Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

China, India and the 'shadow fleet': how Trump’s proposed secondary tariffs could impact shipping

Shipping analysts are sceptical about whether US President Donald Trump will follow through on his recent threat to impose secondary tariffs on Russia – measures that could reshape global trading patterns and force a rerouteing of the so-called shadow fleet

During a meeting with NATO secretary general Mark Rutte on 14 July, President Trump stated the US would impose 100% tariffs on countries that continue doing business with Moscow if a peace deal in Ukraine is not reached within 50 days. He expressed strong dissatisfaction, saying the US is "very unhappy and disappointed with Russia."

However, industry experts doubt the feasibility of the proposal. “I’m sceptical this policy will ever be implemented, considering Trump’s historical approach to Russia,” said Banchero Costa head of research Ralph Leszczynski, speaking to Riviera. He added any effective policy targeting Russian oil exports would likely drive up oil prices – something the current US administration is actively trying to avoid.

Should the US move forward with secondary tariffs, analysts believe the cost of Russia’s primary export commodities would increase. Intermodal head of research Yiannis Parganas, pointed to oil, natural gas, coal and iron ore as likely targets.

Focus on China and India

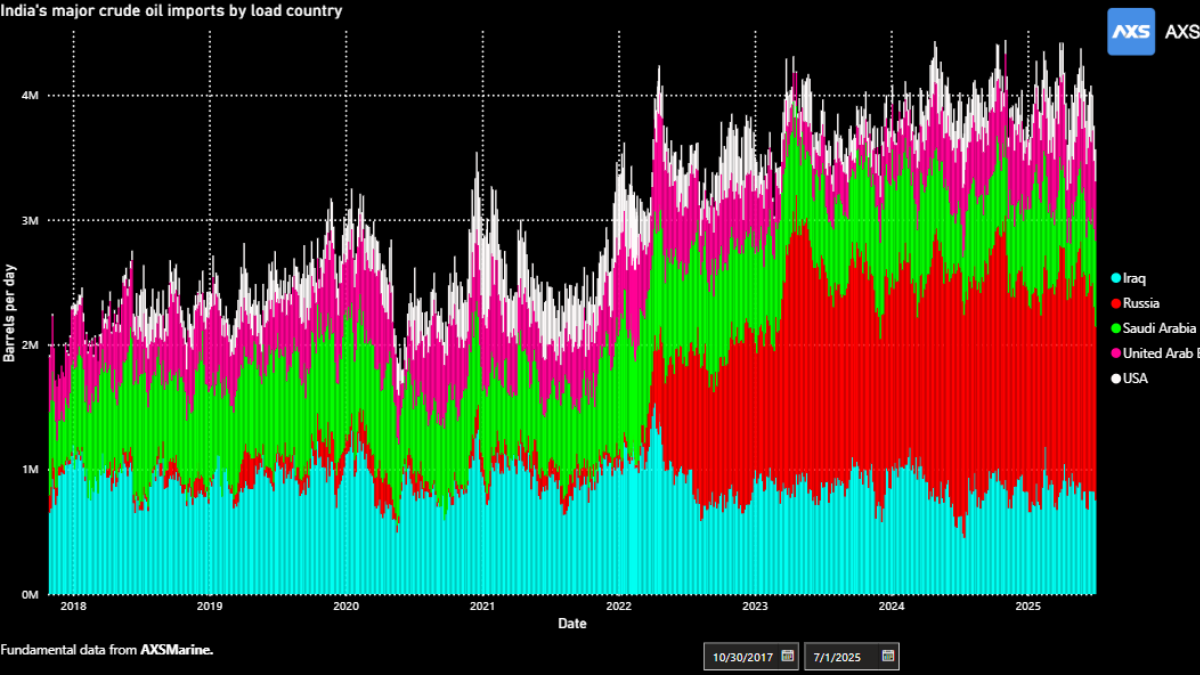

Turning to oil and the tanker market – one of the most affected sectors since the beginning of the war – Mr Leszczynski explained such tariffs would primarily affect three major importers: India, China and Turkey. “Over 50% of Russian oil exports currently go to India, around 30% to China, and the remainder to Turkey, North Africa and southeast Asia,” he said.

“This means India and China would have to find alternative sources for the lost Russian cargoes, which could significantly impact tonne-mile demand,” added Mr Parganas.

However, he cautioned this shift may not benefit the tanker market. “Lower Russian prices have fostered new trade patterns that lengthened sailing distances and increased tonne miles.” Disrupting that could reduce demand.

AXSMarine shipping analyst Nikolas Zannikos expects China and India to continue purchasing Russian oil despite the potential implementation of secondary tariffs, as there appears to be no compelling incentive for them to switch suppliers.

However, Mr Zannikos noted India might reduce its intake of Russian crude due to the deteriorating security situation in the Bab El-Mandeb Strait, which is currently disrupting transits. This could prompt a redirection of cargoes either toward the Arabian Gulf or the Atlantic Basin. He explained the former scenario would be negative for tonne miles, while the latter could be marginally positive. Overall, he expects the net impact on the tanker market to be neutral.

Interestingly, China may already be adjusting its oil sourcing. According to Banchero Costa data, Chinese imports of Russian oil are down by one-third year-on-year in 2025. Meanwhile, its imports from Brazil, Canada and West Africa are increasing.

The expanding role of the shadow fleet

Optima Shipping Services head of market analysis and decarbonisation strategies Angelica Kemene told Riviera secondary tariffs could substantially disrupt Russian crude exports. She expects reduced volumes on conventional tankers and greater freight rate volatility due to rerouteing and compliance challenges.

However, Ms Kemene underscored the growing influence of Moscow’s shadow fleet – a fleet of more than 600 older and opaque vessels, carrying a significant share of Russian crude outside the mainstream system.

“As restrictions tighten, I expect this fleet to play an even larger role – especially benefiting segments like Suezmaxes and Aframaxes, which are commonly used for Russian trades,” she said. “This could support demand and spot rates for these tankers, even as regulatory and insurance risks grow.”

As for the product tanker market, Ms Kemene sees a more nuanced impact. “We could witness shifting trade flows and opportunistic movements if Russian refined products are affected by new tariffs or seek alternative markets,” she concluded.

Complex geopolitics

In any case, implementing secondary tariffs would be highly complex, given the current geopolitical landscape. Using India as an example, Mr Leszczynski questioned the logic behind imposing tariffs, “Sanctioning – indirectly – India would likely serve little purpose other than creating political friction.”

He noted US imports from India are minimal and warned such tariffs could derail potential plans by companies such as Apple to relocate manufacturing from China to India – undermining Washington’s broader strategic goal of reducing dependence on Chinese production.

Regarding China, Mr Leszczynski pointed out the potential economic backlash, “When China is targeted with tariffs, it responds. High tariffs on Chinese exports harm American consumers and the broader US economy – something the US government is fully aware of.”

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.