 heavy-lift units, each with lifting capacities above 2,000 tonnes, worldwide. Only 10 crane vessels remain with adequate lifting capacity for larger projects and half are in China, said Mr Wessels.

Based on this analysis, Ulstein projects a shortage of vessels in the market over the next decade.

While some of the shortage could be solved by converting existing vessels, Ulstein contends the strategy "may not be the best fit for future markets.”

Ulstein’s newbuilding design is the dynamic positioning class 2 (DP-2) Ulstein HX 118, which is able to transport and install six 2,000 tonne monopiles or five 1,500-tonne jackets.

The vessel has a length of 193.2 m and beam of 49 m, with a 130-m deck length and a 99-m crane tower.

Ulstein said it was working with Huisman on the crane, with a main hoist of 3,000 tonnes at 30 m, 2,000 tonnes at 40 m and 1,000 tonnes at 50 m.

Riviera will host a series of 45-minute webinars on subjects ranging from maritime propulsion to vessel optimisation, ballast water management, maritime air pollution and maritime leaders among many others commencing 5 May 2020. Find a list of the webinars and register your interest now

Related to this Story

Events

Maritime Environmental Protection Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.