Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

Rigs report: H1 rig rates support positive forecast for offshore market

With overall rig activity remaining steady, Transocean has reported several drillships working for day rates in excess of US$300,000

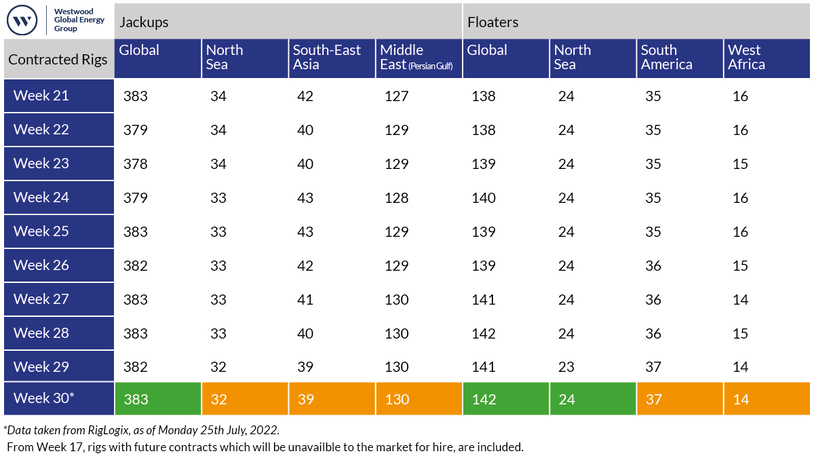

In week 30, 2022 the number of active rigs remained almost unchanged week-on-week, with 383 active jack-ups and 142 floaters engaged, according to data from analyst Westwood Global Energy. As OSJ reported this week, Westwood has forecast a very strong overall financial outlook for the offshore oil and gas industry over the next five years, including an outlay of about US$276Bn on engineering, procurement and construction (EPC) services between 2022-2026, a 71% increase on its previous five-year forecast.

Major projects sanctioned in H1 2022 include ExxonMobil’s Yellowtail development in Guyana, Shell’s Crux in Australia, Equinor’s Haltenbanken East in Norway, and ADNOC’s Umm Shaif Long Term Development Phase I and Saudi Aramco’s Zuluf Incremental project in the Middle East. Westwood forecasts total EPC spending to hit US$68Bn this year. The increasing investment is driving rig utilisation and pushing charter rates higher with rates for semi-submersibles pegged at over US$350,000/day, a huge increase compared with the sub-US$200,000/day figures common in 2020.

Those positive figures were backed up by this week’s quarterly fleet report from offshore giant Transocean. Deepwater Skyros was awarded a 10-well contract in Angola at US$310,000 a day. In the US Gulf of Mexico, Deepwater Invictus clinched a two-well contract extension at US$375,000 per day. India’s Reliance awarded the Dhirubhai Deepwater KG1 rig an 86-day contract extension plus up to four option wells (adding another 270 days) at US$330,000 per day. Deepwater Mykonos was awarded a 435-day contract, with an option for another 279 days in Brazil at approximately US$364,000 per day.

Norway’s Equinor awarded semi-submersible Transocean Spitsbergen a nine-well deal at US$335,000 per day, plus two one-well options at US$375,000 per day. The 18-month contract is valued at US$253M. And another Transocean semi-submersible, Paul B Loyd Jr, was employed on a one-well contract, plus two one-well options and an eight-well option for plug and abandonment work in the UK North Sea. Equinor’s aggregate incremental backlog stands at approximately US$650M and the company’s total backlog stands at US$6.2Bn as of 25 July 2022.

Also in the UK North Sea, Shell’s Jackdaw offshore gas project received a financial green light as BG International Ltd, a Shell UK affiliate, took a final investment decision to develop the gas field, following regulatory approval earlier this year. The project is expected to come online in the mid-2020s. Jackdaw will comprise a wellhead platform that is not permanently attended, along with subsea infrastructure which will tie back to Shell’s existing Shearwater gas hub and is part of the oil major’s broader intent to invest £20-25Bn (US$24-30Bn) in the UK energy system over the next decade, subject to board approval.

Dolphin Drilling, a harsh environment and deepwater drilling contractor, has signed a master frame agreement with IKM Gruppen for drilling and well services under its new Well Delivery Model umbrella. The frame agreement will initially focus on ROV services and underpins the integration of services and personnel between the two companies. Dolphin’s Well Delivery Model is a customised support service created to assist clients with oil and gas production. The contractor has operational bases in Aberdeen and Stavanger, and owns and operates three Aker H3 moored semi-submersible rigs which are currently being marketed in the UK, Norway and internationally.

Drilling contractor Valaris said it has successfully reactivated four of its deepwater floaters in H1 2022 for projects around the globe. The reactivations include semisubmersible Valaris DPS-1 for Woodside Energy in Australia and drillships Valaris DS-4 for Petrobras in Brazil, Valaris DS-16 for Occidental Petroleum in the US Gulf of Mexico and Valaris DS-9 for ExxonMobil in Angola.

ExxonMobil this week announced two more discoveries in its Stabroek Block within the Yellowtail development. The discoveries at Seabob-1 and Kiru-Kiru-1 are the sixth and seventh finds made in the block this year. The Seabob-1 well encountered approximately 40 m of high-quality hydrocarbon-bearing sandstone and was drilled in a 1,421-m depth of water by drillship Stena Carron. Kiru-Kiru-1 well encountered approximately 30 m of high-quality hydrocarbon-bearing sandstone drilled by the Stena DrillMAX in 1,756 m of water. Drilling operations at Kiru-Kiru are ongoing. The US-based energy major added that two FPSOs operating offshore Guyana — Liza Destiny and Liza Unity — have exceeded their initial combined production target of 340,000 barrels of oil per day.

Narrowing in on Guyana, analyst Rystad Energy believes Guyana’s domestic production will surpass the US$1Bn mark this year and accelerate to US$7.5Bn annually by 2030. And this week, SBM Offshore secured financing for another FPSO for the Guyanese deepwater project.

In the Mediterranean, Turkey’s Abdulhamid Han drillship will depart from Mersin to begin hydrocarbon exploration in the Mediterranean Sea beginning 9 August. It will join a fleet of three other drillships also conducting hydrocarbon exploration.

And finally, an update on the proposed merger between Maersk Drilling and Noble Corp which looks set to go ahead. In June 2022, to offset any potential anticompetitive concerns, Noble Corp agreed to the sale of five jack-up rigs for US$375M to a newly formed subsidiary of Shelf Drilling. On 22 July, the British antitrust regulator, Competition and Markets Authority (CMA) published its latest guidance and suggested the sale could enable the merger to proceed. The regulator said it “currently does not have material doubts about the overall effectiveness” of Noble’s proposed sale and found Shelf Drilling to be a suitable purchaser.

However, the CMA will seek further consultation on the proposals. All interested parties are invited to submit their views to the CMA before it publishes a final decision. The deadline for comments is 5 August 2022.

The Offshore Support Journal Conference, Asia will be held 19 October 2022. Register your interest and access more information here

The Offshore Support Journal Conference, Middle East will be held 6 December 2022. Register your interest and access more information here

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.