Business Sectors

Events

Contents

Hot floater market: Valaris pulls trigger on two drillship newbuilds

With global floater utilisation rates reaching 90% for the first time since 2014, and leading-edge day rates topping US$500,000, Valaris has pulled the trigger on its options for two newbuild drillships

The move will see two high-spec drillships, Valaris DS-13 and Valaris DS-14, added to the Big board-listed drilling contractor’s fleet for an aggregate purchase price of US$337M from Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering).

Valaris president and chief executive Anton Dibowitz was “delighted” by the additions. “Following the successful contracting of six of our stacked drillships since mid-2021, the purchase of Valaris DS-13 and DS-14 increases our operating leverage to the attractive ultra-deepwater floater market. Based on our positive market outlook, growing future demand and strong customer interest in these rigs, we believe that the purchase of these high-specification drillships at compelling prices will generate attractive returns” he said.

Following their mobilisation from South Korea, Valaris DS-13 and Valaris DS-14 will be stacked at ASTICAN shipyard in Las Palmas, Spain, until they are contracted for work.

Valaris reported the purchase of the rigs would increase Q4 2023 capex by about US$355M, representing the purchase price for the drillships and costs associated with preparing them to mobilise from South Korea to Las Palmas. Additionally, the New York-listed driller anticipates 2024 capex of approximately US$35M primarily related to mobilisation costs.

In Q3 2023, Valaris executed US$400M add-on senior secured second lien notes to back the purchase of the two drillships.

Expectations are the drillships will better the bottom line, said Valaris. “The outlook for Valaris is positive, with increasing demand and constrained supply tightening the market” said Mr Dibowitz said in reporting the driller’s Q3 results. “We are confident in the strength and duration of this upcycle, and we expect to deliver meaningfully improved earnings in both 2024 and 2025 due to the impact of recent and ongoing drillship reactivations at attractive day rates, as well as the repricing of rigs from legacy day rate contracts to higher market rates.”

Utilisation rates hit 90%

Those higher market rates are due to the extremely tight availability of floaters —reflecting utilisation levels that have not seen in offshore oil and gas in 10 years, according to Steve Gordon, managing director, Clarksons Research.

He said global floater drilling rig utilisation reached 90% in early December for the first time since 2014.

“Utilisation has firmed especially sharply in the drillship sector, where global utilisation rose to 93% by start-December, 16pp above the 10-year average. Drillship utilisation has been supported by strong ultra-deepwater (UDW) demand in the ‘Golden Triangle’ of US Gulf, West Africa and Brazil, where the number of active units increased to 72 as of start-December, up 32% on the five-year average” said Mr Gordon.

These sustained gains in demand and utilisation “continue to exert strong upward pressure on floater rates” he said. He said ‘leading edge’ floater day rate awards have surpassed the US$500,000/day mark in Q4 2023, and Clarksons Research’s overall Floater Rate Index has more than doubled since start 2021, reaching 130 points, up from 2021 (54 points), and nearing 2013 (153).

Offshore oil and gas production continues to be an important source to meet surging global energy demand. The shipbroker pointed out it accounts for 16% of global energy supply including 25.5M barrels per day of oil and 129Bn cubic feet per day of gas.

According to Clarksons Research, the active number of floaters, which covers drillships and semi-submersibles, rose to 143 units globally as of early December. This represents an increase of up 38 units (+36%) since a low-point of 105 in 2020, but well below 2014 when the peak reached 289.

Scrapping and recycling older floaters have reshaped and constrained the market. “Supply-side re-balancing over the past decade has also tightened floater markets, with marketable floater supply falling to 161 units as of December 2023, down 47% since 2015 due to removal/recycling of rigs in previous downturn” said Mr Gordon. 173 floaters have been removed from the global offshore floater fleet between 2014 and 2021.

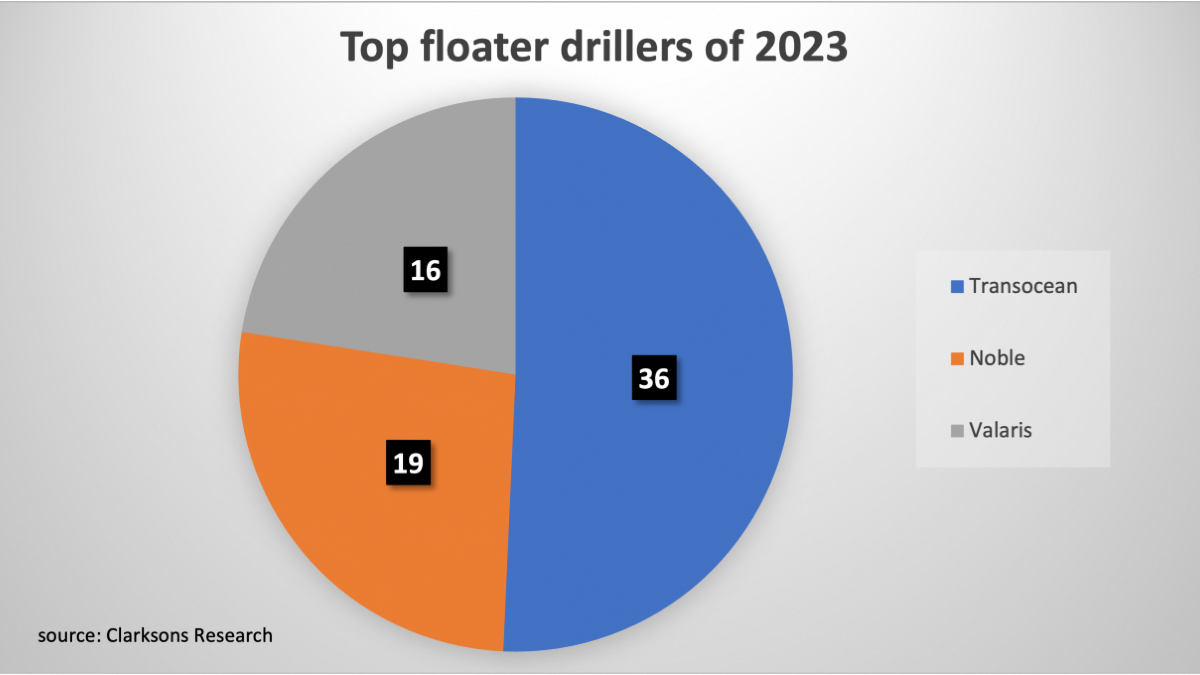

NYSE-listed Transocean is the largest floater driller with 36 units, followed by Noble (19) and Valaris (16). The largest floater operator is Brazil’s Petrobras, with 22 units, followed by China’s CNOOC (12) and Dutch-Anglo Shell (11).

In December, Transocean reported securing a contract for the harsh semi-sub Transocean Barents with OMV Petrom for a minimum 540-day campaign in the Romanian Black Sea. The rate for the deal is US$465,000 per day, starting in Q1 2025, which will generate US$251M in backlog. At day beyond the initial 540-day period, day rate will increase to US$480,000. OMV Petrom holds option periods.

Outlook for 2024

So where does the ultra-deepwater market go from here? “Our projections suggest rig demand will grow 11% in 2024—building on gains of 14% in 2022 and about 8% in 2023— amidst elevated levels of tendering activity in the ‘Golden Triangle’ and stronger demand for harsh environment semi-subs, driven by firm activity in West Africa, Australia and the Mediterranean” said Mr Gordon.

Despite the elevated levels of tendering activity and tight availability of floaters, Mr Gordon, however, does not see much in the way of new capacity entering the market. “Floater supply-side capacity is only expected to increase only gradually given the limited newbuild orderbook and the increasing cost/time intensity of reactivating long-term cold-stacked units” he said.

As a result, Clarksons forecasts global floater utilisation will reach 92% by end of 2024 and 96% by the end of 2025.

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.