Business Sectors

Events

Ship Recycling Webinar Week

Contents

Covid-19: shipping disruptor is an accelerator of change

Few events have the power of a pandemic to disrupt the world almost overnight. Just as the Black Death brought about the end of feudalism in Europe in the 14th century, Covid-19 will accelerate sea change from which there will be no turning back, writes TSW managing director Michael Herson

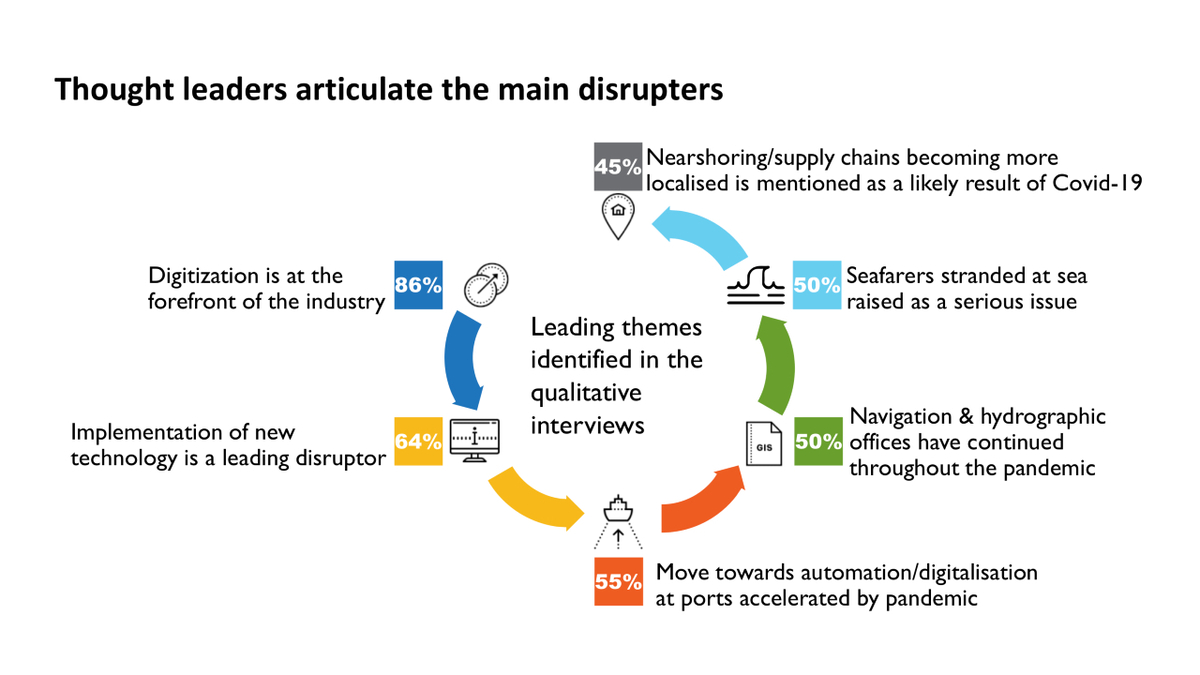

What has been the impact of Covid-19 on shipping? London-based strategy consultancy The Strategy Works (TSW) has carried out an intensive desk research and interview programme, studying the impact of Covid-19 on shipping and core maritime offshore activities. This required carrying out 22 depth qualitative interviews within ports and harbours, maritime solutions providers, trade bodies representing shipping companies, class societies and IMO. The research revealed a combination of generic themes and those that impact individual sectors, both positively and negatively.

Ports demonstrate resilience

Ports have shown resilience throughout the pandemic, with very little disruption reported globally, according to TSW’s research. Investment in port infrastructure continues as planned, as part of an integrated digital platform for shipping. Covid-19 has presented an opportunity for ‘smart’ ports to test their existing digital /automated systems.

“Ports have done enormously important work during Covid-19 to make sure the flow of goods and cargos could continue,” said BIMCO chief shipping analyst Peter Sand.

UK Major Ports chief executive Tim Morris agreed. “Ports have actually responded really well to this pandemic; they have stayed open and continued to process freight to an almost normal degree,” said Mr Morris.

“This has been a stress test for the resilience of ports,” observed European Sea Ports Organisation (ESPO) secretary general Isabelle Ryckbast. “Many were afraid that their own operations would be badly impacted by the virus but that hasn’t been the case. They have all remained operational and have developed extra resilience,” said Ms Ryckbast.

European Community Shipowners’ Associations (ECSA) secretary general Martin Dorsman said there have been no major disruptions in ports. “If you look at port operations, terminals, there’s no issue,” said Mr Dorsman.

“Ports are pretty resilient in that they have facilities with fixed costs that are usually funded by long-term investments,” said British Ports chief executive Richard Ballantyne. “They still need to dredge the channels so that ships can get through, even if there are a lot less of them.”

Besides maintenance, investments are continuing in port infrastructure, pointed out Italian Hydrographic Office director Luigi Sinapi. “Italy is very attentive to investment in major Italian ports,” said Mr Sinapi, citing Genoa and Trieste as examples.

Cruise shipping feels the pain

By far the most affected sector impacted by the pandemic has been the cruise Industry, which was all set for a record year in 2020 but has been brought to its knees by Covid-19. Trade associations are working actively with government on a recovery plan.

Cruise Europe chairman Captain Michael McCarthy called the pandemic “absolutely catastrophic to the whole industry,” while Bureau Veritas marine marketing and sales director Gijsbert De Jong, added: “The cruise industry is going through a difficult time and they are very uncertain on the timing and the recovery of their business.”

“The cruise sector will probably be one of the last maritime sectors to really recover from the Covid pandemic, though much work at governmental level continues to support the recovery of the cruise industry,” said UK Harbour Masters Association executive officer Martin Willis.

“The cruise industry has been paused for months,” said UK Chamber of Shipping Bob Sanguinetti. “At the Chamber we have been working with government to get cruises back sailing as soon as possible and have developed a new set of frameworks which gives government, passengers, crew and operators confidence, based on the very latest science and medical advice.”

Passenger ferry disruption

As is the case in the cruise industry, passenger ferry services have been severely disrupted by the pandemic. Many ferry operators have reduced both passenger capacity and the numbers of sailings, in response to reduced tourism and economic activity. Many ships have reduced onboard services, such as catering, further impacting revenues.

“It was hard for the ferry industry because passengers immediately dropped to zero,” said Mr Dorsman, “so the liquidity issue was right on the table for both the cruise and the ferry industry.”

Offshore renewables remain resilient

Offshore energy has been a tale of two markets. Covid-19 energy demand destruction, combined with a low-price oil environment resulting from the OPEC+ fallout, has created strong headwinds for the offshore oil and gas sector, which was just showing signs of recovery.

On the other hand, a juggernaut prior to the pandemic, offshore wind has proved resilient and buoyant, with governments globally introducing green stimulus packages, including investment in hydrogen from renewables, opening niche markets for powering vessels.

Investment sentiment has quickly reflected this shift in the market. “Spending on renewable power will outstrip oil and gas drilling for the first-time next year,” Goldman Sachs told the Financial Times in August. “Borrowing rates have risen to as much as 20% for fossil fuel ventures, compared with as little as 3 % for renewables”

Offshore oil rigs, some barely 10-years old and worth billions of dollars, are being scrapped, compounding the decommissioning problem that already exists for ageing rigs.

“Offshore service firms may need to scrap up to 200 of the about 800 existing floating rigs to regain profitable lease rates,” Bassoe Offshore head of analysis for rig brokerage told Reuters.

“We expect about 12 to 18 months of pretty hard conditions for oil and gas,” said Mr Sand.

Proving further insight, Seajacks UK operations manager John Vingoe said: “Once they shut up shop it tends to take them a long while to get going again….the oil and gas industry is a bit of a ‘wounded animal’.”

Green economic stimulus packages focused on low carbon energy and infrastructure will have a fundamental effect on reducing emissions during the recovery. In parallel, a managed decline of fossil fuels will be central to green recovery plans.

Lloyd’s Register global head of sustainability Katharine Palmer said: “Economic fallout from the Covid-19 pandemic might actually help drive decarbonisation as governments consider stimulus packages and investments to rebuild economic growth and focus on re-setting the carbon trajectory.”

Added Mr Sanguinetti: “Renewables and decarbonisation are very much on most development countries’ agendas; linking Covid recovery to sustainable credentials.”

“There will definitely be a stimulus in renewable energy and for the ships too,” said Mr De Jong. “We need to support the installation and maintenance of those windfarms.”

Energy majors are also shifting their investments. BP has said it will produce 40% less oil and gas, generating 20 times more renewable energy. It also plans to invest 10 times more in low-carbon technology.

Shipbuilding suffers

With BIMCO reporting that container traffic for retail goods is down by about 10% so far in 2020; the pandemic is now impacting on forward orders in the shipbuilding sector.

The orderbooks for dry bulk and container ships have fallen sharply. At 63.4M dwt, the dry bulk orderbook is at its lowest level since April 2004 and 34.7% smaller than 12 months ago. According to BIMCO’s data, containership orders have fallen nearly 40% so far in 2020. That places the total volume for the containership orderbook at its lowest level since September 2003.

Covid-19 accelerates digital shift

It is widely agreed that Covid-19 has and will continue to drive technology change, especially towards digital applications. Digitisation is perceived as playing a key role in getting through the challenges of the pandemic. Enforced adoption of new technologies and digital applications is perceived as a positive disruptor across all shipping segments.

The wider use of remote surveys has accelerated a trend that was already underway and there is every reason to believe that sales of digital products and services will actually benefit from Covid-19.

Advances in digitisation are also a call to action to accelerate port digitalisation. As an industry, maritime, shipping and ports must implement electronic communications and data exchange between ships and ports to minimise face-to-face interaction on ships and in harbours for document exchange.

Marine and coastal survey data provider OceanWise reported there has been no reduction in demand for its data “We certainly haven’t had any cancellations and in fact we’ve had a couple of customers very recently say that they want to crack on with it,” commented Oceanwise managing director Mike Osborne.

Navtor agreed increased digitisation is positive for ports. “We have talked to a few ports, like Singapore; all these big companies have a plan to integrate digitally with ports to create a more efficient supply chain,” added Navtor chief commercial officer Borge Hetland. “I’m sure that will be an area of growth.”

Only 49 of the 174 member states of IMO have introduced functioning port community systems, with the rest still relying on personal interaction and paper-based transactions for shipboard, ship-port interface and port-hinterland-based exchanges. Electronic data exchange will lower the risk of port workers contracting Covid-19.

Ocean supply chain stakeholders are abandoning manual processes and embracing automated transport management solutions to drive business growth. When trade is transparent, deals close faster, ships sail at capacity, and the entire supply chain benefits. This will be driven by new blockchain technologies, leveraging ‘smart contracts’, which will improve data sharing, freight broking and shipment tracking.

Voyage optimisation has become further advanced by AI and machine learning. Shipping is adopting just-in-time (JIT) arrival and sea traffic management (STM) in regions where it has been thoroughly tested. STM is gaining traction in the Mediterranean, Suez Canal/Red Sea, Middle East Gulf, Chinese coastal region and Australia, with pilot trials starting.

Voyager Worldwide chief executive Kent Lee sees this as part of an inexorable trend towards automation: “Data delivery and collection will be done automatically without the need for crew intervention,” said Mr Lee. “Whatever can be automated should be automated to reduce the administrative burden, improve data quality and accuracy, improve decision making, shorten response times and enable increasingly more efficient data sharing between maritime stakeholders.”

International Taskforce Port Call Optimisation chairman Ben van Scherpenzeel agreed that Covid-19 is a wake-up call. “There will be a bigger need, if anything, to digitise anything that needs human handling today, so clearance from customs and immigration,” he said.

Supply chain shift

China accounts for 30% of global manufacturing and, in the short term, there are unlikely to be significant changes, but Covid-19 has been a wake-up call and made companies nervous about long supply lines – ‘just in time’ is likely to switch to ‘just in case’ over a two- to five-year scenario.

“Everyone in the supply chain will now look at self-sustaining options from their local domain before going out into the outside supply chain,” said ONEOCEAN vice president for maritime strategy Malcolm Soares.

“We expect to see more near-shoring, but not much on-shoring,” said Port of LA cargo marketing manager Marcel Van Dijk, adding “Mexico could be a big beneficiary of this move.”

“There’s been a huge wakeup call that there was too much dependence on long and insecure supply chains,” said Mr McCarthy.

Added Mr Dorsman: “Manufacturers will have bigger stocks so that they can cope for longer.”

This will require changes port side. “Storage facilities are now needed to store large quantities of goods,” said Imperial College visiting professor in ports and maritime logistics Khalid Bichou. “We have started seeing the importance of nearshoring ports, a little bit away from the sea, but they belong to a port area; custom zones to provide storage facilities.”

Wärtsilä Voyage director solutions Vladimir Ponomarev, added: “We need to look where the world’s production hubs will shift; how alternative supply chains will develop, i.e. China to Europe railway transportation, pipeline construction – all this can seriously affect the size and profitability of marine.”

“Due to the US/China trade war some of the main shippers have de-risked supply chains by investing in other Asian countries,” said Mr Sand. “Cambodia and Vietnam have seen most changes.”

Adoption of new technology and the recalibration of supply chains are connected and often occur in the aftermath of the stress of major dislocations or downturns.

Strategic alliances will play an important part in shaping new supply chains, as digital ship concept technologies bring together an alliance of stakeholders within marine, to collaborate under a single platform.

“More vertically integrated companies will emerge to control the entire supply chain, including maritime operations, the use of ships and terminals,” said Mr Ponomarev. "The triangle ’shipowner, ship operator and fleet management company’ will cease to exist. Instead, vertically integrated companies will enter the market. Vertical integration will aim primarily at optimising the supply chain and reducing costs,” he added.

Professor Bichou added: “For tighter supply chains, we are likely to need more shipping rather than less shipping. Simply in logistics terms, if you have smaller warehouses you have more shipping and more smaller trucks. This same concept applies to shipping, if we have countries closer to us, which probably offer more flexibility, you have a portfolio of supply chains. So instead of manufacturing all of our goods in one country, we can manufacture them in two or three countries, even at a higher total cost. I think this is very relevant.”

Changing behaviours

Like any major disruptor in history, Covid-19 has caused hardship for many but also created new opportunities in its wake. The difficulties encountered in crew repatriation and rotation, due to travel restrictions imposed at airports and ports, created a human capital problem at the start of lockdown that is taking months to resolve. The cruise industry has suffered economic devastation on a scale that no-one could have envisaged at the start of 2020.

But despite these well-publicised disruptors, looked at through a long lens, shipping has changed its behaviours at a remarkable pace, demonstrating resilience and an appetite to go further and faster in the adoption of new technology to build on these gains. Shipping, often unfairly branded as 10 years behind the airline industry, stands to benefit from geo-political forces such as the directional change to offshore renewables and is now a leading part of the recovery.

Managing director of The Strategy Works, Mr Herson can be reached at mherson@thestrategyworks.com. He will be among the presenters at Riviera Maritime Media’s MAP Europe Virtual Conference, 20-22 October 2020. Produced in conjunction with Marine Propulsion, MAP Europe will provide insight and answers to the challenges faced in IMO 2020 implementation and compliance with future regulations on greenhouse gas emissions and air pollution reduction.

Related to this Story

Events

Ship Recycling Webinar Week

International Bulk Shipping Conference 2025

Tankers 2030 Conference

Maritime Navigation Innovation Webinar Week

© 2024 Riviera Maritime Media Ltd.