Business Sectors

Events

Offshore Wind Webinar Week

Contents

Register to read more articles.

Rigs Report: Noble-Maersk merger set for CMA approval, Equinor divests from Ekofisk field

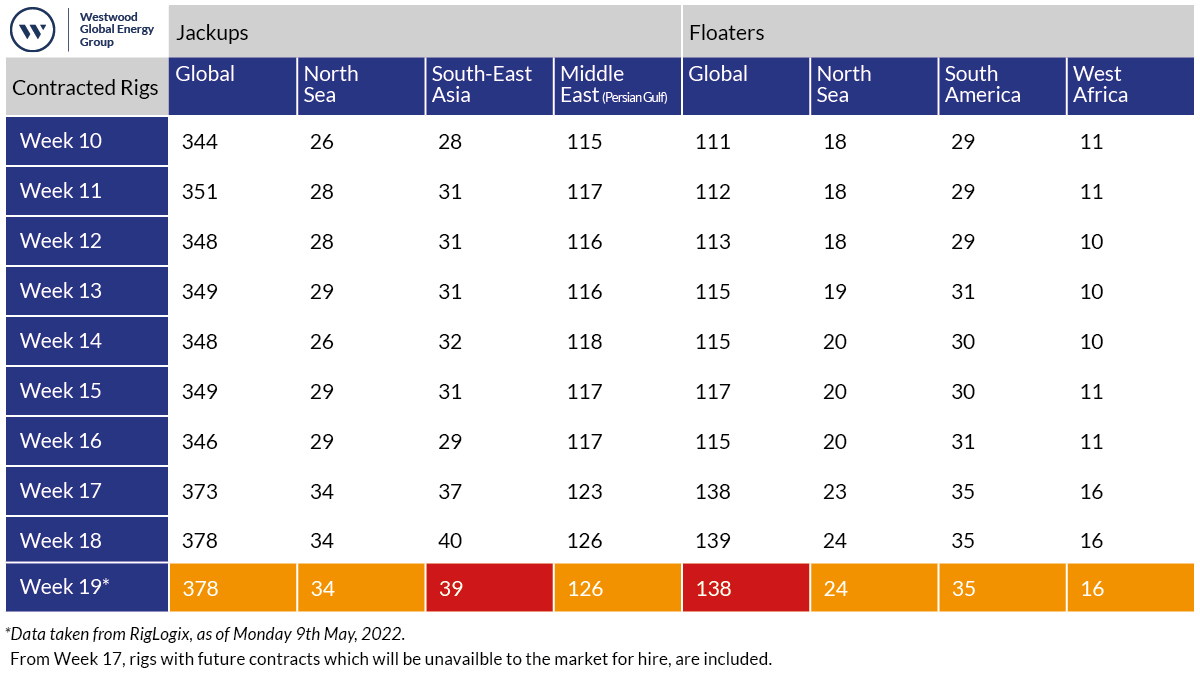

Data from Westwood Global Energy shows the number of active global jack-ups remains steady week-on-week with 378 active or contracted rigs. Data published by Clarksons in April noted rig markets continue to tighten in 2022, with day rates rising for jack-ups and floaters alike and overall utilisation at its highest level in seven years

In week 19, 2022, the progress made on the potential merger between Maersk Drilling and Noble Corp made headlines. As OSJ noted last month, this could require the divestment of several North Sea rigs to satisfy UK regulators.

The companies have offered to sell jack-up rigs Noble Hans Deul, Noble Sam Hartley, Noble Sam Turner, Noble Houston Colbert, and either Maersk Innovator or Noble Lloyd Noble.

On 9 May, the UK’s Competition and Markets Authority (CMA) said there are reasonable grounds to believe these concessions might be accepted by the CMA. A final decision is expected by 6 July 2022.

Seperately, Maersk Drilling secured an extension for semi-submersible rig Mærsk Developer after Australian firm Karoon Energy exercised options to add the drilling of up to two wells at the Neon field offshore Brazil to the rig’s work scope. The contract extension has a duration of 80 days, in direct continuation of Mærsk Developer’s previous work scope and a firm contract value of approximately US$21M.

In the North Sea, Equinor sold its stake in the non-operated share in the Greater Ekofisk Area and a minority share in Martin Linge (19%) to Sval Energi. The agreement includes a cash consideration of US$1Bn and a contingent payment structure linked to realised oil and gas prices for both assets for 2022 and 2023.

Capital from the sale of the Greater Ekofisk Area will be redirected to other core areas of its business. The agreement includes 8% of Ekofisk area licences PL018, PL018B and PL275, including the Ekofisk, Eldfisk and Embla fields, and 7% in the Tor Unit.

Equinor will no longer have any ownership interests in the Greater Ekofisk Area but will retain a 51% ownership share in Martin Linge and continue as the operator of that field.

Included in the deal is the sale of Equinor’s interest in Norpipe Oil (19%), part of the infrastructure transporting oil from the Greater Ekofisk Area to land.

This week, Equinor also extended drilling services and specialist service contracts worth US$1.5Bn and US$637M across several Equinor-operated fields on the Norwegian continental shelf.

UAE-based Lamprell will perform major upgrade work on three jack-ups owned by an international rig operator (as yet unnamed) in readiness for the rigs’ deployment in the Gulf. Work will begin as soon as the first of these rigs arrives at Lamprell’s Hamriyah quayside this month. The second and third rigs will follow later. The combined scope of the contract was not revealed but is stated to be a ‘small’ contract, which Lamprell classes as below US$50M.

Lamprell chief executive Christopher McDonald said, “Over the last 12 months, we have seen increasing demand in this business segment evidenced through the awards of drilling contracts by regional operators. The entire team looks forward to delivering the upgrades safely and on time for our client.”

Singapore’s Keppel Offshore & Marine signed agreements worth S$135M (US$97M) for the utilisation of two KFELS B Class rigs to be deployed in Saudi Arabia with charterer ADES. The bareboat contracts include modification work to prepare for deployment and the charter term begins in Q4 2022 for a five-year period.

In week 18 2022, Keppel also won contracts totalling nearly US$180M to integrate two floating production storage and offloading vessels for Single Buoy Moorings and BW Offshore.

Finally, Diamond Offshore announced its first quarterly financial results since relisting on the New York Stock Exchange. The company was delisted two years ago after filing for voluntary Chapter 11 bankruptcy proceedings.

The deepwater drilling company reported a net loss of US$34M for Q1 2022. Contract drilling revenue for the first quarter totalled US$150M compared with US$184M in Q4 2021. The decline in revenue was primarily attributed to jack-up Ocean Apex being off contract in Q1 2022. The rig resumed work under a new contract this month in the Kanga-1 well offshore Western Australia.

Ocean Patriot and Ocean Endeavor rigs were both out of action undergoing repairs, including a special survey for Ocean Patriot. Both rigs are now back on contract and working in the North Sea.

Diamond Offshore added US$29M of backlog during the first quarter to bring its total contracted backlog to US$1.2Bn as of 1 April 2022, representing 15.6 years of work for its rigs, combined.

The Offshore Support Journal Conference will be held 15 June 2022. Details and tickets can be found here

Related to this Story

Events

Offshore Wind Webinar Week

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

© 2024 Riviera Maritime Media Ltd.