Business Sectors

Contents

Register to read more articles.

Ørsted raises nearly US$9.4Bn in highly successful rights issue

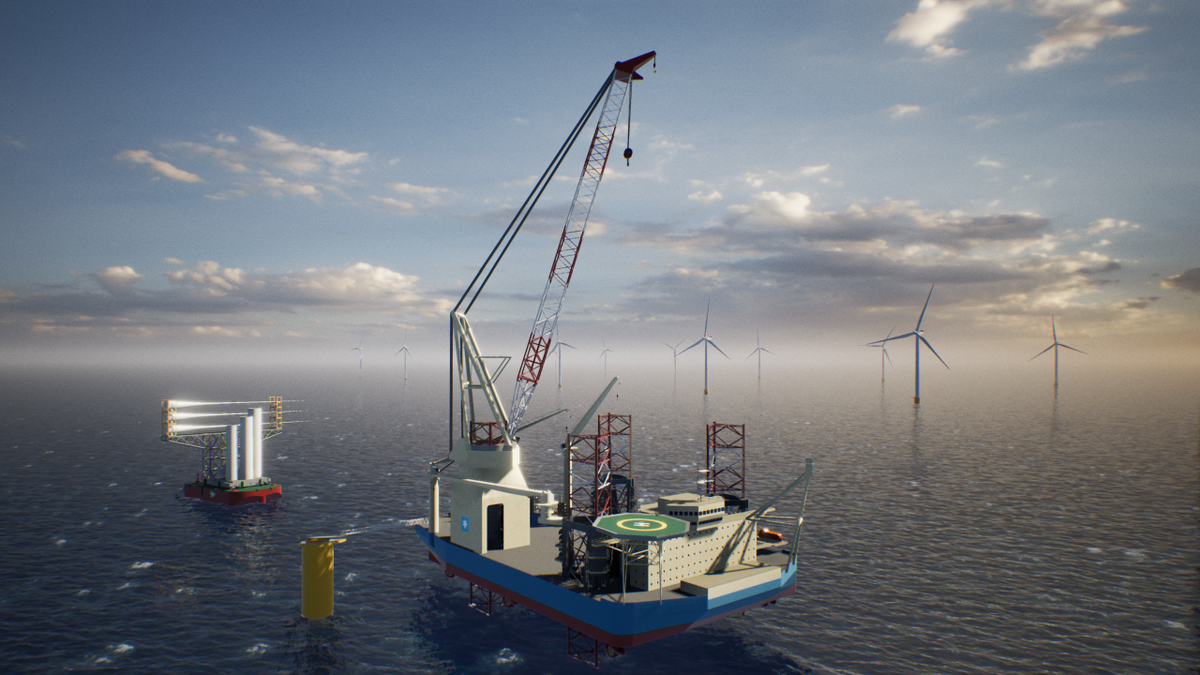

Offshore wind developer Ørsted has raised US$9.4Bn from the rights issue it was forced to undertake after the Trump administration targeted the industry and projects the developer was undertaking

The rights issue saw a total of 894,298,680 of new shares subscribed for by existing shareholders through the exercise of allocated pre-emptive rights or by other investors through the exercise of acquired pre-emptive rights, including 451,522,164 new shares – equivalent to approximately 50.1% of the total – subscribed for by the Danish state.

The company said demand for the remaining shares “has been extraordinarily high and has exceeded the number of new shares not subscribed for by exercise of pre-emptive rights.”

Ørsted group president and chief executive Rasmus Errboe said, “I am very pleased with the strong support we received for our rights issue, from small and large investors from Denmark and abroad, including from our majority shareholder, the Danish State.

“The rights issue strengthens Ørsted’s financial foundation, allowing us to focus on delivering the six offshore windfarms we have under construction, while continuing to handle the regulatory uncertainty in the US, and strengthen our position as a market leader in offshore wind.

“We will continue to work hard, executing our strategy and delivering results quarter after quarter. It will be a long, tough haul, and we have a lot of work ahead of us in the coming years to ensure progress on our projects under construction, improve competitiveness, and focus the business on offshore wind, especially in Europe.”

Ørsted was forced to announce the rights issue after it was unable to complete the planned partial divestment and associated non-recourse project financing of the Sunrise Wind project in the US.

The Trump administration also dealt the company another major blow, when the Bureau of Ocean Energy Management ordered work to stop on the Revolution Wind project off the New England Coast, a project that has almost been completed.

The company launched the rights issue to enhance the value of its portfolio and cover the incremental funding requirements from the full ownership of the Sunrise Wind offshore windfarm in the US, while strengthening its capital structure to preserve and optimise the value of its operational and construction portfolio.

The company said that, following the recent material adverse development in the US offshore wind market, it was not possible for it complete the planned partial divestment and associated non-recourse project financing of the Sunrise Wind project on terms which would provide the required strengthening of Ørsted’s capital structure.

Sign up for Riviera’s series of technical and operational webinars and conferences:

-

Register to attend by visiting our events page.

-

Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

Marine Coatings Webinar Week

© 2024 Riviera Maritime Media Ltd.