Business Sectors

Contents

Register to read more articles.

LPG newbuild ordering hits record high, but will the momentum last in 2025?

LPG shipping has hit headwinds, including an oversupplied market and muted trade growth, but new ordering in 2024 has maintained its momentum, writes Drewry Maritime Research senior lead analyst, Aman Sud

Despite the concerns of oversupply from 2027, the expected increase in clean ammonia trade will keep new ordering high. This momentum in new ordering will continue in 2025 as replacement orders continue from shipowners looking for dual-fuel ships amid increasingly stringent regulation. Some owners may wait for ammonia engines to be commercially proven before opting for replacement tonnage.

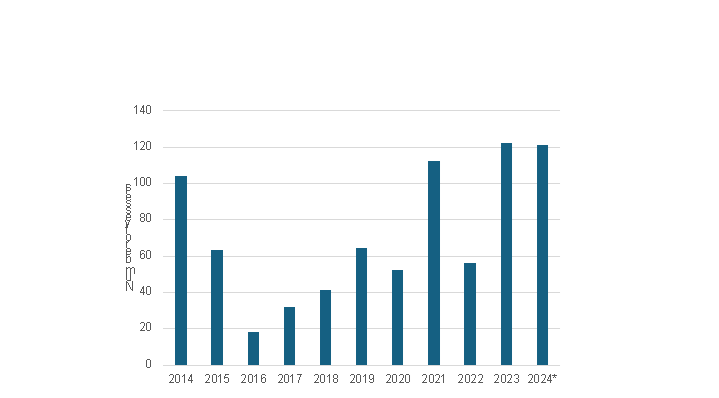

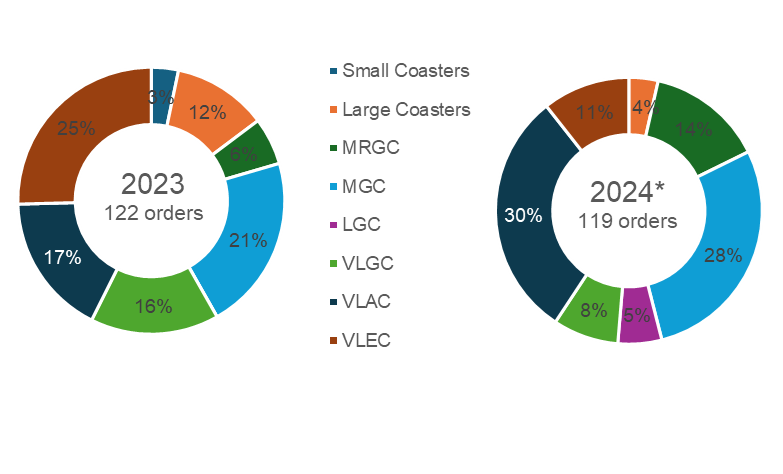

Newbuilding activity has been expanding, with 126 orders placed as of the end of September 2024 compared to 122 vessels ordered in 2023. The surge is primarily driven by the interest in very large ammonia carriers (VLACs) and very large ethane carriers (VLECs), while other segments also report record orders. Drewry has analysed the key factors supporting this uptick in orders.

Ammonia frenzy

Interest in ammonia transportation as an emerging green fuel is boosting investments in the sector. Although ammonia is already transported through liquefied petroleum gas (LPG) carriers, the volume is low, limiting the trade to the smaller large gas carriers in the 50,000-70,000 m3 size range and medium gas carriers (MGCs) of 30,000-50,000 m3.

“MGCs are rapidly adopting dual-fuel propulsion”

While 200+ projects for clean ammonia are in the planning stages, s developments have been slow. Meanwhile, the uptake of clean ammonia in the existing import markets will require subsidies and incentives. Therefore, Drewry expects the clean ammonia trade to reach 8-10 million tonnes per annum (mta) by 2029. Despite the early impediments, the future looks bright for this trade, fuelling orders, especially for the larger vessels – VLACs. As of Q3 2024, 38 VLACs were ordered compared to only nine VLGC orders in 2024. There are now 55 VLACs on the orderbook, while the VLGC tally is 40.

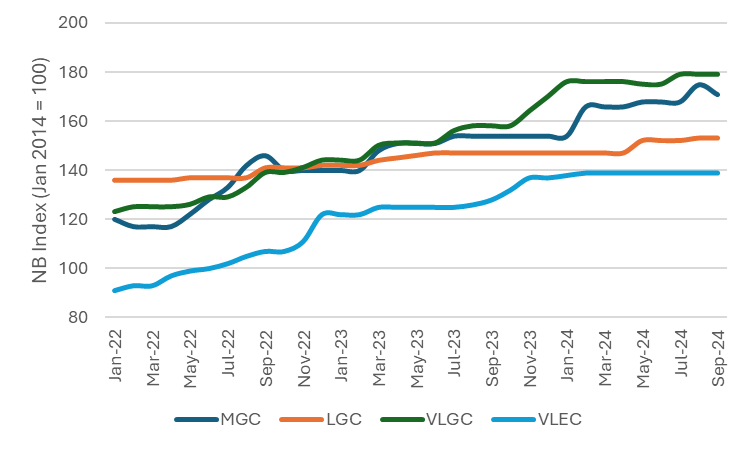

The newbuild price for a VLAC is around US$120-125M, which is quite high, deterring shipowners. However, owners are opting for costly ammonia carriers over VLGCs to reach the decarbonisation goal.

Interest in MGC gains traction

MGC orders have skyrocketed this year and now stand at a record high of 34 orders; just like VLACs, the momentum from 2023 has rolled into 2024. MGCs offer versatility to shipowners as they can be used for LPG, ammonia and olefins/ethane (specialised carriers). The segment has an orderbook with 63 vessels, accounting for 45% of the current fleet.

“There are now 55 VLACs on the orderbook”

MGCs are rapidly adopting dual-fuel propulsion, with 83% of the orderbook comprising dual-fuel engines. LPG as an alternative marine fuel remains the favourite option, but interest in ammonia is also picking up, with 13 vessels on the orderbook.

As clean ammonia volumes will be low until the end of the decade, MGCs are touted as the first vessels to be used. Meanwhile, a higher return on investment (ROI) and versatility than VLGCs is stoking orders for MGCs.

The rare LGC orders

After nearly a decade, the first LGC order was recorded in 2024, with Eastern Pacific Shipping (EPS) ordering four LGC carriers. The LGC segment is used in niche areas and for long-haul ammonia transportation. With only 21 vessels in service, the segment is waning. The EPS order is expected to be a replacement tonnage as the company has three 15-year-old LGCs already in service. Moreover, Vietnam’s Asia Pacific Shipping followed up with a two-vessel order, taking the tally to six vessels.

Although Drewry does not expect a surge in LGC orders, a few may materialise with potential for clean ammonia trade and interest from smaller shipowners who might opt for the much higher priced VLGC/VLAC.

Initiation of ULECs

While 31 VLECs were ordered in 2023, just 12 newbuilds were ordered as of Q3 2024. Meanwhile, ethane cracker operators like China’s Satellite Chemicals have upgraded the vessel sizes by ordering six ultra-large ethane carriers (ULECs), followed by another two through Eastern Pacific Shipping in October, all on long-term charters. The orderbook-to-operations ratio for ethane carriers stands at a whopping 220%, with 60 vessels on order against 27 in service.

The rise in demand for ethane as a cheaper feedstock for petchem plants has supported new orders. Higher ethane production, associated with record-high natural gas processing in the US, has increased the economic benefits of using the commodity for cracking. Ethane cracker plants have emerged in many countries and are operational in India, China and Europe, with more crackers in the pipeline. Furthermore, weaker petchem margins with volatile LPG and naphtha prices also compel operators to convert their existing crackers to ethane.

Related to this Story

Events

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

Marine Coatings Webinar Week

© 2024 Riviera Maritime Media Ltd.