Business Sectors

Contents

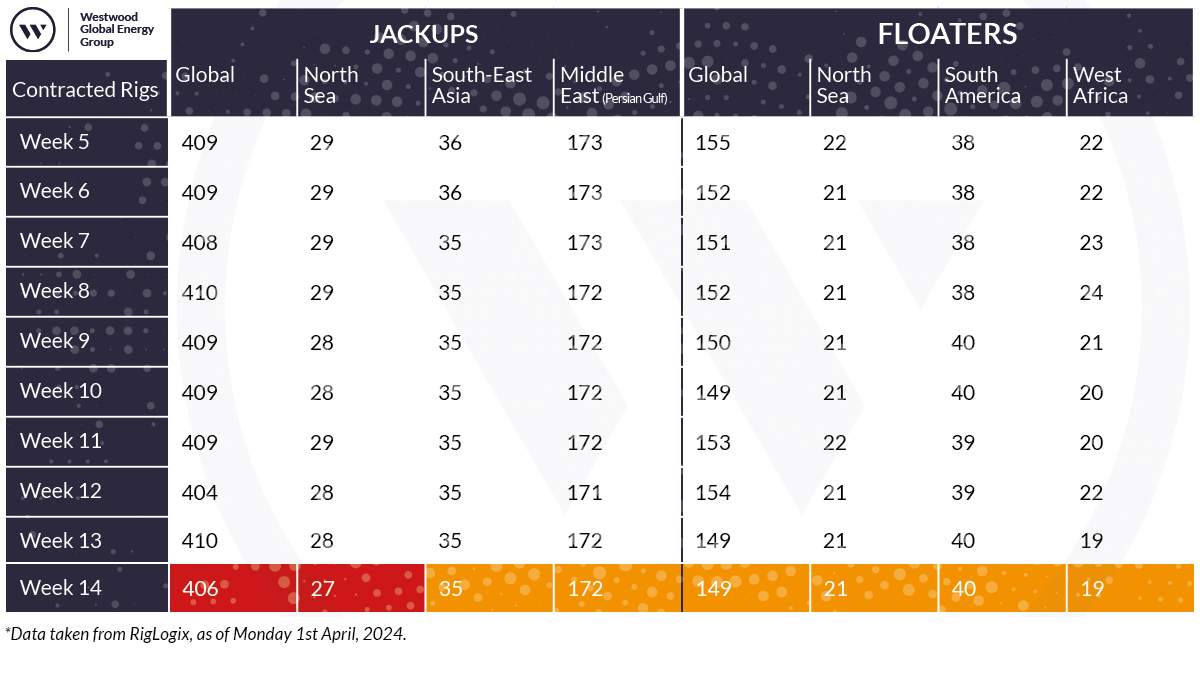

Rigs report: tracking regional rig movements since 2020; Saudi Arabia operators face contract suspensions

Westwood Global Energy Group’s RigLogix data platform director Teresa Wilkie tracks geographical placement trends across drilling rig markets

Jack-up regional changes 2020-2024

Between 2020 and 2023, the Middle East was one of only two regions in the world to witness an increase in jack-up supply. During the period, the area saw 48 rigs moved in from other areas of the world to help fulfil national oil companies’ thirsts to ramp up reserves and production.

Saudi Aramco has been the biggest driving force behind this, increasing its jack-up provisions by 30 units in just three years. The operator’s mass contracting of these rigs has led to global utilisation skyrocketing as well as average leading-edge day rates, which recorded a 40% increase between 2020 and 2024.

Asia is the only other area to have recorded an increase in supply, but only from 2023 to the end of 2024, where supply will grow by at least 12 rigs coming in from Africa and the North Sea. During the same period, similarly to the semisub market, North Sea jack-up supply witnessed a mass exodus, reducing by nine rigs in the period due to more favourable opportunities in other areas such as Mexico, West Africa, Australia and the Middle East.

Semi-submersible regional changes 2020-2024

The starkest regional trend witnessed in the semi-submersible market since 2020 has been the exodus of units from the sluggish North Sea (and wider northwest European) market to other areas offering up longer-duration campaigns and higher day rates.

Between 2020 and the end of this year, there will have been a 23% reduction in the marketed supply of these units in the North Sea. The main areas attracting these harsh-environment rigs are Africa, Australia and Asia. Meanwhile, over the same period, there was also a 22% decrease in supply in Asia but a 100% and 150% increase in Australia and Africa, respectively.

Drillship regional changes 2020-2024

The biggest change in regional distribution of drillships over the past five years has been the growth in South American supply, majorly driven by Brazilian national oil company Petrobras. The operator has increased its fleet by 13 rigs, or 62%, in this short period, soaking up capacity from areas such as North America, Africa and Asia to cover the operator’s ambitious drilling plans.

The Asian market saw the exit of three rigs between 2020 and 2021, reaching a trough of just eight units but is anticipated to grow to up to 14 rigs by the end of this year, following rigs entering from Africa as well as newbuilds due for delivery from the Far East.

Contracts

Transocean has landed a year-long contract extension for Deepwater Asgard with an unnamed independent operator in the US Gulf of Mexico. The programme is expected to commence in June 2024 in direct continuation of the rig’s current programme and includes additional services. The total contract value of approximately US$195M includes an US$11M lump sum payment, which is not included in the estimated backlog of approximately US$184M.

In the Middle East, Shelf Drilling reported a notice of suspension of operations for four jack-up rigs from a customer. The company said it remains unclear which rigs will be suspended and the timing of the suspensions. Shelf said it expects to be able to actively market the four rigs to other customers and to have opportunities to terminate the rigs’ contracts.

Shelf Drilling chief executive David Mullen said, “We are disappointed with the decision to suspend four of our rigs, particularly in light of the outstanding operating performance of our rigs and teams over many years in the Middle East. This recent development will create near-term challenges, but we remain optimistic on the long-term outlook for the business. We have a leading position in multiple regions and see opportunities across our geographic footprint for our fleet of rigs.”

Another operator in the Middle East Gulf, Advanced Energy Services (ADES), received a suspension notice from an unnamed client in Saudi Arabia for temporary suspension of operations on five of the 33 offshore jack-up rigs the company has operating offshore. Similarly to Shelf Drilling, ADES’s mutually-agreed suspension of work offers flexible terms, allowing the rigs to tender for new work and complete that work before returning to Saudi Arabia to complete the work begun there. ADES also has the right to terminate the suspended contracts if it so chooses.

In southeast Asia, ADES has received a letter of intent from PTTEP Energy Development Co for a jack-up drilling rig contract in the Gulf of Thailand. The contract is set to begin in the second half of 2024, but the jack-up rig has not been named. The 18-month contract has an additional nine-month optional extension period. The total contract value for the firm and optional terms is around SAR 354M (US$94M), including mobilisation fees.

Dolphin Drilling has reached agreement with General Hydrocarbons Ltd (GHL) in a dispute concerning overdue payments and remaining work offshore Nigeria for semi-submersible rig Blackford Dolphin.

The company said the agreement is intended to enable Dolphin Drilling to receive payment of all sums due under the contract, and to enable GHL to continue to utilise Blackford Dolphin for an agreed period. Following the agreement, the company has received a further payment and Blackford will continue operations for GHL. The next payment in the plan is due by late April 2024. Upon conclusion of the agreement, Blackford Dolphin will depart Nigeria for India.

“It was important for us to find a win-win solution with GHL on the current contract, payment and work scope, and to create a predictable exit for the rig Blackford Dolphin from Nigeria while also ensuring on-time delivery of the unit for our next client in India”, Dolphin Drilling chief executive Bjørnar Iversen said.

Stena Drilling says it is planning a "significant equipment upgrade" for its seventh-generation drillship, Stena Evolution.

"With this enhancement, Stena Evolution will be capable of drilling and completing wells requiring 20,000 psi (20K) pressure control, enabling drilling in previously inaccessible reservoirs for our clients. Stena Evolution is already equipped to handle a wide range of drilling operations, including exploration, development and production activities in offshore oil and gas fields worldwide. Upgrading the vessel for 20K operations will enable Stena Drilling to remain in the forefront of technological advancement in the drilling industry," the company said.

Stena Drilling, together with equipment supplier NOV, and Shell, will start the installation of the 20K subsea blow-out preventer and other key equipment in 2026. When the 20K equipment package is installed, the rig will be able to perform completion operations in the Sparta field on behalf of Shell in the US Gulf of Mexico.

Riviera Maritime Media’s Offshore Support Journal Conference, Americas will be held in Houston, Texas, 11-12 June 2024, click here for more information.

Related to this Story

Events

International Bulk Shipping Conference 2025

Tankers 2030 Conference

Maritime Navigation Innovation Webinar Week

© 2024 Riviera Maritime Media Ltd.