Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Shipbuilding orders 'running ahead of all years since 2007'

Shipbroker Clarksons’ research arm reports a newbuilding swell that is mounting towards historic delivery numbers in coming years

Clarksons Research’s latest figures on newbuilding in the global shipbuilding market show orders, spending and deliveries all trending at historically high levels.

The first 10 months of 2024 have seen more than 1,900 vessels contracted, according to Clarksons, tallying 136.1M dwt in total cargo-carrying weight and 54.2M CGT, which measures shipyard output.

"Amid strong cross-sector newbuild demand, the pace of ordering in 2024 in CGT terms is running ahead of any year since 2007, the peak of the last ordering cycle. Newbuild appetite is being supported by generally robust shipping markets, a focus on ’green’ fleet renewal from some owners and competition for slots amid lengthening lead times," Clarkons Research said.

The containership newbuild market is trending ’just below record levels’, according to Clarksons, with 286 vessels ordered for a total of 3.3M TEU that puts the market pace at 13% below the 2021 annual record for total box ship ordering.

Clarksons linked the record-setting ordering pace in some sectors to fleet renewals from shipowners aiming to prepare for environmental regulations that are set to tighten over vessels’ lifespans. With half of the orderbook in 2024 designated as ’alternative fuel-ready’ by the researchers, liner companies’ fleet renewal programmes led the way in alternative fuel capable terms at 81% of TEU ordered.

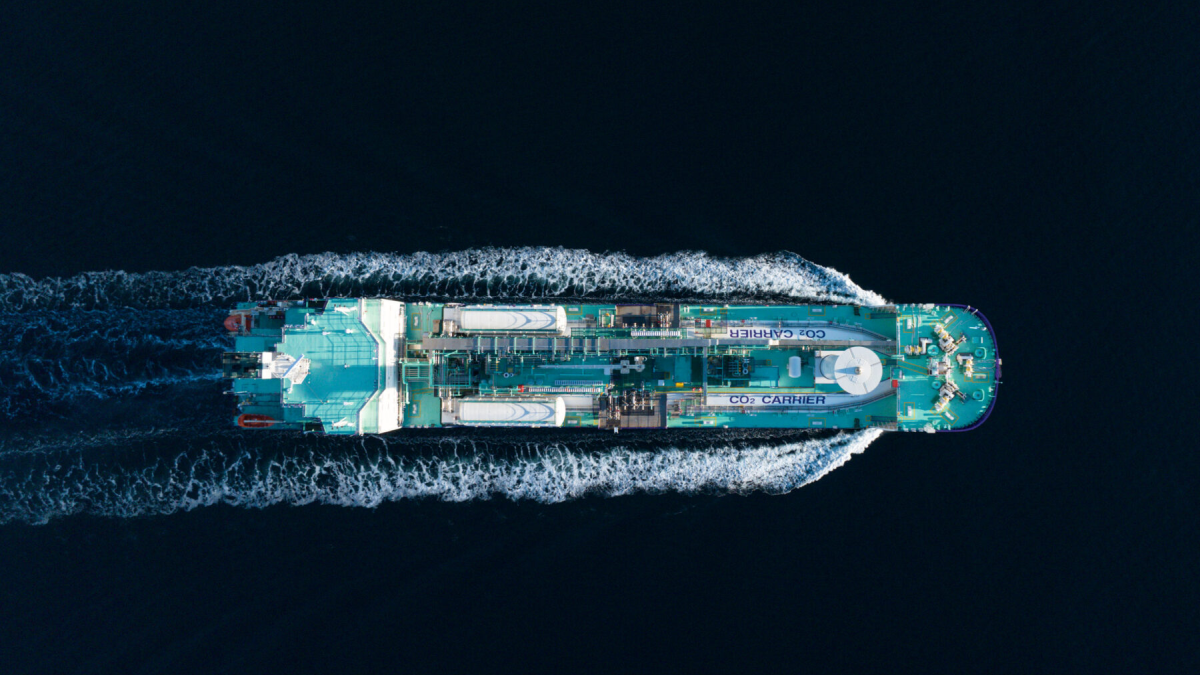

In the gas shipping sector, LNG carrier ordering has also been strong, at 83 vessels contracted in 2024, to date, reaching the second highest annual total on record with two months of the year remaining. The strong figures for LNG carrier ordering are no surpise, and mostly linked to Qatar’s ongoing development of its offshore LNG resources.

LPG carrier volumes have already hit record levels, with 132 vessels ordered, and Clarksons deemed prospects for very-large ammonia carrier (VLAC) and very-large ethane carrier (VLEC) designs "firm".

Tanker activity has also been strong, the maritime services company confirmed, and with total vessel orders in the sector topping 500, it appears the tanker fleet renewal is gathering pace, despite the emergence of a multi-tiered fleet of older, often sanctions-dodging vessels in the so-called dark fleet and newer vessels trading in non-sanctioned energy cargoes.

"572 units of 45.4M dwt ordered, 95% above the ten-year average run-rate in dwt terms, including 106 crude tankers of 23.2M dwt and 273 product tankers of 17.2M dwt," Clarksons said.

In spending terms, Clarksons Research reported that newbuild spending has reached its highest level since the last shipbuilding boom era in the late years of the 2000s decade, with owners investing US$168.4Bn in Jan-Oct, already 85% above the ten-year average and on track to be the strongest annual investment since 2007 (US$264.3bn).

"Spending is being supported by historically strong order volumes, elevated newbuild prices and increased spending on ’green’ technologies," Clarksons said. "Newbuild prices are historically firm; our Newbuilding Price Index now stands at 189 points, 43% higher than its 2010s average and, in nominal terms, just 1% below its 2008 peak amid strong contract activity, elevated forward cover and inflationary pressure at yards. However, gains in the index have slowed in recent months with prices fairly stable in some segments and easing marginally in others."

On the whole, Clarksons figures show that the global orderbook has risen across 2024 to stand at 5,404 ships of 346.2M dwt and 150.6m CGT, up 15% from 2023 figures in CGT terms. This would put shipyard output at its highest level since mid-2011, Clarksons said.

"Though the orderbook as a share of the total fleet has edged higher as a result, to 14% in dwt terms (from 12% at start year), this remains a relatively moderate level overall, but there remains significant variation between sectors," the company said, noting that global deliveries are projected to rise in the coming years amid a larger orderbook and expanding shipyard capacity.

Clarksons’ forecasts for output see a continued swell in shipyard production in coming years, potentially building toward another peak, as yards expand capacity to meet demaind. Output is forecast to reach 41.0M CGT in full year 2024, before rising to 42.7M CGT in 2025 and increasing again in 2026 to 42.9M CGT, with the potential for some upside from further orders that may be placed, according to Clarksons.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.