Business Sectors

Events

Contents

Register to read more articles.

Research for the win at WinGD

Amid an intensifying battle for market share in alternative-fuelled engines, WinGD’s new CEO, Dominik Schneiter, believes the company’s research investments will make all the difference

With methanol-fuelled main engines storming up the orderbook rankings, the first retrofit contracts signed and ammonia research advancing rapidly, carbon-neutral fuels are emerging as the next battleground for two-stroke engine designers. So when Swiss marine power company, WinGD, announced the departure of chief executive Klaus Heim in July, who better to replace him than the man who has led those developments since the company spun into existence in 2015?

Dominik Schneiter, formerly the company’s vice president of research and development, has overseen plenty of big technology shifts in his time. Under his watch, the first low-pressure dual-fuel engines were introduced seven years ago; a development so successful that it forced the company’s main competitor, MAN Energy Solutions, to launch a rival range alongside its high-pressure engines to regain market share in the gas carrier segment.

“The developments we made with the X-DF series back then put us in a good position to advance for today’s requirements,” says Mr Schneiter. “The engine structure is designed to accommodate the high temperatures and pressures that may be needed for alternative fuels, so we have a solid base to work on. We took the decision then to make all new engines, including the diesel-fuelled X-series from the same base, so all existing engines can be retrofitted for new fuels. And we already have industry-leading efficiency in high-pressure combustion, which we will use in the methanol and ammonia engines, with the X92-B diesel engine.”

“We already have industry-leading efficiency in high-pressure combustion”

If research was critical for the X-DF breakthrough, it is even more important today. Backed by its owner, the world’s biggest shipbuilder, China State Shipbuilding Corp (CSSC), the Swiss company has been quietly building a network of research centres, test engines and partnerships that are proving pivotal as it develops not only methanol and ammonia-fuelled engines, but hybrid power capabilities, digital optimisation tools and continued evolutions in core engine design.

Core advances

“We should not forget that the need for incremental improvements in efficiency and reliability remain fundamental to engines, whichever fuel they use,” Mr Schneiter notes. “Some of our most important advances in recent years have been in this area – variable compression ratio is one standout example – along with building out a portfolio of solutions beyond the engine that will make ship operations more efficient.”

But for operators of large deep-sea going vessels, it is clean fuels that will provide the decisive reduction in emissions that will enable them to reach the more advanced stages of decarbonisation. Here, MAN ES has a head start in methanol – a fact borne out by the orderbook – from its years of supplying engines to methanol tankers. WinGD’s first engines will be on the water in Q1 2025, and Mr Schneiter is determined that the catch-up will be rapid.

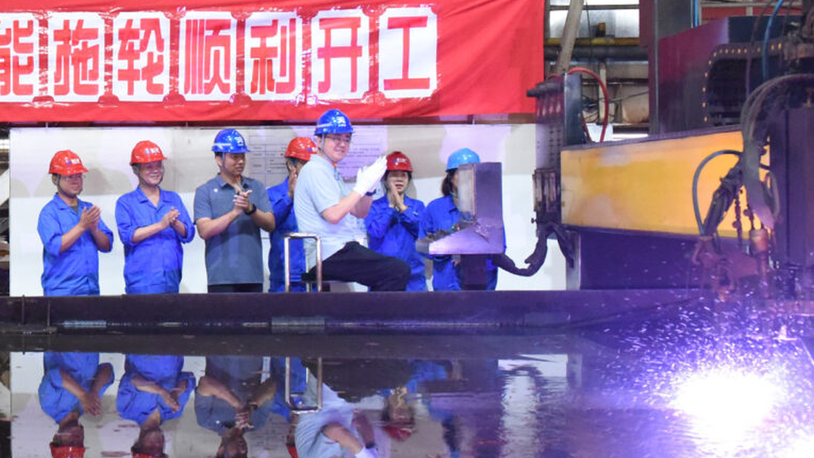

One example of the company’s accelerated investment in developing methanol engines is its contract with Chinese container operator COSCO. Four 16,000-TEU vessels, due for delivery from 2025, will feature the first X-DF-M methanol-fuelled engines to be built in China. Unconventionally, the third vessel will be the first to receive a newbuild X-DF-M engine; the previous two builds will initially house X92-B engines which will be retrofitted at the shipyard once the first X-DF-M passes its factory tests. WinGD will thus be using an early newbuild order to advance its retrofit capabilities, which traditionally take between six months to a year after a newbuild delivery.

“By working closely with our partners at an early stage – far more closely than we have ever before – we are aiming to speed up the time it takes to get the engines from design to operation, and to deliver a product that will be safe and reliable in service,” says Mr Schneiter. “Our projects with engine builders, shipyards, shipowners and equipment suppliers are a fundamental component of our development plans.”

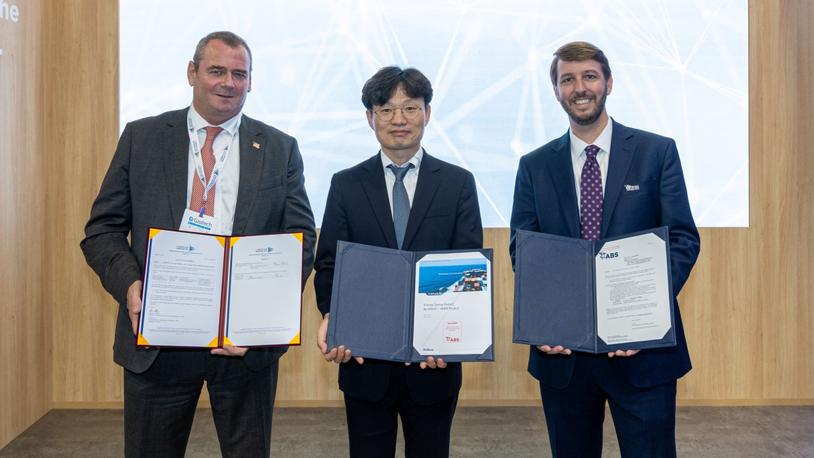

Nowhere is this more evident than in WinGD’s work towards its X-DF-A ammonia-fuelled engines. In the past year alone the company has signed a co-development agreement with CMB.Tech, the innovation nerve centre of the Saverys shipping empire that also includes Exmar and CMB; begun a joint development project with Mitsubishi Shipbuilding Corp that will see preparations made for integrating X-DF-A engines with ammonia fuel supply systems; and signed an agreement with tanker operator AET and its sister company, maritime academy Akademi Laut Malaysia, that will see WinGD develop a training curriculum for seafarers using its ammonia-fuelled engines.

Ammonia advantage

While the company may be playing catch-up on methanol – and is investing accordingly – it is at no such disadvantage when it comes to ammonia, which could later become a key clean fuel in some markets due its non-carbon composition. In fact, with the first combustion tests performed in 2021 and novel rapid prototyping techniques now advancing engine concepts, Mr Schneiter believes WinGD may have the edge on ammonia.

“All existing engines can be retrofitted for new fuels”

“We know our engine and combustion concept – in fact we have already released detailed installation and safety guidance – and will begin single- and multi-cylinder testing shorty,” he reveals. “There is no doubt that adapting engines for ammonia is a challenge, but we are convinced that safe, reliable X-DF-A engines will be operating from 2025, which will likely be long before green ammonia is widely available.”

Amid those already extensive research areas, WinGD has also found time to develop a hybrid propulsion offer, through its X-EL Energy Management solution. Main engines are more efficient energy converters than four-strokes but have rarely been used as gensets in marine applications, due to the relatively low electricity demand on vessels and a lack of knowledge on the part of integrators. Both factors are changing: first as hybridisation’s potential for emissions reduction becomes clear; and second, as WinGD has entered the system integration market, building holistic energy systems for deep-sea vessels centred around the main engine.

A recent series of NYK Line newbuildings was a proving ground for the X-EL solution, with an LNG-battery hybrid arrangement designed and integrated by WinGD, also featuring the latest version of its dual-fuel X-DF2.0 technology. Controlled by X-EL Energy Manager and with optimisation from WinGD’s own remote engine diagnostics tool, WiDE, the energy systems on these vessels offer the most complete picture to date of what WinGD describes as its ‘ecosystem of solutions’.

Mr Schneiter says: “Decarbonisation will not come through one solution. It will be complex, encompassing alternative fuels, digital optimisation and in many cases, hybrid propulsion. As a company we need to be where the customers need us, both in terms of our technology offer and our close co-operation with the industry.”

It could be seen as a dauntingly diverse manifesto for a new CEO, especially amid intensifying competition around decarbonisation. But for a veteran that has led the company’s innovation drive for nearly a decade, it is a challenge that he relishes. “It’s hard to predict where the industry is going in the next few years,” Mr Schneiter says. “But for us technology designers, it will not be dull.”

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.