Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

Banks can step up the fight for biodiversity in the world’s oceans

We have heard a lot about the decarbonisation of the shipping industry and have concentrated our efforts on reducing emissions into the atmosphere, fuel efficiency and other measures

But undersea ecosystems and marine life also deserve our attention. We should look down into the world’s oceans as well as up to our atmosphere.

With the development of global trade, marine biodiversity loss has accelerated in recent decades. Despite some advances, global commerce continues to pose often overlooked threats to delicate marine environments and the creatures that live in them.

In fact, biodiversity loss is in the same league as our warming atmosphere given the necessity of our oceans for our economy (and human life).

In addition, data on biodiversity loss as a result of shipping activity is less reported on than decarbonisation.

As capital providers, banks need to have a conversation on ocean biodiversity. They have the opportunity to channel capital towards clients and projects which not only meet regulations but that also demonstrate the highest standards of environmental stewardship.

Recently, the Poseidon Principles, a 36-member consortium of shipping finance banks who account for about 80% of global shipping finance, met in London. The group also measures and publicly reports the CO2 emissions intensity of its shipping portfolios. One new point of discussion was the threat to the diversity of life in the seas.

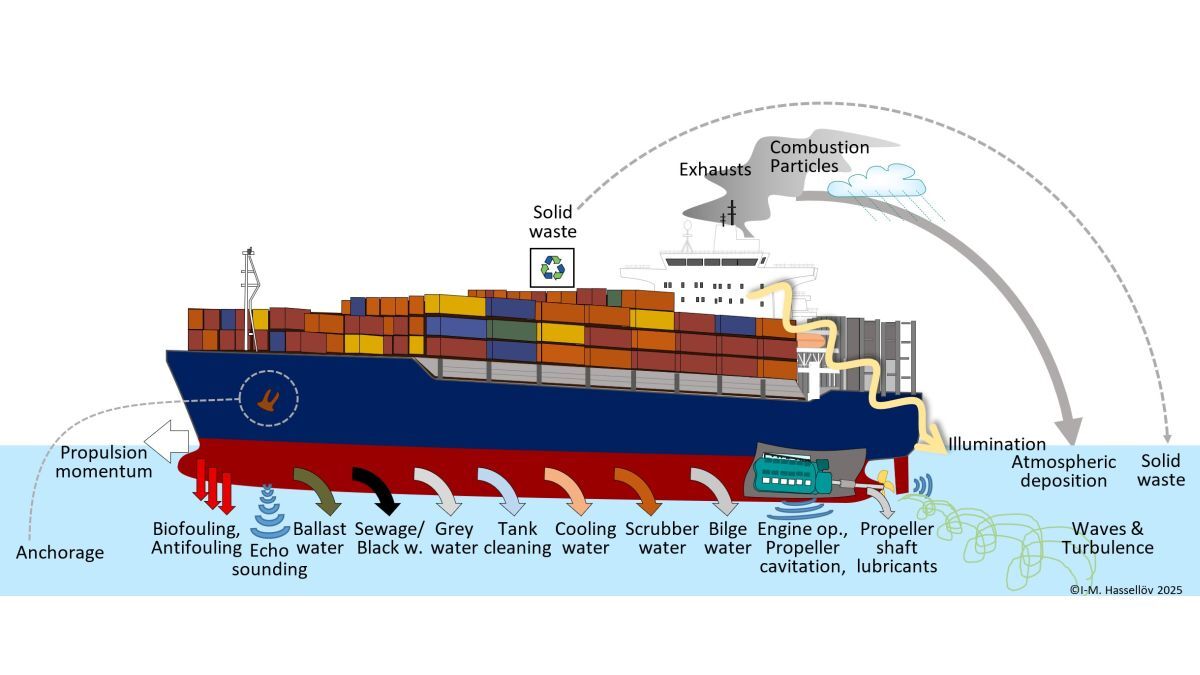

Chemical pollution from scrubber effluent to residue from antifouling paint on ship hulls to collisions with marine wildlife may not seem like significant issues. However, when magnified by rapid increases in commercial maritime shipping, their detrimental effects are keenly felt in marine ecosystems around the world including those far from busy shipping lanes.

Despite updated ballast water systems over the past few years, water and liquid found in ship ballast tanks and bilges can inadvertently transport organisms from their natural ecosystems to others that are hundreds and even thousands of miles away where their existence may pose a threat.

As such, transported ballast water merges diverse ecosystems which are not meant to be mixed. While sewage and other forms of grey wastewater are some of the more obvious pollutants, cooling water and tank cleaning water also pose important risks. New regulations over the past couple of years point to how serious an issue this is, though adherence to rules is unfortunately not universal.

Anyone who has attempted to swim in Turkey’s Bosphorus Strait may have heard some of the underwater cacophony ship engines and propellors create and can understand the noise pollution taking place wherever commercial ships travel. Wakes and underwater turbulence merely compound this problem. Extrapolate that onto the delicacy and fragility of many ocean species, given the number of commercial ships that travel daily through world’s largest ports.

Among financiers and insurers, thought is now being given to better incentives for vessel owners and operators as well as ports and terminals, including how crews at sea and on land are trained.

For example, ports can offer priority berths to ships that adhere to practices helping conserve biodiversity. Shipowners and operators can better train their crews and ensure transparent reporting on pollutants transported or discharged.

Fortunately, shipowners and ports already have measures at their disposal to lessen these impacts, but financiers can play a pivotal role incentivising their adoption.

Banks are now beginning to discuss a list of marine biodiversity performance indicators that can be applied to measure progress among their clients and integrate that into how they arrange funding for the shipping industry. These indicators can be used to measure maritime and shipping clients alongside initiatives many clients have already undertaken.

Alongside decarbonisation, institutions are now considering how to account for risks to biodiversity loss as part of their lending decisions, and how to incorporate the impact of all these factors on biodiversity. They need to understand the most meaningful measurements that can help enhance regulatory adherence.

By using economic incentives as the industry is funded, banks can help to slow marine pollution and biodiversity loss.

Paul Taylor is vice chairman of the Poseidon Principles Association and Global Head of Maritime Industries at Societe Generale

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.