Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

CSL to build electric self-unloader

Canadian owner to build electric dry bulk carrier; US-listed dry bulk carrier company attracts interest from shipping entrepreneur

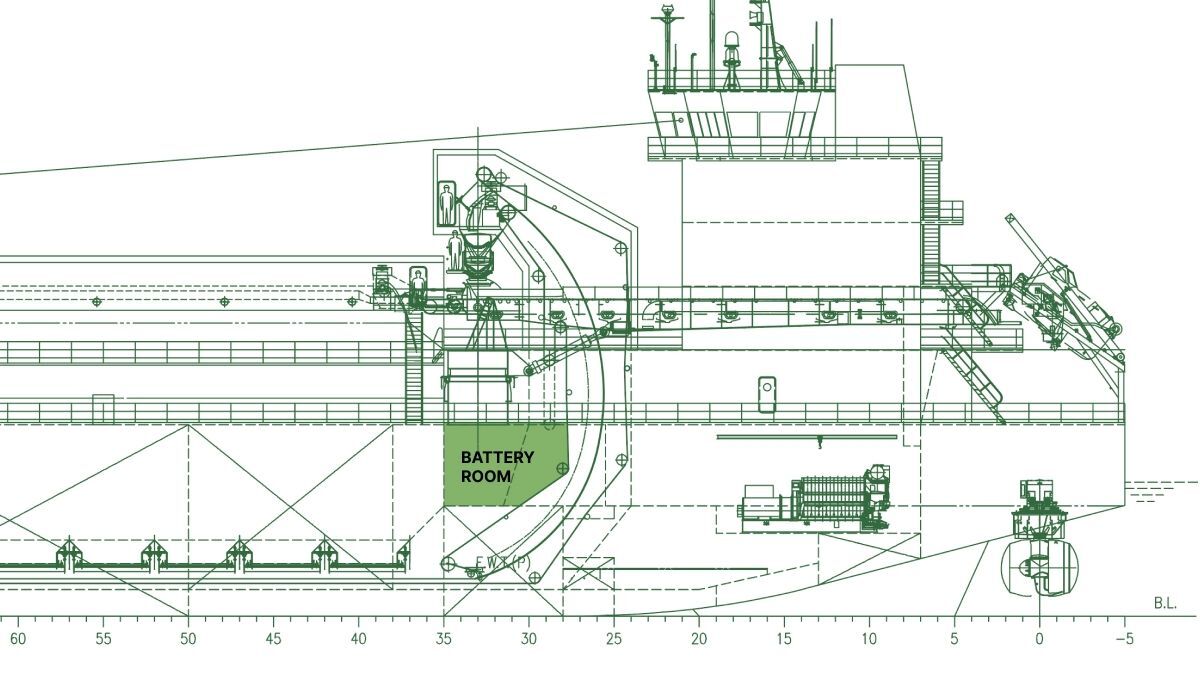

CSL and Adelaide Brighton Cement to build world’s first fully electric self-unloading vessel

The partnership plans to build and operate an 11,000-dwt self-loading, self-discharging bulk carrier, featuring a hybrid diesel-electric propulsion system combined with one of the most advanced battery installations on a bulk carrier globally.

Approximately 50% of the vessel’s energy requirements will be provided by a combination of shore power and battery energy storage, with plans to install sufficient batteries in the future to allow 100% electric operations.

Construction of the new vessel will begin in 2024 and delivery is expected in early 2026.

Genco Shipping & Trading in play

A company associated with Greek shipping entrepreneur George Economou has taken a 5.4% stake in the US-listed dry bulk carrier operator Genco Shipping & Trading Ltd.

In a filing to United States Securities and Exchange Commission, the company reported 5.4% of the company’s shares have been acquired by GK Investor LLC.

In the notes to the filing, it was reported, “GK Investor LLC is a controlled affiliate of Sphinx Investment Corp and Maryport Navigation Corp. Maryport Navigation Corp is controlled by George Economou.”

George Economou-associated entities have been taking stakes in various shipping companies, including Performance Shipping, OceanPal and Seanergy Maritime.

Chinese builders win more foreign dry bulk carrier orders in December 2023

December 2023 saw 27 dry bulk carriers orders placed, with all but two placed in Chinese shipyards.

The outliers were two 209,000-dwt Capesize contracts placed by MOL at Nihon Shipyard in Japan for delivery in 2027. MOL also placed three 210,000-dwt Capesize contracts at Qingdao Beihai in China.

Other foreign owners placing dry bulk carrier contracts in Chinese shipyards include Eastern Mediterranean (Thanasis Martinos interests), which placed four 63,500-dwt Ultramax orders at Nantong Xiangyu for a reported US$33M each, according to VesselsValue data.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.