Business Sectors

Events

Marine Coatings Webinar Week

Contents

Oil developers pounce on ultra-deepwater blocks in US Gulf lease sale

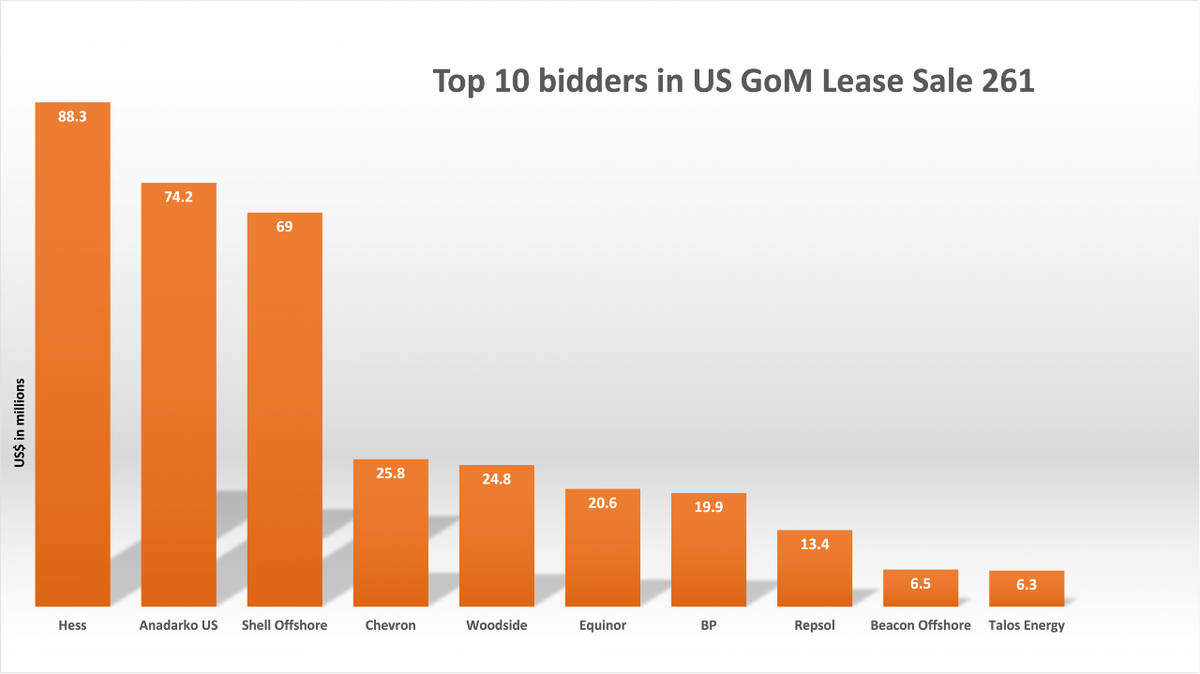

With seven of the top 10 high bids, Anadarko and Hess dominated the Gulf of Mexico Oil and Gas Lease Sale 261, which overall amassed US$382.2M in high bids—the majority of which were for ultra-deepwater and deepwater tracts

There was clearly a wellspring of interest among oil independents and majors revealed by the oft-delayed sale, which generated US$131.6M more—a jump of 52%—over the last federal lease sale held in March 2023. Oil developers offered high bids totaling US$250.6M some nine months ago during Gulf of Mexico Oil and Gas Lease Sale 259.

Results from Lease Sale 261 were far more robust, with $382.2M in high bids for 311 tracts covering 1.7M acres in federal waters of the Gulf of Mexico (GoM). A total of 26 companies participated in the lease sale, submitting 352 bids totaling $441.9M.

Andarko had the highest bid, US$25.5M, for a block in 1,600 M+ of water in the Mississippi Canyon. It also had the fourth highest and winning bid, US$17.2M, for a block in 1,600 m+ water in the Green Canyon. Overall, Andarko had 49 high bids totaling US$74.2M in the sale.

20 high bids from Hess topped US$88.3M, with winning offers for blocks in the Green Canyon, all in water depths of 400 m to <800 m. Hess, due to be acquired by Chevron in a US$60Bn transaction set to close in H1 2024, had five of the top 10 high bids in the sale.

Shell active bidder

With 65 high bids totaling US$69M, Shell was the third biggest spender in the sale. It had two of the top10 bids, with blocks in Garden Banks and Keathley Canyon. Shell is already the biggest player in US GoM deepwater. In December, Shell Offshore, a subsidiary of the Dutch-Anglo oil major, took FID on Sparta, its 15th deepwater oil and gas in GoM. Owned by Shell Offshore (51%) and Equinor Gulf of Mexico LLC (49%), Sparta is in the Garden Banks area. It will use a semi-submersible production platform, with a projected peak production of approximately 90,000 barrels of oil equivalent per day (boe/d). Currently, Shell estimates a recoverable resource volume of 244M boe. Production will begin in 2028.

Meanwhile, Equinor was active in the lease sale, with 13 high bids, including one of almost US12M secured for a tract in 800 to<1,600 m of water in Green Canyon.

Both 259 and 261 lease sales were required by the Inflation Reduction Act (IRA), with the most recent tied up in environmental litigation and slow walked by the Biden Administration. The administration and the US Bureau of Ocean Energy Management (BOEM) only moved forward with the sale after being compelled by a ruling from the US Court of Appeals for the Fifth Circuit issued on 14 November.

Pursuant to a ruling from the appeals court, BOEM included lease blocks that were previously excluded due to potential impacts to the Rice’s whale population from oil and gas activities in the GoM.

Three lease sales in five years

Noting the importance of continuing oil and gas lease sales, National Ocean Industry Association (NOIA) president Erik Milito said: “The US offshore oil and gas industry is stepping up and making the investments vital to enhance our energy, economic, and national security for decades to come”. But Mr Milito said more lease sales were needed to continue growing US energy, while providing more market certainty for investment. He said Congressional action was needed to amend the Biden Administration’s 2024-2029 National OCS Program, which proposes just three GoM oil and gas lease sales, one in 2025, 2027 and 2029, in the five-year period. This is the smallest offshore oil and gas lease sales program ever proposed.

"Without Congressional intervention, this is the final lease sale until at least 2025” said Mr Milito. “In our forward-thinking industry, securing new lease blocks is vital for exploring and developing resources crucial to the US economy”.

Since entering office, the administration has thrown up multiple roadblocks to US offshore oil and gas development, said Mr Milito. “Over the past three years, the Administration has followed its stated agenda of restricting offshore energy development with tangible actions that include leasing pauses, sale cancellations, permit delays for geophysical research, and arbitrary restrictions related to the Rice’s whale” he said.

NOIA also pointed out that the lack of offshore oil and gas lease sales would hinder the administration’s plans to advance offshore wind, too.

“To issue offshore wind leases while adhering to the Inflation Reduction Act, the DOI must offer at least 60M acres annually for offshore oil and gas leasing. “With only three potential sales spread across five years, the Interior will be unable to comply with the IRA and legally conduct offshore wind lease sales annually through 2029—a critical factor for supporting the growth of offshore renewables along America’s coastlines”.

Related to this Story

Events

Marine Coatings Webinar Week

Maritime Environmental Protection Webinar Week

Ship Recycling Webinar Week

© 2024 Riviera Maritime Media Ltd.