Business Sectors

Events

Contents

Register to read more articles.

Tier III/biofuels for now, methanol/batteries for the future

Most tugboats and workboats under construction and delivered in 2024 still have diesel engines, but the tide is turning towards electric and methanol

Owners of tugs and workboats are beginning to commit to technologies for reducing greenhouse gas (GHG) emissions and are already reducing other pollutants from vessels in their fleets.

However, a majority of vessels being delivered by shipyards continue to have diesel main engines driving two azimuth thrusters, mostly on the stern, which are more fuel efficient than those being replaced.

There has been a swing towards constructing tugs and workboats with aftertreatment modules on board to minimising NOx emissions to meet IMO Tier III and US Environmental Protection Agency (EPA) Tier 4 requirements, with diesel particulate filters for European Union stage V standards, especially for inland waterways and river ports.

Around 300 tugboats are built and delivered to owners worldwide each year and the shipyard orderbook stood at 376 tugs under construction at global shipyards at the beginning of September, according to BRL Shipping Consultants. This included 339 harbour tugs, 23 salvage tugs, seven tractor tugs and four pusher tugs.

The global orderbook for offshore support vessels was 520, according to BRL, including 108 offshore support, 45 anchor handlers, 40 supply vessels, 53 drilling rigs, 10 drill ships, 14 floating production storage and offloading vessels and 247 classed as offshore miscellaneous.

Some of the biggest tug and workboat construction centres include shipyards in China, Turkey, Vietnam, Malaysia, Indonesia and the US, while yards are building vessels in the Netherlands, India and Japan.

Damen Shipyards is probably the biggest builder of tugs and workboats with shipyards almost worldwide, while all the shipyards in Turkey combined produce close to 100 tugs each year, mainly for export.

Shipyards in the US are building tugs to EPA Tier 4 standards for local owners and operators, while more than half of tugs built in China are for domestic players, although there are considerable exports to other nations in Asia and Australia. There are several shipyards in Malaysia and Indonesia producing low-cost tugs for national and independent owners and operators servicing hundreds of ports, harbours and terminals in south-east Asia.

Q2 2024 data

Up to July 2024, there had been 152 tugs ordered from shipyards, which is roughly half of the number ordered for all of 2023. There were around 170 tugs delivered worldwide in H1 2024, and just over 300 delivered to owners during all of 2023, according to International Tug & Salvage (ITS) accumulated data.

In Q2 2024, almost 100 tugboats left shipyards to join the growing global sector with owners enjoying rising demand as more ports and terminals opened. ITS identified 98 tug deliveries in April to June, the highest since 2018.

A majority of tugs built in Q2 2024 started operating in nine countries, including Australia, China, India, Indonesia, Malaysia, Turkey, Saudi Arabia, South Africa and the US, while several entered the northern European market.

Some of the main builders were Cheoy Lee Shipyards, Damen Shipyards, Jiangsu Zhenjiang Shipyards, Med Marine, Sanmar Shipyards and Uzmar. ITS identified 68 owners welcomed at least one newbuild, with Boluda Towage and Svitzer adding the most in the quarter.

With this output, shipyards required new contracts to balance their orderbooks.

In Q2 2024, shipyards secured orders for 82 newbuild tugs, according to ITS accumulating data from various sources, although this includes 30 tugs ONEX Group has reportedly decided to build in Greek shipyards over the next three years. This also includes 11 tugboat contracts Egyptian Ship Repairs & Building Co has gained from three Egyptian port authorities.

Secondhand market

Rising shipyard orderbooks, contracts and deliveries are also partially down to a tightness in the secondhand market where owners are holding on to their assets, reducing the number available to purchase.

According to Marcon International, the availability of secondhand tonnage has slumped 23.4% in one year, down to 242 tugboats, as of the end of May 2024, from 316 in May 2023. It is also down 55% from 534 in May 2019.

“The market for tugs of all sizes has been very tight for a while,” said Marcon in its latest tug market report. “With the current elevated newbuilding costs, owners are not interested in selling, but are instead trying to refresh equipment, renew certificates or otherwise get laid up vessels back into working shape to meet commitments.”

Newbuilding prices have doubled in the last 10 years and costs for retrofitting older tugs have also risen. “On top of the already tight market, owners are facing even more challenges as increased machinery costs and limited shipyard space are causing issues with keeping tugs working. So many owners are faced with a no-win situation,” said Marcon.

Upgrading existing tugboats or those purchased from the tight market will also be costly.

“For those tugs which are offered for sale, they are few and far between at premium prices,” said Marcon.

Of the 242 tugs on the global secondhand market, just 26, representing 10.7%, were built within the last 10 years, whereas 44 (18.2%) are over 50 years of age. Three of those are over 75 years old, with the oldest identified by Marcon being built in 1944.

Of the 242 tugs on sale in May 2024, 72 were in the US, 30 in Europe, 29 in the Far East, 22 in the Mediterranean, 21 in south-east Asia, 18 in the South Pacific, 17 in Latin America, 12 in the Caribbean, nine in the Middle East, four in Africa and eight elsewhere.

Propulsion technology

Some of the major owners are considering and investing in alternative fuels and power sources, leading to shipyard orders for tugs running on biofuels and batteries now and methanol and hydrogen in the future. Energy storage solutions are being installed on more tugboats, pilot transfer vessels and multipurpose workboats, reducing fuel consumption and emissions while helping owners and ports achieve their sustainability goals.

There are advantages in terms of emissions reductions for going fully electric, but vessels need charging stations and back-up gensets to be effective and safe. For longer voyages, they need extending technologies, such as hydrogen fuel cells, or back-up generators running on methanol.

According to ITS, there are 26 tugs operating globally where batteries are the primary energy source on board, and all of these have some type of back-up or alternative fuel for generating power. There are another 19 electric-powered tugs either on order or being considered for construction in shipyards worldwide.

There are tens of tugs operating with mechanical hybrid propulsion where motors, shaft generators, specialised transmission and engine-thruster configuration reduce fuel consumption and emissions.

Turkish shipyards and Damen are leaders in building battery electric tugs with four operating in Turkey from these yards and five in British Columbia, three with HaiSea Marine and two in SAAM Towage’s fleet. Crowley is the first to operate an electric tug in the US – eWolf supports ships in San Diego and Kirby Inland Marine operates electric-powered towboat Green Diamond.

Tokyo Kisen operates electric powered Taiga in Japan, Ports of Auckland uses Sparky, the first built by Damen, in New Zealand, while Damen’s second, Bu Tinah, is with AD Ports in the UAE. A third, Volta 1, is en route to Belgium for operations in Antwerp. In the Netherlands; Stormer Marine built three electric tugs for the Dutch Navy and Padmos is building E-Pusher tugs for Kotug.

There is a growing fleet of hybrid-electric tugs being built and operated in China, while operators in Singapore and India are working to introduce electric harbour craft.

Sanmar is building another seven battery electric tugs to Robert Allan Ltd’s ElectRA series designs after commencing operations of its first and delivering six to other owners in the past 12 months.

Kotug and Svitzer are leaders for investing in methanol-fuelled tugs, with Turkish shipbuilders Sanmar and Uzmar gaining orders for the first set. Sanmar is building two escort tugs for Kotug Canada’s operations in Vancouver and Uzmar just picked up an order for a battery methanol tug from Svitzer to support ships in the Port of Gothenburg, Sweden.

Port of Antwerp-Bruges is the first to operate a methanol-fuelled tug as it retrofitted one from its existing fleet. It also operates Hydrotug-1, the world’s first hydrogen-fuelled harbour tug, owned and developed by CMB.Tech.

Ammonia is being tested on tugs in first sea-trials before it can be rolled out in commercial ships. In the US, Amogy has started operating the world’s first carbon-free, ammonia-powered vessel, NH3 Kraken on a tributary of the Hudson River, New York. Feeney Shipyard in Kingston converted a 1957-built tugboat with a 1-MW ammonia-to-power system and a hydrogen fuel cell.

In Japan, NYK completed the world’s first ammonia-fuelled harbour tug ready to start operating in Tokyo Bay. Keihin Dock Co converted LNG-fuelled, 2015-built tugboat, Sakigake as a demonstration of the technology and fuel. NYK worked with IHI Power Systems Co and ClassNK on this project.

Shin-Nippon Kaiyosha will employ this vessel in ship-handling operations in Tokyo Bay over a three-month demonstration period. This initiative is part of a Green Innovation Fund Project initiated in October 2021 under Japan’s New Energy and Industrial Technology Development Organization to develop vessels equipped with domestically produced ammonia-fuelled engines.

In addition, NYK is conducting research and development on an ammonia-fuelled medium gas carrier with Japan Engine Corp, Nihon Shipyard, IHI Power Systems and ClassNK, with this vessel scheduled for delivery in November 2026.

ClassNK says it will continue to support the introduction of alternative-fuelled vessels by providing issuance of safety requirements and guidance for design and safety assessments.

Hydrogen as a fuel is gaining traction with Damen contracted to build a fleet of hydrogen-ready harbour tugs for CMB.Tech and German owner Fairplay Towage seeking shipyards to build its proposed series of hydrogen fuelled vessels. The future for tugboats and workboats will be a mixture of fuels depending on their availability, dedicated bunkering facilities in set ports and charging stations for battery electric fleets.

Related to this Story

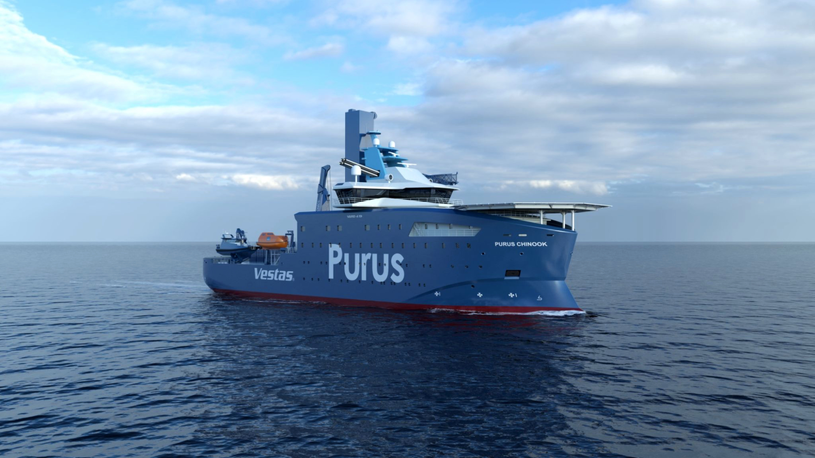

AI, digital twins help design cyber-secure, green SOVs

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.