Business Sectors

Events

Marine Coatings Webinar Week

Contents

Register to read more articles.

Rigs report: Maersk and Noble in mega-merger

In a move that would create a world-class driller, Maersk Drilling and Noble Corp have entered into a merger deal to combine in a primarily all-stock transaction

Following the completion of the transaction, the shareholders of each offshore driller will own approximately 50% of the outstanding shares of the combined company.

The combined company, called Noble Corp, will be headquartered in Houston and listed on the NYSE and Nasdaq Copenhagen. Upon the closing of the transaction, Robert W Eifler, Noble’s president and chief executive, will become president and chief executive of the combined company and a member of the seven-person board of directors. Maersk and Noble will each designate three board members. Charles M (Chuck) Sledge will become chairman of the board of directors jointly appointed by Noble and Maersk Drilling. Claus V Hemmingsen will be one of the three directors designated by Maersk Drilling.

The new Noble Corp will have a fleet of 20 floaters and 19 offshore jack-ups, with no newbuild capex debt. In the last 12 months ended September 2021, Noble and Maersk Drilling had combined pro-forma revenue of about US$2.1Bn, a cash balance of US$900M resulting in net debt of approximately US$600M. The combined revenue backlog of the two drillers is US$2.4Bn.

Expected to close in mid-2022, the merger would need shareholder and regulatory approvals.

Signs of recovery

The merger agreement comes as the prospects for offshore drilling continue to brighten. Commenting on the merger deal, Maersk Drilling’s Mr Hemmingsen said the combination “carries strong industry logic.” He noted the combination “will offer investors a unique opportunity to benefit from the market recovery.”

In reporting its performance for Q3 2021, Maersk Drilling noted utilisation was trending higher in the offshore rig market due to a combination of increased demand and further rationalisation on the supply side.

In its market outlook, Maersk Drilling said, “In both the North Sea jack-up and global floater markets, total utilisation has surpassed peaks previously reached in 2019. The North Sea jack-up market has had an increase in activity with average demand growing to 28 units (26 units), while the average marketed supply remained unchanged at 36 units, driving an increase in average marketed utilisation to 78% (72%). At the end of Q3 2021, the one-year forward contract coverage for North Sea jack-ups decreased to 40% (44%) reflecting that a decreasing share of the available jack-up rig capacity in the North Sea is contracted for the coming 12 months.”

Prospects in 2022 and 2023 in Norway are mixed for jack-ups, the driller noted, with limited tender opportunities next year.

“From 2023 onwards, demand is expected to normalise given the significant pipeline of economically viable subsea development projects in shallow waters.”

Improving deepwater prospects

Deepwater activity showed an incremental rise with “average demand increasing to 113 floaters (111 units), while the average marketed supply increased to 164 units (163), driving a slight increase in the average marketed utilisation to 69% (68%),” said Maersk. “At the end of Q3 2021, the one-year forward contract coverage for the global floater market improved to 42% (39%) and, given current requirements, demand for global floaters is expected to increase into 2022. With an average marketed oversupply of 51 rigs at the end of Q3 2021, the global floater market continues to be characterised by excess capacity, restraining the pace of recovery.

As of Q3 2021, certain markets, such as the US Gulf of Mexico, and asset classes, such as seventh-generation floaters, have seen market dynamics improve faster than the global floater market as a whole.”

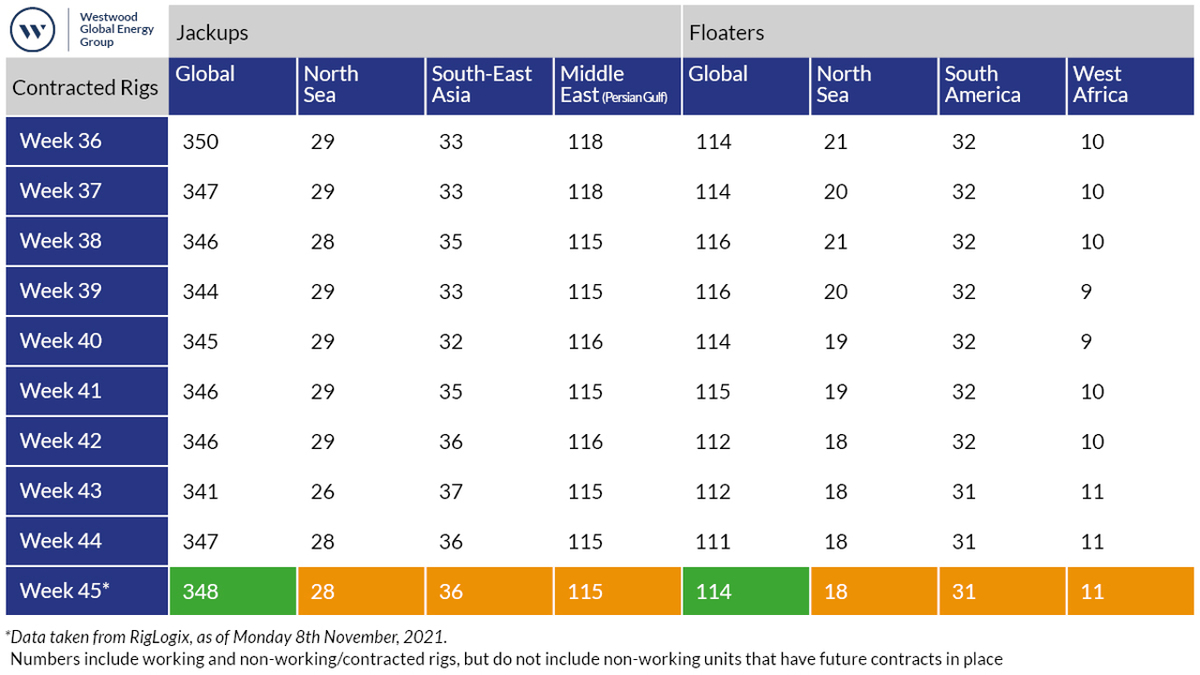

For week 45 2021, Westwood Global Energy’s RigLogix reported 348 offshore jack-up rigs were contracted, up one unit week-on-week. Meanwhile, deepwater activity pushed floater contracting to 114 units, an increase of three week-on-week.

Riviera Maritime Media will be hosting Offshore Support Journal conferences in Asia, the Middle East and Europe during 2021 - use this link to our events site for more details and to register for these conferences

Related to this Story

Events

Marine Coatings Webinar Week

Maritime Environmental Protection Webinar Week

Ship Recycling Webinar Week

© 2024 Riviera Maritime Media Ltd.