Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

Rigs report: UK to lift fracking ban, announces 100 new licences

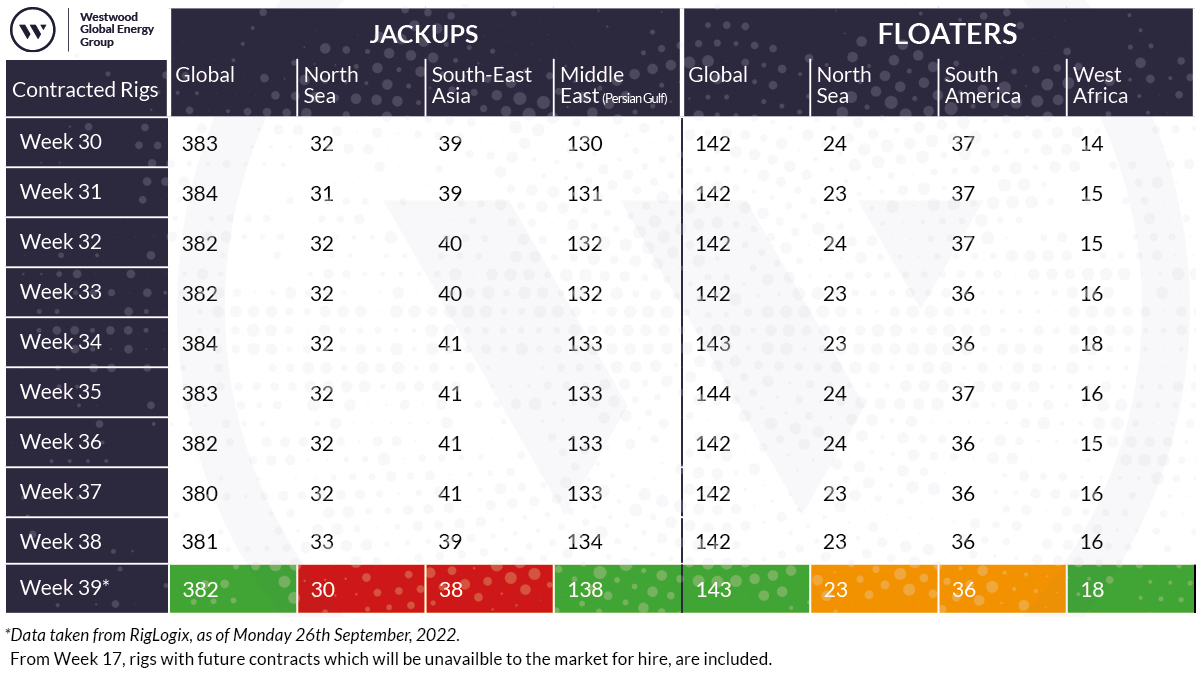

In week 39, the number of active rigs continues to hold across both jack-ups and floaters. While North Sea jack-ups declined by three units, the Middle East Gulf added four more rigs. Floaters remained relatively unchanged, according to the latest data from Westwood Global Energy Group

Picking up on last week’s positive news for further oil and gas exploration, the UK Government has announced it is lifting its moratorium on shale gas and will consider future applications for hydraulic fracturing consent. The North Sea Transition Authority (NSTA) is expected to sanction a licensing round in early October to help secure Britain’s energy security. More than 100 new oil and gas licences will be available to bidders for new blocks of the UK Continental Shelf.

Rig operators continue to see contracts coming in and Maersk Drilling marked a busy week as oil major TotalEnergies exercised an option to add a one-well extension to Maersk Valiant’s current programme. Maersk Drilling’s drillship is currently operating for Total in Suriname, and will drill an additional well in Block 58 offshore Suriname. The extension is valued at US$24.7M and is expected to commence January 2023 in direct continuation of the rig’s current work scope, with an estimated duration of 100 days.

INEOS and partners, Danoil and Nordsøfonden, agreed a final investment decision on developing the Solsort field in the Danish North Sea following regulatory approval from the Danish Energy Agency. Hydrocarbons from the two-well Solsort development will be produced via the INEOS-operated Syd Arne platform with first production expected Q4 next year.

The harsh-environment jack-up rig Maersk Resolve will spud both wells in the Solsort field and perform well intervention work scopes on two wells within the Siri cluster which is also in the Danish North Sea. The contract is expected to commence H1 2023, with an estimated duration of 322 days. The firm contract is valued at US$34M and includes options to add drilling or plugging and abandonment work scopes at up to nine additional wells.

And in Asia Pacific, Maersk tied up an extension with Sarawak Shell Berhad and Sabah Shell Petroleum (SSB/SSPC) for the for seventh-generation drillship Maersk Viking. SSP/SSPC executed the remaining three one-well options with the drillship.

A five-well work scope will be novated to Thailand’s PTTEP for drilling and plugging and abandonment activities at the Kikeh field offshore Sabah, with an estimated duration of 116 days and expected commencement of the first well November 2022, in direct continuation of the drillship’s previous work scope.

Upon completion of work for PTTEP, Maersk Viking will undergo a scheduled special periodic survey, and commence operations for SSB/SSPC in Q4 2023, with an estimated duration of 281 days.

SSP/SSPC has also awarded an eight-well drilling contract to Maersk Drilling. In all, Maersk Drilling estimates the total firm contract value of the extension and additional contract at US$153M, including demobilisation and mobilisation fees, and fees for using managed pressure drilling on certain wells.

Transocean reported its semi-submersible Transocean Norge received a contract award from Wintershall Dea Norge and OMV Norge granting exclusive rights to drill all of the wells for their respective drilling campaigns starting in 2023 through 2027, subject to rig availability and other conditions.

Transocean Norge will drill 11 wells for Wintershall Dea and six wells for OMV, keeping the rig employed for 1,071 days at an average day rate of US$408,000, which adds some US$437M in backlog. A portion of this work is subject to operator and government approvals. The current firm term is 208 days, which contributes approximately US$72M in backlog. Backlog estimates exclude any revenue associated with additional products and services or options that may be exercised as part of the contract.

Drilling contractor Archer has inked a five-year deal with UK-based Platform Drilling for drilling and maintenance services on seven installations in UK waters. Valued at US$50M, the firm contract period commences 1 November 2022 in direct continuation of the current contract and contains options for an additional four years. The scope includes platform drilling operations and maintenance services, intervention support activities, well services, facilities engineering support and equipment rental.

In the UK, Neptune Energy awarded a US$30M decommissioning contract to Well-Safe Solutions. The Well-Safe Protector jack-up will carry out the plug and abandonment (P&A) of at least four subsea and 17 platform wells across eight Dutch and UK North Sea fields. The work will begin in direct continuation of its current contract with Ithaca for six P&A wells. Neptune expects Well-Safe Protector to mobilise in Q1 2023. The contract has eight three-month options, which if exercised, will keep the rig employed for a further two years.

Finally, shallow-water specialist Shelf Drilling has completed a secured notes offering to help pay for the five jack-ups it agreed to purchase from Noble Corp. Shelf said it had closed its previously announced offering of US$250M aggregate principal amount of 10.25% senior secured notes due 2025 and will use the proceeds to fund the purchase of Noble Hans Deul, Noble Sam Hartley, Noble Sam Turner, Noble Houston Colbert and Noble Lloyd Noble.

As OSJ reported, Noble Corp agreed to divest these rigs to obtain regulatory approval for its merger with Maersk Drilling.

The Offshore Support Journal Conference, Asia will be held 19 October 2022. Register your interest and access more information here

The Offshore Support Journal Conference, Middle East will be held 6 December 2022. Register your interest and access more information here

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.