Business Sectors

Contents

Register to read more articles.

Cruise ship orderbook rebounds, with shift to alternative fuels

The global cruise ship order book shows that ordering has rebounded, while LNG and bio-LNG, methanol and hydrogen are all growing fuel options

Cruise ship ordering has “rebounded with a bang in 2024”, says Maritime Strategies International (MSI), director, Niklas Carlen, with orders for 25 new vessels placed during the first nine months of 2024.

Although this includes a number of orders that are still at the LOI stage pending confirmation of financing, MSI expects these to be confirmed.

Mr Carlen says: “This represents a remarkable turnaround in the fortunes of European shipbuilders, who have been the sole beneficiaries of this year’s resurgence in newbuild contracting. Cruise ship ordering all but collapsed during the pandemic and its immediate aftermath, as cruise operators retrenched in the face of mounting debt and significantly lower passenger volumes.”

MSI says that the three leading cruise groups together recorded aggregate net losses of US$48Bn during the four-year period beginning in 2020. However, cruise lines have finally returned to profit in 2024, with annual global passenger numbers set to reach a new record of over 33M.

Mr Carlen singles out that although the 25 vessels ordered to date in 2024 match the 25 orders placed during the entire preceding four-year period, the difference in terms of capacity is more dramatic. During 2020-23, a total 19,000 of lower-berth capacity was ordered, as the focus switched almost exclusively towards smaller luxury and expedition ships. In contrast, this year’s orders amount to 83,000 of lower-berth capacity, with 15 of the 25 orders being for vessels with 3,000 lower berths or more.

Of the major cruise groups, Norwegian Cruise Line Holdings (NCLH) grabbed the headlines with eight vessels ordered, including two each for its Regent Seven Seas and Oceania Cruises brands. The remaining four vessels are destined for Norwegian Cruise Line (NCL) with delivery scheduled from 2030 onwards. With each NCL vessel weighing in at 225,000 gt and providing over 5,000 lower berths, these vessels will be the largest ever to set sail for NCL.

“I don’t think it is likely that ammonia will be a fuel of choice for the cruise sector because of the safety aspects”

Carnival Corp has also been busy in 2024, adding a further two XL-class vessels at Meyer Werft as well as ordering three vessels at Fincantieri for delivery from 2029 onwards. The latter vessels represent a new design, with capacity expected to comfortably exceed 6,000 lower berths. In contrast, Royal Caribbean (RCCL) has been “more subdued”, says Mr Carlen, with just two vessels ordered so far this year.

Disney added a further four vessels to the Meyer Werft orderbook in 2024, each with 3,000 lower berths, with the first vessel scheduled to hit the water in 2027. The company is also linked to an order placed by Oriental Land Co ltd (OLC), Disney’s partner in Japan, also at Meyer Werft. OLC plans to offer year-round Disney-themed cruises in Japan once the vessel is delivered in 2028.

Recent deliveries and alternative fuels

Moving to propulsion, Mr Carlen says: “The cruise industry was an early mover in alternative fuels, with the first LNG-fuelled vessels ordered in 2015. Since then, alternative fuels have continued to play an important part in the contracting mix and have accounted for over 90% of all ordering in berth capacity terms during 2024. LNG has been the preferred option to date, with 23 LNG-powered vessels already sailing, and a further 33 on order.”

Recent LNG-fuelled cruise ship deliveries include Royal Caribbean’s Utopia of the Seas, which started cruising in July 2024. It is the first ship in the Oasis class to be LNG-fuelled, as well as being the first vessel in the world to deploy the new Wärtsilä 46TS-DF engine. Six engines are deployed with a power of 96,000 kW.

Royal Caribbean Group chose the Wärtsilä 46TS-DF for its power density and lower fuel oil consumption – much lower than the previous version of the engine. The engine was also chosen for its ability to meet guest demands – primarily minimal vibration, emissions and noise. These were a focus of the factory acceptance tests carried out in Vaasa, Finland in November 2022.

Elsewhere, Ritz-Carlton Yacht Collection’s Ilma, delivered in 2024, is the first vessel of the cruise operator to deploy LNG dual-fuel propulsion. The company’s vice president, newbuild, Tobias King explains: “The international shipping industry is going through a paradigm shift on the topic of sustainability, and when Ilma was designed in 2021, we decided we wanted to contribute to our joint path toward net-zero greenhouse gas emissions. During [the vessel’s] lifecycle, we are optimistic and believe the supply chains of sustainable fuels will continue to expand, but there is uncertainty on what type of sustainable fuel will be available to us, whether various forms of biofuels or synthetic e-fuels, and the type of sustainable fuel may vary according to the area of operation.

“By installing an LNG system on Ilma, we are increasing our flexibility, while reducing local emissions in port and at anchorage.”

“The shipping sector will have to compete for green hydrogen”

Explora Journeys newbuild order book also highlights how the company is developing its use of alterative duels. The third and fourth vessels in its fleet, Explora III and Explora IV will both be powered by LNG and enter service in 2026 and 2027 respectively. While sister ships Explora V and Explora VI will enter service in 2027 and 2028 respectively and will be capable of alternative fuels such as bio and synthetic gas. These two ships will pursue the use of liquid hydrogen with fuel cells for their hotel operations while docked in ports to eliminate carbon emissions with the vessels’ engines switched off.

A look at the future orderbook shows that methanol has also started to make some movement within the cruise sector. Mr Carlen comments: “In line with more traditional shipping sectors, the adoption of methanol has lagged behind that of LNG but is starting to gain traction. Both RCCL’s Celebrity Xcel and Disney’s Adventure will be able to use methanol on delivery in 2025, and NCL’s two Prima Plus class vessels scheduled for delivery in 2027-28 will also have the option of using methanol. Although the fuel choice for NCL’s new series of vessels ordered earlier this year has yet to be revealed, these are also expected to favour methanol over LNG.”

“We are looking at every fuel option you can imagine”

Elsewhere, SunStone Ships’ new Boundless-class ships will be designed prepared for green methanol. An electric grid will enable the shipowner to add fuel cells, solar panels or batteries to the cruise ships.

In terms of shore power, Industry association CLIA’s figures reveal that 46% of cruise ships are already equipped for onshore power, with this figure expected to rise to 72% by 2028.

MSC: a multi fuel future

An exclusive interview with MSC Group executive vice president, maritime policy and government affairs, Bud Darr, also highlights the move that the cruise ship industry is making towards decarbonisation.

Mr Darr underlines the importance of a multi fuel future, and of being flexible and creative. MSC Group has a wide and diverse fleet, from container and cruise ships to high-speed ferries and ropax, and car carriers and towage. Therefore, it is looking at “every fuel option you can imagine,” he says.

“We have ships over 20 years old and then some like our forthcoming cruise ship MSC World America that are as modern and sophisticated as they could be and some ships in between, so it is going to take a very flexible, creative approach to find just the right fuel at the right time. Depending on the life cycle there could be a different answer in the future, and flexibility is the key to making it work,” Mr Darr emphasises.

He adds: “It would be much simpler for us if it was obvious which fuel to use and which regulations govern. But there is no one obvious solution and the availability of future fuels is almost nil now too. I also think it is important not to only focus on one type of molecule as we would be unlikely to have enough. So, there is a lot of room for companies to take different strategies.”

Singling out fuel options for the cruise sector, he says that advanced forms of methane, including bio or synthetic LNG or an advanced form of methanol, are likely to be the fuels of choice.

“I don’t think it is likely that ammonia will be a fuel of choice for the cruise sector because the safety aspects around it make it difficult. And we need to keep in mind that in the short term there are LNG and biofuels,” Mr Darr comments.

MSC Cruises has embraced the use of dual-fuel LNG propulsion for its new ships and last year trialled bio-LNG on a mass balance basis on MSC Euribia. Mr Darr says: “Bio LNG is available in the market, but it is very, very expensive. But it is growing in volumes, and more entrants are coming in and bringing additional capacity. I think the same will start to be true for bio forms of methanol, but that is a bit further down the line.”

Mr Darr singles out hydrogen as of particular interest. “Hydrogen has two potential uses,” he explains. “As a niche marine fuel it has real potential. It could take the form of short duration voyages where ships refuel quickly in the same place. But it is not very dense and takes up a lot of space. But it could be used as a supplemental fuel source; for example, if the engineering is right, it could be used for zero carbon emissions in port.”

But he says that the more important role of hydrogen, in his opinion, is not directly as a marine fuel but as a critical fuel stock for synthetic forms of methanol, methane, and green ammonia. “All of these fuels will likely use a process where green hydrogen is the building block and that is why MSC Cruises has really been a promoter of hydrogen - not necessarily because it is a primary fuel source for us because of its density and some challenging characteristics. Rather, we feel it is going to be critical to provide large-scale production of other synthetic fuels.”

While green hydrogen is starting to develop, with substantial progress, Mr Darr says that the amount that is needed is huge and there is a very big gap between what we have today and what maritime will ultimately need, not only for cruise shipping but for society as well. This means that the shipping sector will have to compete.

MSC Cruises is running several developmental projects with fuels cells of different characteristics, and as part of this it is looking at ways to store hydrogen, both compressing it and cryogenically cooling it to -273 degrees centigrade and storing it in liquid form.

MSC Group is also looking at LNG as a fuel and converting it to hydrogen onboard, although currently this is not a complete solution as the ship is left with carbon that needs to be dealt with. “This technology applies to cruise or container ships,” Mr Darr says. “We have a strategic partnership with Shell on decarbonisation and we have a lot of involvement from both cruise and cargo ships in this.”

Related to this Story

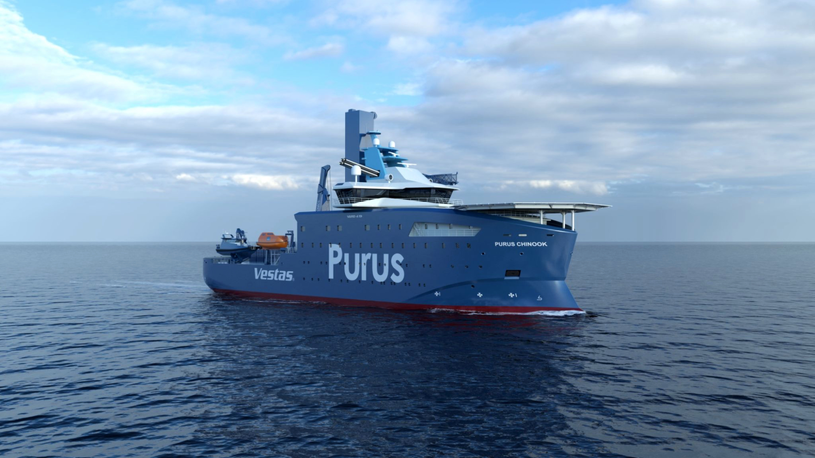

AI, digital twins help design cyber-secure, green SOVs

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.