Business Sectors

Events

Marine Coatings Webinar Week

Contents

Register to read more articles.

South Korean shipyards dominate Greek newbuilding activity in 2025 amid geopolitical shifts

South Korean shipyards have capitalised on shifting geopolitical dynamics – particularly US policy discouraging investment in Chinese-built vessels – and have taken a commanding lead in Greek newbuilding orders at the start of 2025

Meanwhile, Chinese shipyards have seen a steep drop in order volume.

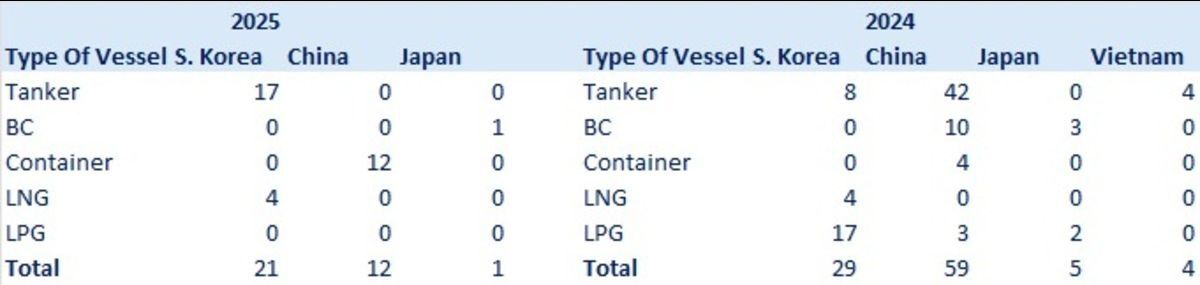

According to Xclusiv Shipbrokers research analyst Eirini Diamantara, Greek shipowners placed orders for 34 vessels in the first four months of 2025, a sharp decline of nearly 65% compared with 97 vessels during the same period in 2024.

This year, Greek owners have been notably conservative in newbuilding investments. Ongoing trade tensions and the USTR port fee plan have dampened sentiment for fresh orders. This cautious approach is not limited to Greek owners but reflects a broader trend in the global shipping industry, where political risk is widely seen as a major factor shaping investment decisions.

Reflecting this cautious outlook, Greek newbuilding activity declined across all major shipping segments except for container vessels and LNG carriers, including LNG bunker vessels. In the tanker sector, orders fell dramatically from 54 vessels last year to just 17 in 2025. Bulk carrier contracts saw an even steeper drop, from 13 to only one this year. Similarly, LPG carrier deals vanished entirely, compared with 22 orders in the first four months of 2024.

Notably, container vessel orders surged to 12 in 2025, up from just four in 2024, as the recent wave of newbuildings in the sector continues to gain momentum. LNG carrier and LNG bunker vessel orders remained stable, with contracts for four vessels signed in both 2024 and 2025.

South Korea tops activity

South Korean shipyards have emerged as the top destination for Greek newbuilding activity in 2025, securing contracts for 21 vessels, accounting for almost 62% of total Greek orders. Tankers were the main driver behind this performance, with Greek owners ordering 17 units. The remaining four orders were for LNG bunker vessels.

Despite South Korea’s continued dominance, its order volume has declined slightly from 29 vessels in the same period last year, largely due to a slowdown in LPG carrier demand.

Chinese yards, by contrast, have experienced a significant retreat in Greek business. Orders dropped from 59 in early 2024 to just 12 so far this year. Most notably, tanker orders fell from 42 to zero. However, container vessel contracts placed with Chinese builders grew from four to 12, suggesting a shift in focus within that segment.

Japanese shipbuilders, specialised in bulk carriers, did not benefit from the changing landscape. With bulk carrier demand subdued, Japanese yards received just one Greek order in 2025, compared with five in the previous year.

Suezmaxes lead the investments

A closer look at the vessel types being ordered reveals a clear preference for Suezmax tankers among Greek owners. According to Xclusiv Shipbrokers, 13 of the 17 tanker orders so far in 2025 were for Suezmax vessels, with the rest split between VLCCs and MR2 tankers. This compares to the same period last year when Greek owners ordered 16 Suezmaxes, 10 Aframax/LR2s, and seven Panamax/LR1s, among other types.

In the container segment, Greek companies signed contracts for 10 neo Panamax vessels and two feeder ships in early 2025. This is an increase from four neo Panamaxes ordered in the same period of 2024.

As for the dry bulk sector, activity has been virtually non-existent. Only one Handysize bulk carrier was ordered by Greek owners in 2025, compared with 13 vessels last year, including 10 Kamsarmaxes, two Handysizes, and one Ultramax.

Riviera’s Tanker Shipping & Trade Webinar Week will be held from 30 June 2025. Click here to register for this free-to-attend event.

Related to this Story

Events

Marine Coatings Webinar Week

Maritime Environmental Protection Webinar Week

Ship Recycling Webinar Week

© 2024 Riviera Maritime Media Ltd.