Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Turbulent 2022: LNG demand in Asia slides as buyers retreat from high prices

LNG demand in Asia faltered last year as the region’s LNG spot prices averaged twice as much as those in 2021, forcing buyers to retreat to lower-cost fossil fuels

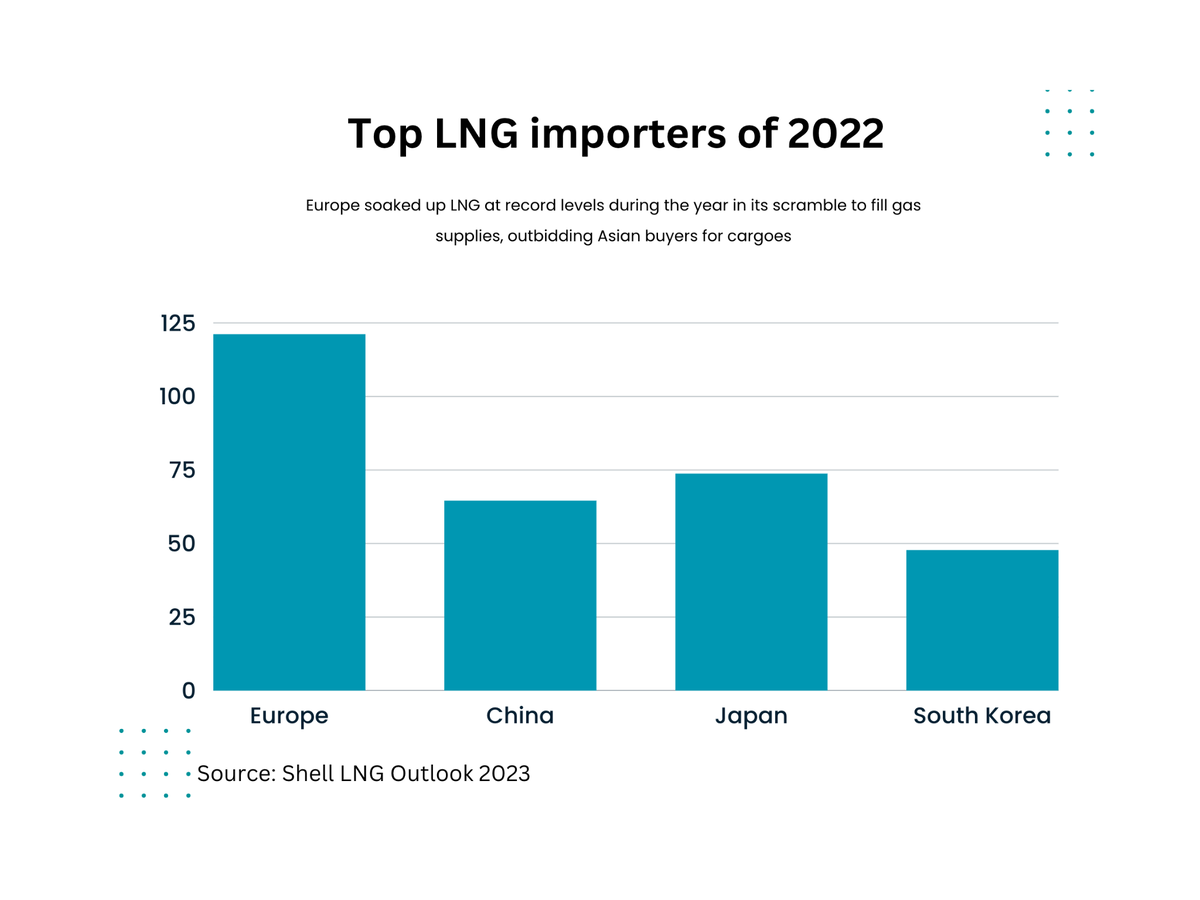

While LNG cargoes flowed to the EU at record levels because of the continent’s pivot from Russian pipeline gas, imports to Asia dipped 7% year-on-year, falling from 270M tonnes to 250M tonnes of LNG in 2022. The region represented about 63% of the global LNG market of 397M tonnes, according to data from Shell.

Energy analysts Kpler reported total global LNG demand was 400.5M tonnes, up from 379.6M in 2021.

Price volatility was the hallmark of 2022 as LNG prices on the Asian spot market averaged about US$34 per million British Thermal Unit (mmbtu), twice that of 2021. Weekly Asian spot prices hit a record US$70.50 per mmbtu on 26 August.

Demand from China weakens

Demand from China, the world’s biggest LNG importer in 2021, weakened in 2022 due to a combination of lockdowns imposed by the government because of zero-tolerance Covid policies and increasing use of natural gas that was domestically produced or imported via pipeline. This resulted in Chinese LNG imports falling 15M tonnes – a whopping 20% year-on-year – to 64.4M tonnes, according to Poten & Partners.

Meanwhile, the EU sopped up 121M tonnes of LNG in 2022, up 60% year-on-year, as it scrambled to replace Russian pipeline gas following the outbreak of the Russia-Ukraine war in February. Europe’s demand for LNG clearly impacted markets in Asia and southeast Asia, causing countries such as Bangladesh, Pakistan and India to shun the high-priced molecules. Pakistan and Bangladesh imported more fuel oil to minimise power supply shortages and India used more coal.

An analysis by Poten & Partners showed LNG imports to China hit their highest monthly levels in December, reaching 7.5M tonnes. “Sentiment towards LNG demand has improved since Covid-19 restrictions have been lifted (on 8 December) and LNG prices have dropped due to present ample supplies in Europe,” noted the commodity and ship broker and energy analyst.

This should not be taken as an indicator of robust demand growth in China for 2023 and 2024, cautioned Poten & Partners.

The energy analyst is forecasting “moderate growth” in China of about 8% year-on-year in LNG imports in 2023 to 69.6M tonnes and almost 9% year-on-year to 75.7M tonnes by 2024. These numbers are still well below 2021 levels.

Further dampening demand are increased domestic natural gas production in China, and the ramping up of gas pipeline imports.

Poten & Partners reported pipeline imports are on the rise, growing from 47 bcm in 2020 (meeting 14% of demand) to 64 bcm in 2022 (about 17% of demand).

“China has not released data showing the volume and source of pipeline imports since the war in Ukraine broke out, but data on the value paid for Russian pipeline gas is available,” noted the energy analyst.

This, Poten & Partners pointed out, is shown by the cost of pipeline gas from Russia, which jumped from US$4Bn in 2021 to nearly US$7Bn in 2022, indicating larger flows.

“All these factors indicate that China is likely to remain out of the spot LNG market for much of 2023,” concluded Poten & Partners.

This, too, was the sentiment expressed in the recently released Shell LNG Outlook 2023. Prior to 2022, over the last five years, Chinese imports on the LNG spot market grew from 2M tonnes in 2017 to 26M tonnes – a thirteenfold increase. In 2022, it secured just 3M tonnes of LNG on the spot market, according to Shell’s data.

“The war in Ukraine has had far-reaching impacts on energy security around the world and caused structural shifts in the market that are likely to impact the global LNG industry over the long term,” said Shell executive vice president for energy marketing Steve Hill. “It has also underscored the need for a more strategic approach – through longer-term contracts – to secure reliable supply to avoid exposure to price spikes.”

By volume, China secured 60M tonnes of LNG, some 95% of its purchases via term contracts in 2022, up from 67% in 2021, according to Shell data.

Highlighting this trend is the long-term sales and purchase agreement (SPA) cut between Sinopec and QatarEnergy in November. The SPA, the second between the two parties, outlines the supply of 4 mta of LNG over 27 years – China’s longest such deal. This was also the first long-term SPA for QatarEnergy’s North Field Expansion project. Deliveries will start in 2026 when the NFE project is commissioned.

“The signing of this agreement aligns with Sinopec’s adherence to green, low-carbon, safe and sustainable development," said Sinopec chairman Ma Yongsheng. "The LNG supply will help meet the demand for natural gas in the Chinese market, but also further optimise China’s energy mix while enhancing the security, stability and reliability of energy supply.”

Japan top LNG importer but…

Prior to 2021, Japan had been the world’s top importer of LNG for 51 consecutive years before it was surpassed by China. And for the fifth consecutive year, Japan’s LNG demand fell in 2022, dropping to about 73.6M tonnes of LNG, some 2% lower than 2021, when imports reached 75.3M tonnes, according to Kpler. Still, almost by default, it once again slipped past China to become the world’s largest importer of LNG.

In his analysis of the north Asia and Australasia markets, Japan Gas Association senior advisor and International Gas Union (IGU) regional coordinator Satoshi Yoshida noted Prime Minister Fumio Kishida’s intention announced last year to restart seven nuclear reactors by mid-2023 as a move to reduce the country’s dependence on imported LNG.

“The latest government’s energy plan shows nuclear power will account for 20% of the power mix by 2030, bringing the share back to where it was before the Fukushima disaster,” wrote Mr Yoshida in IGU’s Global Voice for Gas, released in December.

Japan’s Ministry of Economy, Trade and Industry (METI) has proposed to extend the lifespan of nuclear reactors beyond their current 60 years to ensure stable power supplies and also reduce greenhouse gas emissions. This is part of Japan’s Green Transition Policy, which also envisions carbon pricing and e-methane.

At a meeting in Washington DC in January, METI Minister Nishimura and US Energy Secretary Jennifer Granholm discussed co-operation between the US and Japan on nuclear energy, such as developing and constructing next-generation advanced reactors including small modular reactors to maximise the use of existing reactors and build nuclear component and fuel supply-chains, including uranium fuel.

The US and Japan are also committed to “greenhouse gas abatement in fossil energy,” which includes developing carbon capture, storage and utilisation, and strengthening policies for clean hydrogen and ammonia.

S&P Global reported that this shift towards increased nuclear power utilisation comes at a time when many of the country’s long-term SPA LNG contracts are expiring. It reported volumes are set to drop from around 99 mta in 2020 to 65 mta by 2030.

Imports flat in South Korea

Demand from South Korea, the world’s third-largest LNG importer behind Japan and China, was essentially flat in 2022, importing about 46.7M tonnes of LNG.

As one of the world’s largest buyers of LNG, South Korea’s KOGAS maintains a near monopoly over the country’s LNG imports. It holds stakes in some of the world’s largest LNG projects, including Gladstone LNG and Prelude FLNG in Australia, Donggi Senoro LNG in Indonesia, LNG Canada in Canada, RasGas LNG in Qatar, Oman LNG in Oman, Yemen LNG in Yemen, and Coral FLNG in Mozambique. Additionally, it owns 72 LNG storage tanks, with a total capacity of 11.5M kilolitres (kl) of capacity.

It opened the country’s first LNG receiving terminal, Pyeongtaek LNG Terminal, in 1986. In late January, Pyeongtaek LNG Terminal marked a remarkable safety milestone, hosting its 5,000th vessel to offload at the terminal without an incident. The 37 years of service without a single safety accident represents the longest accident-free record in the country’s public energy sector, according to operator KOGAS. Golar Spirit was the first LNG carrier to call at the terminal in November 1986.

KOGAS president Choi Yeon-hye delivered a commemorative plaque to the captain of Hyundai Greenpia, the 5,000th LNG carrier to call at the terminal.

KOGAS is working with SK Gas, part of South Korean conglomerate SK Group, on the construction of the Korean Energy Terminal in Ulsan. Set to be completed in 2024, the US$850M facility will import and store LNG.

Ground broken for new terminal

Under a plan to increase storage capacity on the country’s southeast coast, POSCO International has broken ground on a new LNG terminal at Gwangyang.

The expansion is part of some US$2.9Bn in investments in the LNG value chain that were announced by POSCO International at an extraordinary general in November 2022, when a merger with POSCO Energy was approved. The merger was completed 1 January 2023.

The South Korean steel, energy, agro and biodegradable materials company is investing in the construction of two 200,000-kl storage tanks, which will be completed in 2025. Once the expansion is finished, POSCO International’s Gwangyang LNG terminal will have a capacity of 1.33M kl.

The capacity of the existing 730,000-kl storage tanks in Gwangyang and Dangjin terminals will be increased over the course of three years. By increasing their capacity, POSCO International expects to secure 4.6M tonnes of LNG transaction volume and storage infrastructure capable of handling 1.81M kl in South Korea by 2026.

The construction of the storage tanks follows South Korea’s increased demand for LNG and cleaner fuels to lessen its dependency on more carbon-intensive coal and other fossil fuels for thermal power generation in a bid to reduce its GHG emissions.

POSCO International is also investing upstream, with plans to triple natural gas production in Australia by 2025 through its subsidiary, Senex Energy, on top of expanding its production base by securing marine exploration rights in Indonesia the next year.

With an eye towards the future, the South Korean conglomerate is putting Krw700Bn (US$532M) into power generation, which includes developing hydrogen co-firing powerplants. It is looking to convert two of the seven LNG power plants in Incheon to hydrogen co-firing units, which is anticipated to give rise to the world’s first gigawatt-level commercial hydrogen co-firing powerplant.

Sign up for Riviera’s series of technical and operational webinars and conferences in 2023:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.