Business Sectors

Events

Marine Coatings Webinar Week

Contents

Register to read more articles.

Rigs report: low-emissions rigs may generate more revenue

Some oil and gas developers are willing to pay additional fees to offshore drillers for low-emissions rigs

Maersk Drilling reported it could secure an additional payment from a recently awarded Dutch North Sea drilling contract if the rig’s selective catalytic converter (SCR) system is used. Maersk reported a contract with ONE-Dyas BV for jack-up rig Maersk Resolute to drill the IJssel and Clover exploration wells in the Dutch sector of the North Sea. The contract is expected to commence in December 2021, with a firm duration of 84 days.

The contract value is about US$6.9M, excluding an agreed fee for the potential use of the rig’s SCR system. The contract includes two additional one-well options.

Maersk Resolute is equipped with a high-efficiency SCR system that uses ammonia injection to convert NOx into harmless water and oxygen, thereby reducing NOx emissions by up to 98%.

“As part of the global transition to net zero, the E&P sector has an important role and significant contributions to make,” said ONE-Dyas chief operating officer Peter Nieuwenhuijze. “At ONE-Dyas, we have great ambitions in terms of reducing emissions and our impact on the environment. We look to work with like-minded partners and are therefore pleased to have awarded the contract for the upcoming drilling campaign to Maersk Drilling, which is also committed to reducing its environmental footprint and working in a more sustainable manner,” added Mr Nieuwenhuijze.

Currently operating in Dutch waters for Dana Petroleum Netherlands, Maersk Resolute is a 2008-built, Gusto-engineered MSC CJ50 high-efficiency jack-up rig.

“Maersk Resolute and its capable crew is the perfect choice for this campaign with the rig’s recent experience from Dutch waters and its increased capability for providing environmental protection during operations, which is a high priority in the Netherlands,” said Maersk Drilling chief executive Morten Kelstrup.

Last week, OSJ reported on the proposed mega-merger between Maersk Drilling and Noble Corp. The all-stock transaction is expected to close in mid-2022.

Elevated offshore drilling levels

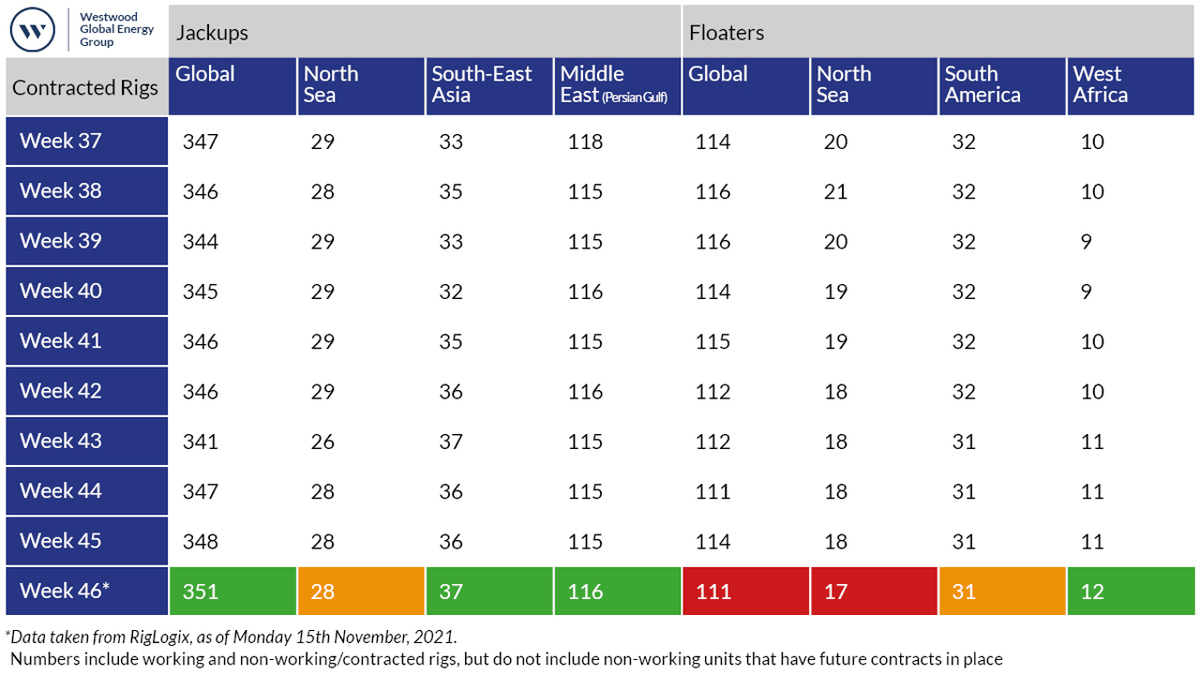

Meanwhile, global offshore jack-up rig activity hit its highest levels of 2021 during week 46, jumping three units to 351, according to Westwood Global Energy’s RigLogix. Main drivers of jack-up contracting were southeast Asia and the Middle East, which both rose one unit. And while deepwater activity moved lower, West Africa continues to heat up, with 12 floaters under contract, its highest level of the year.

Huge lease sale in Gulf of Mexico

Meanwhile in the US, the Bureau of Ocean Energy Management is gearing up for one its largest oil and gas lease sales in its history – covering 80.9M acres. Lease Sale 257, scheduled to be livestreamed from New Orleans this morning (17 November), will be the eighth offshore sale under the 2017-2022 Outer Continental Shelf Oil and Gas Leasing Program. Lease Sale 257 will include approximately 15,135 unleased blocks located from 4 to 371 km offshore in the Gulf of Mexico with water depths ranging from 3 m to 3,400 m.

The area is estimated to hold potentially as much as 1.12Bn barrels of oil and 4.2Tn cubic feet of gas available for extraction.

In its Daily Logix Offshore Rig Review, Westwood Global Energy reported Eni had signed a contract to take Seadrill UDW semi Sevan Louisiana for one well in the US Gulf of Mexico. The 150-day campaign is expected to be in Green Canyon Block 297.

“Drilling will begin in direct continuation of the rig’s current contract with Walter O&G. However, completion of that work is not clear at present. The rig was originally signed for one well with Walter O&G and the operator exercised two, one-well options in late August. However, the rig suffered thruster damage in Hurricane Ida which delayed its return to location in Mississippi Canyon Block 617 for about two weeks,” said Westwood Global Energy.

The new work for Eni is not expected to begin until February 2022 or later.

Related to this Story

Events

Marine Coatings Webinar Week

Maritime Environmental Protection Webinar Week

Ship Recycling Webinar Week

© 2024 Riviera Maritime Media Ltd.