Business Sectors

Events

Contents

The impact of crude tankers entering product trades

Geopolitical instability has led crude oil tankers to shift into clean product trades, leveraging cost advantages and boosting tonne-mile demand for operators

The crude oil tanker sector is increasingly exploring new avenues for profitability by shifting large vessels, such as VLCCs and Suezmax tankers, into the clean petroleum products (CPP) trades.

This pivot comes at a time when geopolitical instability and market disruptions have constrained crude oil flows, leading to underperformance in the crude tanker market.

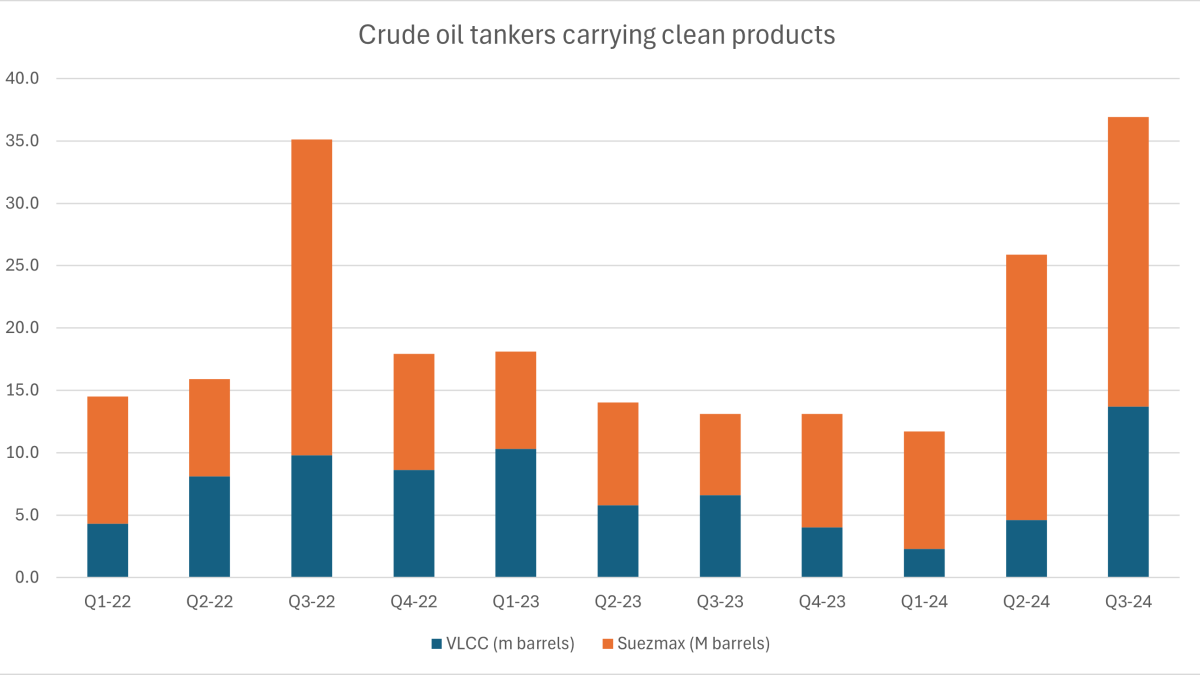

According to the Capital Link Tanker Panel in September 2024, “There were 37 VLCCs and Suezmax tankers cleaned up to transport CPP,” highlighting the scale of this emerging strategy.

Product tanker companies and tanker pool operators such as Scorpio Tankers and Hafnia have been impacted by this trend, which has developed through the size and economies of scale crude tankers bring to the movement of clean products such as diesel.

Scorpio Tankers Q2 2024 results presentation noted the current disruption presents opportunities for owners willing to clean their vessels.

Meanwhile, Hafnia has acknowledged an "increase in cannibalisation from the crude sector," a move that has impacted product tanker earnings but offered a temporary supply solution to meet rising demand.

TORM has further emphasised that rerouteing these vessels and cleaning them for product trades helps absorb market capacity and boosts overall tonne-mile demand.

One of the primary reasons behind this shift is the cost advantage.

According to a Poten Weekly Opinion report, moving diesel on a VLCC costs about US$25 per tonne, compared with US$49 per tonne on an LR2 vessel, providing significant savings for operators.

Additionally, the longer voyages required for refined products, particularly across East-West trade routes, have boosted tonne-mile demand, particularly in TORM’s LR2 fleet, which continues to benefit from this surge in trade.

Hafnia’s recent decision to redomicile from Bermuda to Singapore, expected to be completed by October 2024, further reflects the company’s strategic alignment with Asia’s growing demand for oil products.

As product tanker rates remain elevated and the crude oil tanker market continues to struggle, the repurposing of crude vessels into the clean trades could persist in the short term.

Scorpio Tankers has cautioned this trend might slow down in the medium term as market conditions stabilise.

In related news, the board of Hafnia stated the move is aimed at better positioning the company to tap into the dynamic Asia-Pacific market while streamlining regulatory compliance.

Find out what is in store for tankers at the Tanker Shipping & Trade Conference, Awards & Exhibition 2024. Register your interest here.

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.