Business Sectors

Events

Offshore Wind Webinar Week

Contents

Register to read more articles.

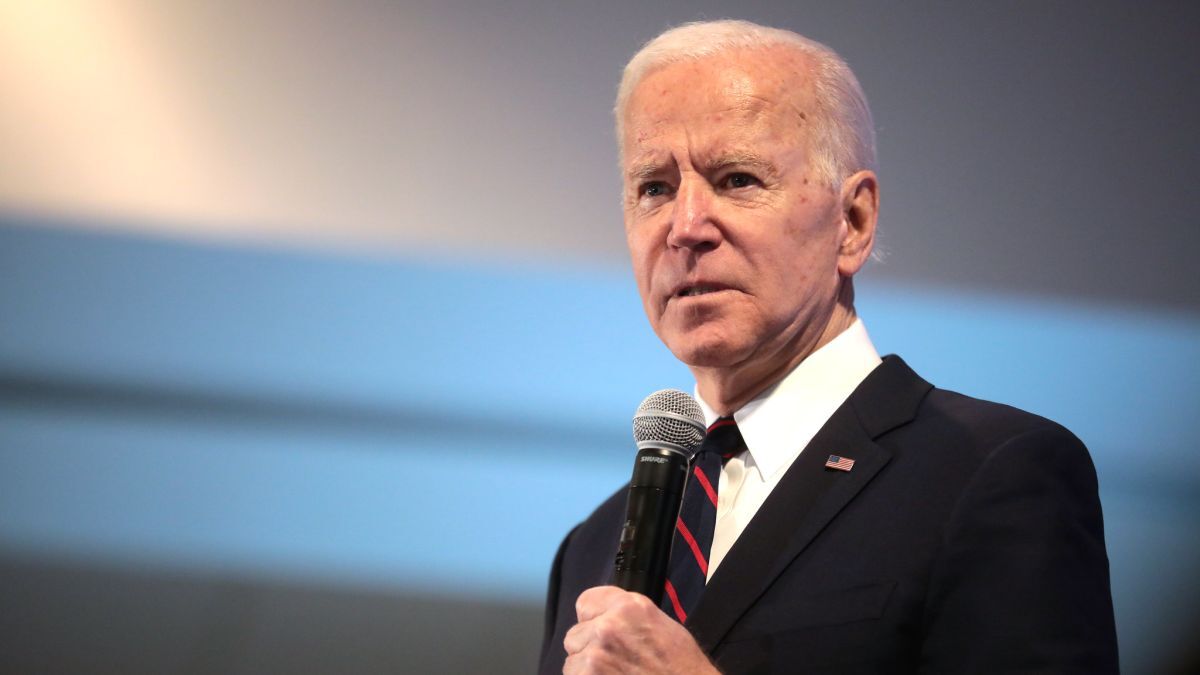

Rigs report: after huge profits, oil majors may face more windfall taxes

US President Joe Biden has threatened to penalise oil and gas companies with higher taxes if they do not use their profits to help lower energy costs for American consumers

President Biden accused oil and gas companies of “war profiteering” and has called for the companies to increase production and refining capacity to help lower costs.

“Give me a break. Enough is enough. Look, I’m a capitalist. You’ve heard me say this before: I have no problem with corporations turning a fair profit or getting the return on their investment and innovation. But this isn’t remotely what’s happening.”

Energy prices have spiked since Russia began a war in Ukraine and many countries imposed sanctions on Russia in response. And oil majors have seen record-high profits over the same period.

In their latest quarterly results, BP posted a US$8.2Bn profit, Shell reported profits of US$9.45Bn, TotalEnergies’ tally stood at US$9.9Bn, Chevron’s earnings for Q3 stood at US$11.2Bn while ExxonMobil reported nearly US$20Bn. Saudi Aramco’s net income rose 39% year-on-year to US$42.4Bn for Q3.

The EU has laid out a plan to levy a windfall tax on oil and gas company profits, from which the Eurozone expects to raise some US$140Bn. A windfall tax also exists in the UK, however companies can offset the tax paid with investments in oil and gas extraction in the UK and UK waters. Shell, for example, said it will not pay tax due to the level of investment it has made in the UK North Sea.

The US is holding mid-term elections on 8 November, and President Biden’s Democratic party is projected to lose control of at least one of the houses of US Congress. Polls and analysts have cited high levels of dissatisfaction among the electorate largely attributed to higher prices on goods, including fuel, amid inflation that has spiked globally since Russia invaded Ukraine and sanctions have disrupted the transport of energy.

“My team will work with congress to look at these options that are available to us and others. It’s time for these companies to stop war profiteering, meet their responsibilities to this country, give the American people a break and still do very well,” President Biden said.

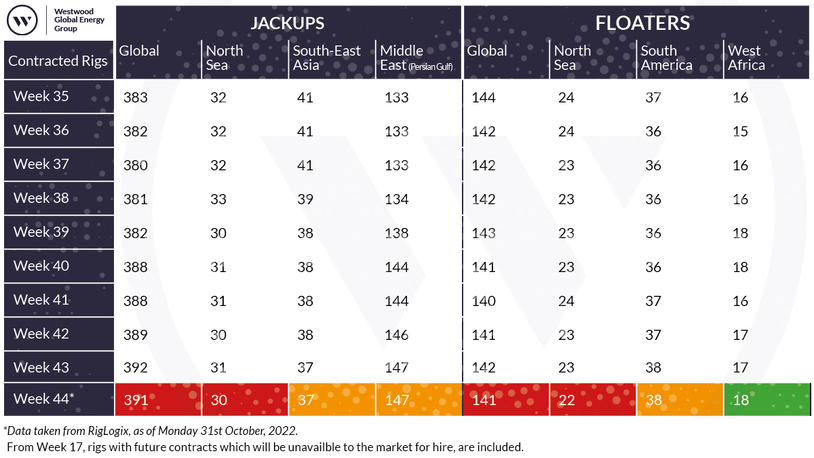

In the offshore drilling trade, rig utilisation continues to remain high as we enter week 44, 2022. Data from Westwood Global Energy shows 391 active jack-ups and 141 floaters, a marginal decrease from last week.

New hydrocarbon discoveries have been made in the Western Hemisphere.

On 31 October, Petrobras said it hit oil at two pre-salt wells in the Sepia Coparticipada block within the prolific Santos basin. The well is located at a water depth of 2,197 m and tests indicate the net thickness of the well’s oil columm may make it one of the largest recorded in Brazil.

The Sépia surplus block was purchased by a consortium comprising Petrobras, which serves as block operator holding a 30% interest, and its partners TotalEnergies (28%), QatarEnergy (21%), and Petronas(21%). Pre-Sal Petróleo, a government-run company is the manager. The consortium is conducting operations to characterise the condition of the reservoir and check the extent of the discovery.

ExxonMobil announced two further discoveries at the Sailfin-1 and Yarrow-1 wells in the Stabroek block offshore Guyana. Exxon has made more than 30 discoveries on the block since 2015. Stena Carron drilled Sailfin-1 in 1,407 m of water and encountered approximately 95 m of hydrocarbon-bearing sandstone and the Yarrow-1 well was drilled in 1,085 m of water, encountering approximately 23 m of hydrocarbon-bearing sandstone.

ExxonMobil’s first two Guyanese projects, Liza Phase 1 and Liza Phase 2, produced an average of 360,000 barrels of oil per day in Q3 2022. A third project, Payara, is expected to start-up by the end of 2023, and Yellowtail, the largest development, is expected to come online in 2025. Exxon said it is pursuing environmental authorisation for a fifth project, Uaru.

Transocean’s Deepwater Atlas drillship began its inaugural contract in the Gulf of Mexico with Beacon Offshore Energy. The rig is employed from October 2022 to June 2023 for work on the Shenandoah project in the Walker Ridge area of the Gulf of Mexico.

Dolphin Drilling listed on the Euronext Growth Oslo stock exchange as of 28 October. Shares closed at Nkr16 (US$1.55) on 1 November 2022.

Blackford Dolphin was awarded a 12-month contract by General Hydrocarbons Ltd in Nigeria. The semi-submersible rig is currently on tow from Mexico to Las Palmas, Gran Canaria to undergo rectification and maintenance work before being deployed to Nigeria.

The West Africa nation plans to auction seven deep offshore oil blocks in November, 15 years since the last ones were auctioned. Nigerian Upstream Petroleum Regulatory Authority chief executive Gbenga Komolafe told Reuters, “We will announce by next month the intention to conduct a transparent bidding round for seven oil blocks.”

All the new blocks will be in Lagos waters, not the Niger delta and Nigerian media reports that at least some of the blocks on offer are located at depths between 944 m and 1,200 m.

Nigeria last issued licences and permits for oil blocks between 2003 and 2007. Oil production in Nigeria has tumbled over the last few months. Production data published by Opec and Nigeria’s own upstream petroleum regulator show crude output has dropped. In case of the latter’s statistics, below 1M barrels a day in August and September.

Crude oil theft has been cited as a major factor. The Trans-Niger Pipeline, a 180,000 barrel a day pipeline, was forced to close in June after reports of vandalism and oil theft. In Q3 2022, Nigeria has reportedly lost out on N288Bn (US$655M) in crude oil revenue.

In the UAE, ADNOC has awarded a raft of framework agreements valued at US$4Bn for integrated drilling fluids services to support the ongoing expansion of the country’s onshore and offshore oil and gas fields.

The awards, the largest of their kind in the industry, were awarded to ADNOC Drilling, Schlumberger Middle East and Halliburton. The contracts cover ADNOC’s onshore and offshore fields and will run for five years with an option to extend for a further two years.

The UK’s North Sea Transition Authority (NSTA) has opened an investigation into an unnamed company that is alleged to have failed meet its obligations including drilling an exploration well and completing a 3D seismic survey, having been awarded a licence in the 28th Licensing Round in 2014. The investigation will examine the situation surrounding the licence, which had been previously extended, in light of changes to company ownership and could lead to a fine of up to £1.0M (US$1.1M) if the company is found to have failed to meet its obligations.

NSTA added that it will not hesitate to take action against other drillers that fail to meet their licence obligations, especially in light of ensuring Britain’s energy security.

Finally, Norway’s Petroleum Safety Authority (PSA) completed its investigation of a lifting incident on Odfjell Drilling’s Deepsea Atlantic rig on 8 March 2002, where a slip joint unintentionally ended up on the seabed. This incident occurred in connection with a lifting operation from the Stril Mar supply ship to Deepsea. During a lift from ship to facility, the load dropped out of control before striking the Stril Mar’s bulkhead and landing on the seabed.

PSA said its investigation showed the planning and execution of the lifting operation was inadequate and the crane was operated outside its design criteria, resulting in damage to the offshore crane, the slip joint and the ship’s bulwark. The incident forced the starboard offshore crane out of action for a time.

The regulator has identified certain nonconformities in connection with the incident and has asked Odfjell Drilling to respond by 28 October 2022.

The Offshore Support Journal Conference, Middle East will be held 6 December 2022. Register your interest and access more information here

Related to this Story

Events

Offshore Wind Webinar Week

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

© 2024 Riviera Maritime Media Ltd.