Business Sectors

Events

Contents

‘Carrot-and-stick’ government policies drive OSV innovation

Attractive terms in contracts, carbon taxes drive investment in electrification, dual-fuel technologies in offshore vessels

‘Carrot-and stick’ government policies are playing key roles in driving innovation in offshore support vessels, increasing the use of electrification and new fuels to lower fuel consumption, while reducing greenhouse gas (GHG) emissions.

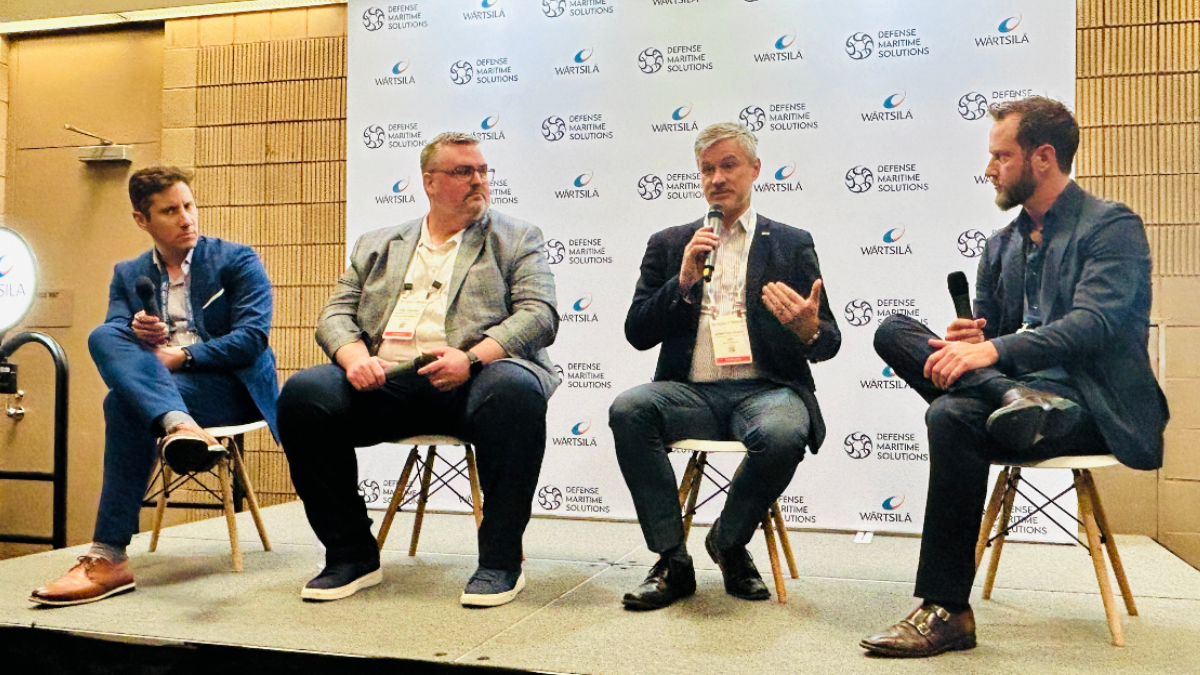

This was among the key takeaways shared by a panel of marine technology experts during an open discussion at the International Workboat Show in New Orleans in December. The panel examined the regulatory and commercial drivers behind the uptake of hybrid-battery technology, alternative fuels and dual-fuel technologies.

Organised by marine technology developer, Wärtsilä, the roundtable included the company’s general manager, decarbonisation, Lucas Correa, marine newbuild sales general manager, Joel Thigpen, and head of offshore SGA, Jon Inge Buli. Joining the trio was DNV segment director, special ships, Arnstein Eknes.

“CSOVs, which operate in a similar way as offshore vessels, are hybrid and a lot are methanol ready. And why? Because they operate in a market where there is a cost to carbon,” observed Mr Buli. “Most offshore vessels are now preparing to do that so they can reduce the carbon tax cost when they come under EU ETS and Fuel Maritime EU. That kind of push drives innovation,” he concluded.

Over the last two decades, increased electrification in the OSV sector has led to significantly lower fuel consumption and reduced CO2 and GHG emissions during dynamic positioning operations, noted Mr Eknes. A slide shared by Mr Eknes showed the evolution of OSV design and dramatic benefits of battery use during DP operations. In 2000, a mechanically driven vessel burned 18 tonnes of fuel per day. By comparison, a battery-hybrid vessel in similar operations in 2024, equipped with more electrical equipment, variable speed flexibility and ready for methanol, consumed less than 3 tonnes of fuel per day.

“It’s coming because of a new way of operating, requiring new competences on board, new technology and more dualistic thinking,” explained Mr Eknes, noting the incorporation of dual-fuel propulsion, batteries and AC/DC grid technology. Admittedly, he said, “It’s more complex for crew,” adding the need for training. But this is balanced by real commercial and environmental benefits: reduced emissions and fuel costs, less running machinery and lower maintenance costs for the owner.

While carbon taxes serve as the ’stick,’ governments are also offering ’carrots’ to drive innovation in OSVs. As it looks to attract new vessel tonnage to meet its offshore oil and gas drilling needs, Brazilian state-owned oil major Petrobras is viewing contracts in a different light, said Mr Correa. “It is looking at ways not to penalise, but to incentivise owners to cut down emissions,” he said. Petrobras is offering long-term charters with attractive terms for newbuilds with battery technology and possible upgrades to use lower carbon fuels like methanol or ethanol.

While there are five LNG dual-fuel platform supply vessels operated by Harvey Gulf International Marine in the US Gulf, all equipped with Wärtsilä engine technology, Mr Thigpen characterised the US offshore oil and gas market as “mixed” under the current administration. “There are customers still asking, ‘How do we decarbonise our fleet? How do we run more efficiently?’ But there is not a push from a government perspective.”

Riviera’s Annual Offshore Support Journal Conference, Awards & Exhibition 2026 will be held in London on 3-4 February 2026. Use this link for more information and to register for the event.

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.