Business Sectors

Contents

Feeder frenzy: owners rush to smarten up ageing fleet

Chinese shipyards are benefitting from a surge in ordering short-sea vessels, with slots evaporating and prices rising

Chinese yards are predictably dominating order books in a rush by container shipping to replace ageing feeder fleets with more advanced designs, ahead of stricter emissions standards.

With Israeli-owned Eastern Pacific Shipping (EPS) in the vanguard, maritime analysts identified 90 orders for newbuilds in H1 2025 alone, with more arriving in August and September. That is the fattest order book in nearly three years, according to Maritime Strategies International (MSI).

And it keeps growing. In August, EPS placed orders with China’s Maewei shipyard for 12 feeders with 1,800 TEU capacity, plus options for another six. In a deal valued at around US$680M, the vessels will be delivered through 2027 and 2028 and are expected to end up in CMA CGM charters, a regular EPS customer. This latest order follows an earlier six-vessel US$180M contract by EPS with Jinling shipyard, also due for delivery through 2027 and 2028.

All up, through August alone Chinese shipyards have taken newbuild bookings for nearly 40 container ships, most of them feeders. And as slots run out, prices are rising for newbuilds and pulling second-hand feeders behind them.

According to VesselsValue’s second-quarter report, the price of a 15-year-old, 2,500-TEU short-sea vessel has shot up by nearly 20% since the beginning of 2025, from US$26.4M to US$31.7M.

And because most of the short-sea tonnage is owned by container giants, the result is “a significant positive impact on fleet values”, notes VesselsValue. At current valuations, the average cost of a feeder under 6,000 TEU is about US$45M.

Meantime, CMA CGM and MSC are reportedly negotiating with Chinese and South Korean shipyards over the renewal of their feeder fleets. On top of the 90 already identified, the two container giants are looking for another 120 newbuilds that will introduce much-needed new technology into increasingly dated short-sea designs. The Baltic and International Maritime Council (BIMCO) estimates that 92% of the world’s container fleet is composed of short-sea vessels that are more than 20 years old.

As fast-growing coastal trade in the Asia-Pacific region boosts the feeder fleet, another sizeable order in the offing comes from Bangladesh Shipping’s venture into coastal trading. The state-owned group is said to be negotiating with HD Hyundai Heavy Industries and Dae Sun Shipbuilding over a six-ship contract valued at US$330M – about US$55M per ship.

“The price of a 15-year-old short-sea vessel has shot up by nearly 20%”

Another busy group, Indonesia’s Meratus, has signed with Guangxi Shipbuilding for more short-sea ships following on from the delivery in 2024 of two 124m-long feeders that are working regional routes.

Singapore’s X-Press Feeders will provide COSCO Shipping with the first option to charter newbuilds for expanded operations across Asia, the Middle East, the Mediterranean, North Europe and Latin America. The world’s largest independent common carrier, X-Press, hit the headlines in mid-2023 when it launched scheduled methanol-fuelled routes in Europe with 1,260-TEU ships.

US-based Crowley’s 1,400-TEU Torogoz began its inaugural service from Port Everglades, Florida to Central America in August, following its delivery from HD Hyundai Mipo. Built to DNV class, the vessel, like the other three feeder ships in the Avance class under construction, has LNG dual-fuel propulsion.

Smarter designs

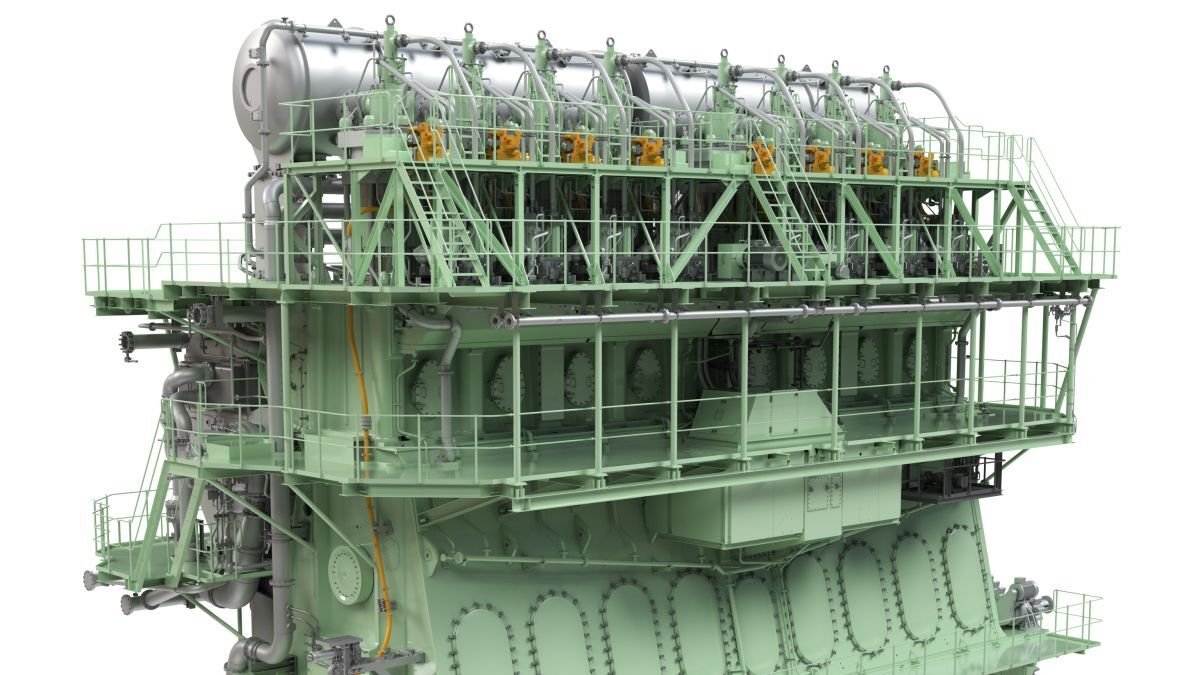

Danish naval architectural firm Knud E Hansen, the inspiration behind the 1,700-1,900-TEU Bangkox Max that plies many Asian routes, has come up with the ECX-2300 TEU design, a forward-looking concept that focuses on energy- and cost-efficiency, compactness and high flexibility in storage and transit speed. In practical terms that means a finer bow, an ultra-long-stroke Everllence G60MEC9.2 engine, a forward-placed deckhouse that allows more containers to be stored on deck, and crew comfort.

Another innovative design, Kongsberg Marine’s Cobalt Blue, features an open-top deck, forward deckhouse and a modular arrangements that allow for future modifications. Designed in partnership with DeltaMarine, the vessel has an eye on the future. As Oskar Levander, Kongsberg Maritime’s head of business concepts explained: “The feeder market will go through fleet renewal in the coming years and owners will be carefully considering their options,” citing the importance of vessels that evolve over time.

Looking further ahead, one of the bolder designs must be Zulu Mass, a zero-emissions, autonomous, wind-assisted 200-TEU vessel that may also use foiling technology. Developed in late 2023 by Belgian-based Zulu Associates with Conoship International, the concept is going through the approval process while IMO works on the fine detail of unmanned operation.

“The current status is that pre-construction plans are ready with approval in principle from Lloyd’s Register,” Zulu chief executive, Antoon van Coillie, said. “Economic analysis shows [this is] a competitive set-up. Discussions with potential clients are on-going.” Zulu Associates is working with the Belgian flag.

The authorities already have a starting point because Zulu Mass is a larger sea-going version of the X-Barge concept, an autonomous 90-TEU low- to zero-emissions dry bulk/container inland barge. So far at least four countries - UK, Belgium, Denmark and the Netherlands - are backing unmanned vessels but there is a way to go.

“Autonomy is still in its infancy but we want to show what is possible and support the process of regulation keeping pace with innovation,” explained Mr van Coillie. “As a result, Zulu Mass is designed from the outset to be unmanned as a part of a maritime autonomy system, which will allow it to compete with fossil-fuelled or hybrid vessels.”

Operators like Oslo-listed MPC Containers are introducing technology into the existing fleet. As Riviera reported in August, MPC is installing an AI-driven platform, Boston-headquartered ShipIn Systems’ Fleet Vision, on its 59 ships. The purpose is to provide more insight into shipboard operations, for instance in early detection of potential hazards. But MPC is also boosting its order book with four 1,300-TEU newbuilds that are designed for a new era with ice-class hulls, energy storage systems, connections to shore power, and the ability to run on green methanol.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

© 2024 Riviera Maritime Media Ltd.