Business Sectors

Events

Contents

Register to read more articles.

Sanctions, SWIFT ban threaten Russian LNG sector

The imposition of Western sanctions on Russia for its invasion of Ukraine has piled uncertainty on the country’s LNG sector, writes Poten & Partners

Sanctions pose a threat to projects under construction or in the planning stage, as well as to current LNG exporters’ ongoing operations.

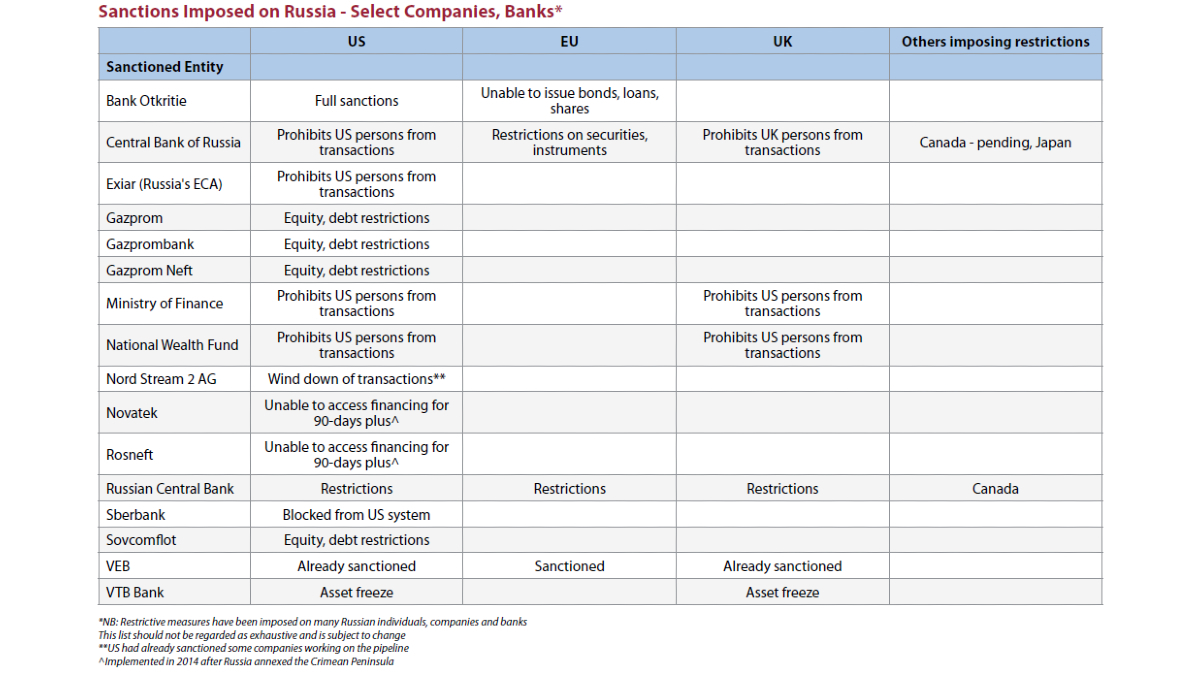

Restrictive measures have been applied by the US, EU, UK and others on a wide range of Russian companies, banks and individuals. In addition to sanctions, they include a plan to ban some yet unnamed Russia banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is a messaging system that banks use to make cross-border payments.

The latest round of sanctions has left Russian LNG sector companies and the domestic and foreign companies that provide finance and services to them struggling to assess their liabilities and exposure to counterparties. Risk is also heightened on fears that further restrictive measures could be on the horizon if political issues go unresolved.

Concern over sanctions – after they were imposed against some Russian entities when it annexed the Crimean Peninsula in 2014 – was in part behind the move to construct more of the equipment needed for the Arctic LNG 2 project in Russia, which is currently under construction. The modules for the LNG trains rest on gravity-based structures which are being built in Murmansk and the Arc7 icebreaking LNG carriers that will serve the project will be built in Russia.

For 19.8-mta Arctic LNG 2, lending by a Russian bank to a Russian project may not appear to be a problem. However international banks and export credit agencies (ECAs) may fear being caught in the sanctions web if they are lending in euros alongside sanctioned entities. It is understood there are sanctions clauses in the loan documents for both Arctic LNG 2 and Yamal LNG that may provide for early repayment. There are no suggestions those clauses will be triggered, but if the situation deteriorates it remains a possibility.

The project’s foreign sponsors will also be looking at their exposure to any entities subject to sanctions. Russia’s Novatek has 60% of Arctic LNG 2, with the rest held by China’s CNPC and CNOOC, the JOGMEC -Mitsui joint venture Japan Arctic LNG, and France’s Total, which all have 10%.

The US$21.3Bn project secured €9.5Bn (US10.5Bn) of finance in November last year and €4.5Bn is coming from Russia’s Sberbank, Gazprombank and its subsidiary, Bank GPB International, Russian state development bank VEB and Bank Otkritie Financial Corp. Sberbank is subject to US sanctions, Otkritie is subject to US and EU sanctions and VEB is sanctioned by the US, EU and UK. Gazprombank is subject to limited debt and equity raising restrictions in the US.

€5Bn of the financing (along with insurance cover and guarantees) is coming from China Development Bank (CDB), Export-Import Bank of China (China Exim), Japan Bank for International Cooperation (JBIC), Nippon Export and Investment Insurance, Sumitomo Mitsui Banking Corp, Italy’s export credit agency SACE, and Italian banks Intesa San Paolo and Casa Depositi e Presiti.

Chinese financiers also stepped up with even bigger funding commitments to 16.5-mta, US$27Bn Yamal LNG after financing the project subsequently added 900,000-tonne Train 4. Even Chinese lenders were concerned about their exposure to sanctions imposed by the US on Novatek in 2014. And this time around, the crisis is more severe and more and harsher sanctions have already been implemented.

Providers of the approximately US$20Bn debt package for Yamal LNG included China Exim, CDB, Sberbank, Gazprombank, Russia’s National Wealth Fund (NWF), Russia’s ECA, Exiar, with smaller portions coming from Germany’s Euler Hermes, Sweden’s EKN, Austria’s Raiffeisen, JBIC and Intesa San Paolo. State development bank VEB also provided a US$3Bn guarantee to the project. Some of the Russian entities on the financing, including VEB, NWF and Exiar are now faced with sanctions. Novatek owns a 50.1% stake, with TotalEnergies and CNPC each holding 20% and China’s Silk Road Fund the remaining 9.9%.

As the operating Yamal LNG project continues to service its loans, with a core group of lenders in Yamal LNG subject to sanctions, it will complicate arrangements. Parties who have contracts with the project such as shippers, suppliers and contractors are also potentially exposed to sanctions. It puts shareholders in a difficult position over whether to try and replace sanctioned entities.

When Novatek and its partners were looking to raise funding for Yamal LNG, Russia’s annexation of Crimea forced them to makeover their financing plan. Financial advisor Societe Generale, and legal advisors White & Case and Latham & Watkins exited the project in 2014 and the financing was reworked to maximise support from Chinese and Russian lenders. It focused on using euros, Russian roubles and Chinese renminbi rather than US dollars to reduce sanctions risks. In its new form, the financing was successful, even though Novatek was subject to limited and defined US sanctions. But with the current round of restrictive measures, conditions are more challenging.

Getting more Russian Government involvement in the financing would be an obvious step to take. But Russian funds are stressed because there is a block on funding of the Russian Central Bank, NWF and Ministry of Finance and support may be needed by other industries that are also subject to restrictive measures. In Russia, the rouble continued to tumble against the dollar, plunging 29% to US$1=RR118 on 28 February. The Russian Central Bank doubled interest rates to 20% to curb the sanctions fallout, as it is also banned foreign sales of local securities.

The banning of select Russian banks from SWIFT will make transactions difficult, although it is possible they could be processed through other means such as telex and fax. However, financial payments take place through correspondent banks and so a block on SWIFT along with the sanctioning of transactions through correspondent banks would be more effective. The US is already taking this step because it has already put sanctions in place for US dollar transactions for some Russian entities.

Sanctions impact on Sovcomflot unclear

Russian shipping company Sovcomflot has said it continues to operate as usual despite being subject to US sanctions. However, in an indication of the current difficulties, Scotland sought to block Sovcomflot Aframax oil tanker NS Challenger from loading at Flotta in the Orkney Islands. Sovcomflot is only subject to US sanctions, but the move to turn away the tanker had the support of the UK transport secretary Grant Shapps. He has told UK ports to reject Russian ships. Sovcomflot also operates the prototype Arc7 LNG carrier Christophe de Margerie which is chartered to Yamal Trade. It departed from the Yamal LNG terminal in Sabetta on 26 February indicating the destination as Isle of Grain in Kent on 4 March, but the reported destination changed to Montoir in France on 5 March.

Sanctioned bank VEB is providing funding via sale and leasebacks for the expansion of Sovcomflot’s icebreaking Arc7 LNG carrier fleet. VEB agreed to provide leases to Smart LNG, a 50/50 joint venture between Sovcomflot (SCF Group) and Novatek, in 2020 for 14 Arc7s. The Arc7s will be built in Russia’s Zvezda shipyard. VEB had already agreed in December 2019 to provide funding for the first of the second-generation Arc7s, which would be solely owned by Sovcomflot and chartered to Arctic LNG 2.

In October last year, Sovcomflot partnered with Japan’s NYK to order up to six newbuild LNG carriers from South Korea’s Samsung Heavy Industries. They are conventional LNG carriers and will be chartered to Novatek Gas & Power Asia.

Arctic LNG 2 on schedule as module arrives on NSR

Novatek-led Arctic LNG 2 maintained its construction schedule by bringing a module on an icebreaking carrier from China along the Northern Sea Route. Module carrier Audax arrived in Murmansk 17 February. Arctic LNG 2 is using gravity-based structures to house the modules for the 19.8-mta liquefaction project.

The project’s Train 1 is expected to startup in 2023, Train 2 in 2024 and Train 3 in 2025. Even though Audax is an Arc7 icebreaking module carrier, it could not have done the voyage alone under the current thick ice conditions that are typical at this time of year, so it required nuclear icebreaker support. Progress was slow with the NSR transit taking about 20 days, despite continuous help from the icebreakers amid temperatures of -25°C to -28°C.

However, one of Yamal’s Arc7 ice-breaking LNG carriers, Vladimir Vize, rounded Cape Dezhnev at about the same time as Audax and the icebreakers and proceeded alone along the NSR. It reached the Ob River unaided in 14 days.

Yamal, with one Arc7 currently out of service for more than three weeks, does not have enough shipping capacity to deliver any more cargoes with Arc7s along the NSR at this time and has restarted transhipments off Murmansk to maximise exports from Sabetta. The sixth transhipment of this year was underway this month at Kildin Island in the Barents Sea.

The LNG Shipping & Terminals Webinar Week will be held from 1 March 2022. Register your interest and access more information here

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.